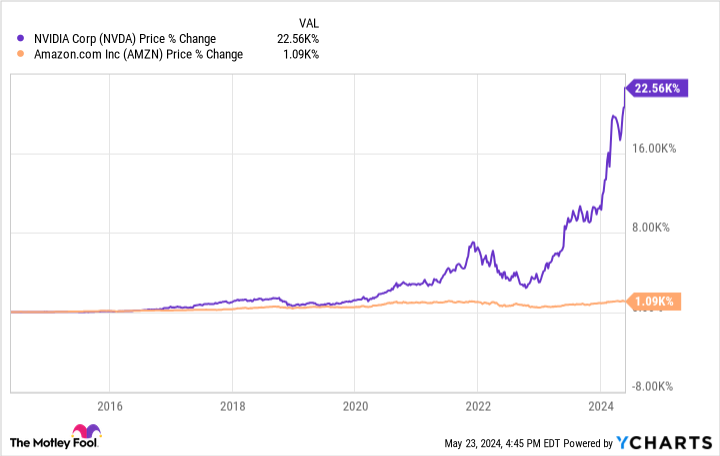

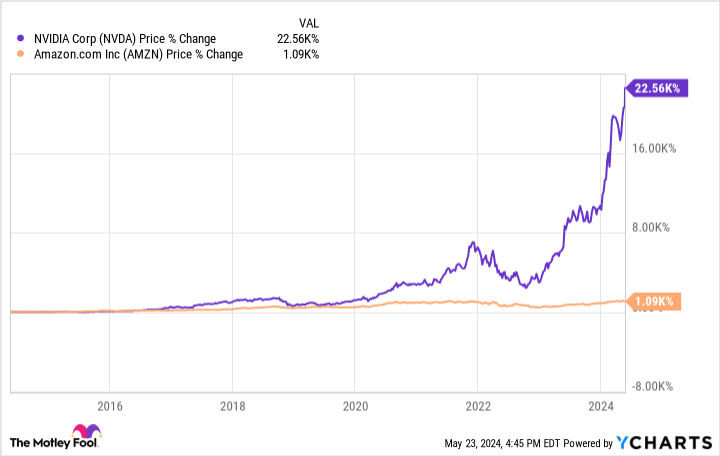

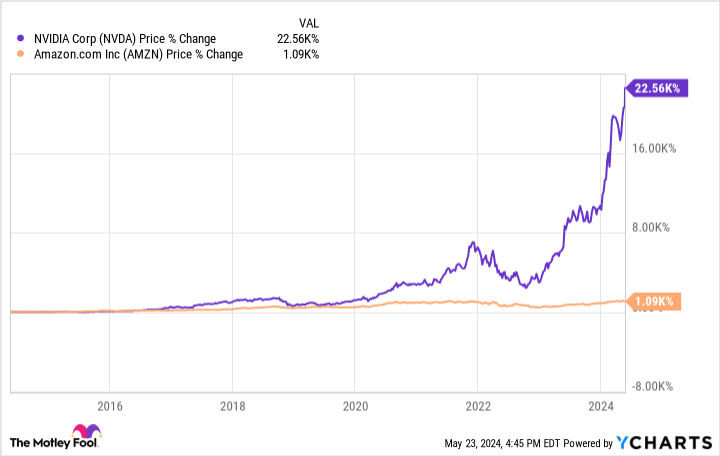

Technology stocks have significantly outperformed the broader market over the past decade. Nasdaq 100 Technology Sector Index This represents a 421% increase during the period. S&P 500 The index rose 178%. This strong performance is not surprising: tech companies tend to benefit from disruptive trends, which allows them to realize outsized growth.

Top tech stocks, e.g. NVIDIA (NASDAQ: NVDA) and Amazon (Nasdaq: AMZN)has far outperformed the Nasdaq 100 Index during that period, providing a significant boost to long-term investors' portfolios.

To be fair, it will be difficult for Nvidia and Amazon, currently the largest companies in the world, to replicate such impressive decade-long gains in the next decade. However, buying these two tech giants and holding them as part of a diversified portfolio is likely to be a smart move in the long term. Both companies still have huge growth opportunities in multiple markets, which is why they could be ideal choices for investors looking to grow their million-dollar portfolio.

For Nvidia

Nvidia has come a long way. Twenty years ago, the company primarily sold graphics processing units (GPUs) for use in gaming personal computers (PCs) and workstations, but today its hardware (and software) powers compute-intensive applications in data centers, advanced driver assistance systems, factories, the creation of digital twins, and many other areas. But the company's biggest driver today is artificial intelligence (AI).

Nvidia's revenue and profits have grown at a staggering pace in recent quarters as customers lined up to get their hands on the company's AI chips. The company reportedly holds a staggering 92% share of the fast-growing AI chip market, and its dominance is expected to continue to provide a major boost to the company's growth. The AI chip market is expected to generate $305 billion in revenue worldwide by 2030 (up from $29 billion in 2022).

Nvidia's data center business generated $47.5 billion in revenue last fiscal year, and assuming the company remains the largest player in the market after the decade, that figure could be even higher by 2030. However, this isn't the only AI-related opportunity Nvidia is looking to exploit.

According to market research firm Canalys, demand for PCs that can run AI software locally is expected to grow at a 44% annual rate through 2028. This impressive growth should ideally translate into greater demand for Nvidia GPUs in laptops and desktop PCs. As a result, it's no surprise to see the company's gaming business boom over the next few years, complementing the growth of data centers.

At the same time, Nvidia is gaining momentum in the digital twin market. The company's GPUs are being deployed to create 3D virtual representations of factories before they're actually built. These digital twins allow organizations to optimize operations, look for problems, and improve efficiencies before the physical factory is built. These virtual spaces can also serve a variety of purposes after the real-world location is completed.

Demand for digital twins is expected to grow at a 41% annual rate through 2035, generating $240 billion in annual revenue by the end of the forecast period.

Overall, Nvidia management expects the company to tap into a market worth a massive $1 trillion. If this is true, it would put the company at the start of a tremendous growth curve, considering revenue last year was just under $61 billion.

With a number of favorable growth opportunities and catalysts, the company should continue to grow at a healthy pace for the foreseeable future, which is why investors looking for a tech stock that can help grow their portfolio to the million dollar level should consider buying Nvidia.

Amazon

Amazon has benefited from the secular growth of the e-commerce market for many years and should continue to capitalize on growth in this sector going forward: Exactitude Consultancy predicts that the global e-commerce market will experience an average annual growth rate of 15% through 2030, generating just over $20 trillion in annual revenue at the end of that period.

Amazon is well positioned to capitalize on this huge growth opportunity as the e-commerce leader in key markets, including the U.S. Amazon's market share in the U.S. is nearly 40%, a figure that has been gradually increasing over the years, but e-commerce is not the only big growth engine that Amazon is looking to capitalize on.

The company is the largest player in the cloud infrastructure services market, with a 31% share in the first quarter of 2024. Its cloud computing division, Amazon Web Services (AWS), reported healthy year-over-year growth of 17% in the first quarter, generating revenue of $25 billion. This outpaced Amazon's overall revenue, which grew 13% to $143.3 billion in the previous quarter.

Growing demand for cloud-based AI services should provide a big boost for AWS in the long term: Mordor Intelligence predicts that annual revenue for the cloud AI market could reach $274 billion in 2029, compared to an estimated $67 billion this year. Amazon's solid share of the cloud computing market and increasing adoption of AI-focused services on AWS suggest that the company is well-positioned to make the most of this opportunity.

Looking at the growth drivers mentioned above, it's easy to see why analysts expect Amazon's annual earnings growth to accelerate to 30% over the next five years from 14% over the past five. The company's improving profitability could lead to the market rewarding tech stocks in the long term, making it an ideal choice for investors looking to add a potential millionaire-maker to their portfolio.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy now… and Nvidia wasn't among them. The 10 stocks selected have the potential to generate big gains over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $652,342.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, serves on The Motley Fool's board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

2 Top Tech Stocks That Will Make You a Millionaire was originally published by The Motley Fool.