(Bloomberg) — The U.S. Treasury plans to keep long-term debt sales steady with a new plan this week, as the government is expected to soon receive relief from the Federal Reserve’s rapid writedown of its securities holdings. .

Most Read Articles on Bloomberg

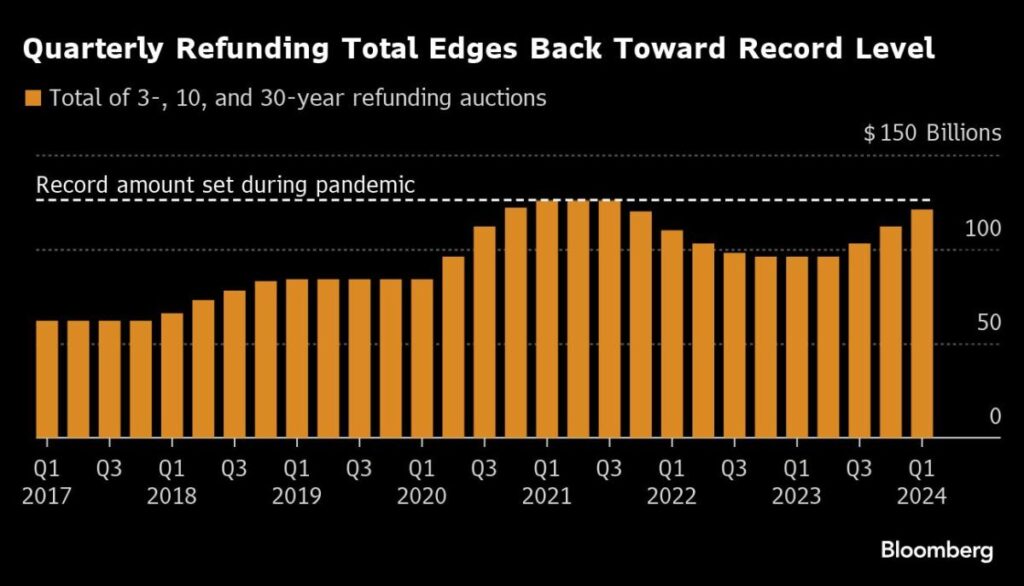

Dealers expect the Treasury Department to implement on Wednesday its January guidance to curb further increases in so-called quarterly refund bids, the size of which is now at record levels seen during the coronavirus crisis. is approaching a scale of This means $125 billion will be made in long-term securities auctions next week.

Borrowing demand is growing thanks to large federal budget deficits and the Fed's quantitative tightening program, which has wiped up to $60 billion in government debt off central bank balance sheets and forced the government to sell even more debt to private sector buyers. are forced to sell. The Fed is expected to release an update on its plans on Wednesday, after officials in March suggested they could soon slow the pace of QT.

The U.S. Treasury market could also take advantage of this support.

U.S. Treasuries were facing their biggest monthly loss since 2022 as of Thursday's close, due to hot inflation data and ballooning bid sizes that have sharply dampened expectations for Fed rate cuts. Two weeks ago, a sell-off in long-term securities caught traders by surprise as demand slumped despite high yield levels.

“All of this will help the Treasury more than it will hurt the Treasury,” said Michael Pugliese, senior economist at Wells Fargo, referring to the Fed's QT tapering and the stabilization of the Treasury's bond sales plan. I'm not sure if that's the case,” he said. “Issuance remains very high, and we are slowly learning in real time how much these auctions will be consumed.”

Pugliese is one of many Fed watchers who expect the central bank to announce the start of QT tapering in June. Speaking at a news conference after the Fed's decision on Wednesday, Chairman Jerome Powell said in March that the process of tapering easing would begin “fairly soon.”

QT focus

Underscoring investors' focus on supply, there is increased focus on the Treasury Department's quarterly funding outlook, which is scheduled to be released Monday afternoon in Washington. Due to strong employment and economic growth, tax revenues have been strong recently, and the short-term deficit situation is improving. In January, the authority recorded net borrowing of $202 billion in the three months to June.

Debt managers are closely monitoring the Fed's plans, asking dealers about their expectations for the Fed QT in a survey ahead of the Fed's refund statement, hours before the Fed's announcement.

Tom Simmons, senior economist at Jefferies, expects the Fed to halve the contraction in U.S. Treasuries starting immediately on Wednesday, to a pace of up to $30 billion a month. Simmons said it's unclear whether the Treasury Department's debt managers will factor the Fed's potential QT changes into Monday's quarterly funding outlook.

The only area where easing is unlikely to materialize at this point is interest rates. Federal debt service costs are expected to reach a record high as a share of gross domestic product next year, and high inflation means Powell and others are unlikely to signal interest rate cuts in the coming months. It means.

Discussion about rates

Swap traders are pricing in a Fed rate cut of only about 33 basis points (bp) for all of 2024, compared to expectations at the beginning of the year that rates would be cut by more than six quarter points. The Federal Reserve on Wednesday is expected to keep its policy rate unchanged at 5.25% to 5.50% since last July.

“The biggest change in language will come from Chairman Powell's message during the press conference,” said Lindsey Piegza, chief economist at Stifel Financial. “This will be an opportunity to confirm our views.” Short-term interest rate cuts. I don't want to overreact to the inflation data, but the inflation data is moving in the wrong direction. ”

So investors will still be grappling with high bids in an inflationary environment.

Auction sizes for several tenors set new records. Investors prefer short-term Treasuries, with yields to maturity nowhere near 5%, as last week's mostly uneventful trading shows. However, demand for 10-year bonds at the beginning of this month was seen as the worst, and there was even no demand for 30-year bonds.

Next week, bidding is scheduled for the 3-year, 10-year and 30-year bonds that make up the refund group.

This $125 billion plan means the size of future refund auctions will be:

-

As of May 7th, $58 billion in three-year bonds has been issued.

-

$42 billion in 10-year bonds as of May 8th

-

A $25 billion 30-year bond will be issued on May 9th.

New three-year bonds are auctioned every month, and the Treasury Department has already placed bids totaling $4 billion in March and April.

Dealers also expect the size of floating rate bonds to remain stable over the next three months.

Among the types of bonds where dealers expect a slight increase, sales of Treasury Inflation-Protected Securities (TIPS) are the only one. HSBC Holdings expects the Treasury Department to raise only the five-year TIPS restart bid in June by $1 billion. JPMorgan Chase strategists believe the increase in TIPS will be driven by a $1 billion increase in new 10-year debt issues in July.

Dealers also believe Treasury managers are beginning to shift away from relying on notes that mature in up to a year and pay no interest. The Treasury Board's Borrowing Advisory Committee, a panel of market participants, recommends that the proportion of bills as a percentage of total debt exceeds the 15-20% range. This also takes into account that the Treasury has room to reduce its cash balance, which currently stands at more than $900 billion.

Read more: Wall Street sees lower Treasury bill issuance in April amid tax season

Dealers will also be looking Wednesday at the exact dates of the Treasury Department's long-awaited existing bond buyback program. This initiative is intended to support market liquidity and also to assist with cash management by smoothing out fluctuations in bill issuance associated with high tax revenues.

Most dealers expect the first buyback operation to occur in May. The last time the Treasury Department conducted stock buybacks was from March 2000 to April 2002.

Bond investors will have to deal with a plethora of economic data this week. Reports related to housing, consumer confidence, and manufacturing activity are expected to be released, but what investors will be most interested in will be further insight into the state of the U.S. labor market. Job information for March will be the focus of attention, but the most important will be the non-agricultural employment figures for April, which will be announced on Friday.

In addition to Powell on Wednesday, New York Fed President John Williams and Chicago Fed President Austan Goolsby are scheduled to speak on Friday.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP