If you want to spot potential multibaggers, there are often underlying trends that can provide clues. In particular, I would like to look at two things.First, grow return The first is capital employed (ROCE) and the second is the company's capital growth. amount of capital employed. Simply put, this type of business is a compound interest machine, meaning you are continually reinvesting your earnings at an ever-higher rate of return. Speaking of which, I noticed some big changes. Dongcheng Travel Holding Co., Ltd. Let's take a look at the return on equity for (HKG:780).

About Return on Capital Employed (ROCE)

In case you aren't familiar, ROCE is a metric that measures how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. This formula for Dongcheng Travel Holding is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.087 = 1.7 billion CN ÷ (32 billion CN – 12 billion CN) (Based on the previous 12 months to December 2023).

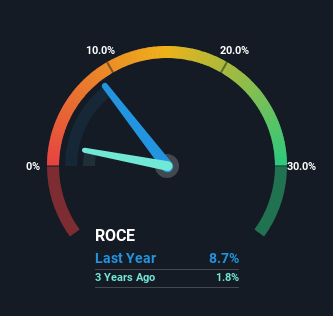

So, Tongcheng Travel Holdings' ROCE is 8.7%. While this is a low absolute return, it is much better than the hospitality industry average of 4.7%.

Check out our latest analysis for Tongcheng Travel Holdings.

In the graph above, we have measured Tongcheng Travel Holdings' previous ROCE against its previous performance, but the future is probably more important. If you're interested, take a look at our analyst forecasts. free Analyst report for Tongcheng Travel Holdings.

What can we learn from Tongcheng Travel Holdings' ROCE trend?

The fact that Tongcheng Travel Holdings has generated some pre-tax profits from its previous investments is very encouraging. This business was in the red five years ago, but is currently generating 8.7% of its capital, so shareholders will no doubt be happy with this. And naturally, like most companies aiming to become profitable, Dongcheng Travel Holding Co., Ltd. is leveraging 62% more capital than it was five years ago. We love this trend. This is because this trend indicates that the company can take advantage of profitable reinvestment opportunities, and if this trend continues, it could lead to multibagger performance.

However, for the record, the company's current liabilities increased significantly during this period, so some of the increase in ROCE can be attributed to this. This effectively means that suppliers or short-term creditors now fund his 37% of the business, which is up from him five years ago. Be wary of future increases in the ratio of current liabilities to total assets, as this can introduce new risks to your business.

Tongcheng Travel Holdings' ROCE Conclusion

In summary, it's great to see that Tongcheng Travel Holdings has managed to return to profitability and continues to reinvest in its business. Investors may not be impressed by the favorable underlying trend yet, as the stock has returned just 7.0% to shareholders over the past five years. So if valuations and other metrics stack up, further research on this stock could reveal some good opportunities.

On the other side of ROCE, you need to consider valuation.That's why we Estimate the intrinsic value of 780 for free on our platform It's definitely worth checking out.

Tongcheng Travel Holdings isn't the most profitable company, but check this out. free A list of companies with solid balance sheets and high return on equity.

Valuation is complex, but we help make it simple.

Please check it out Tojo Travel Holding Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.