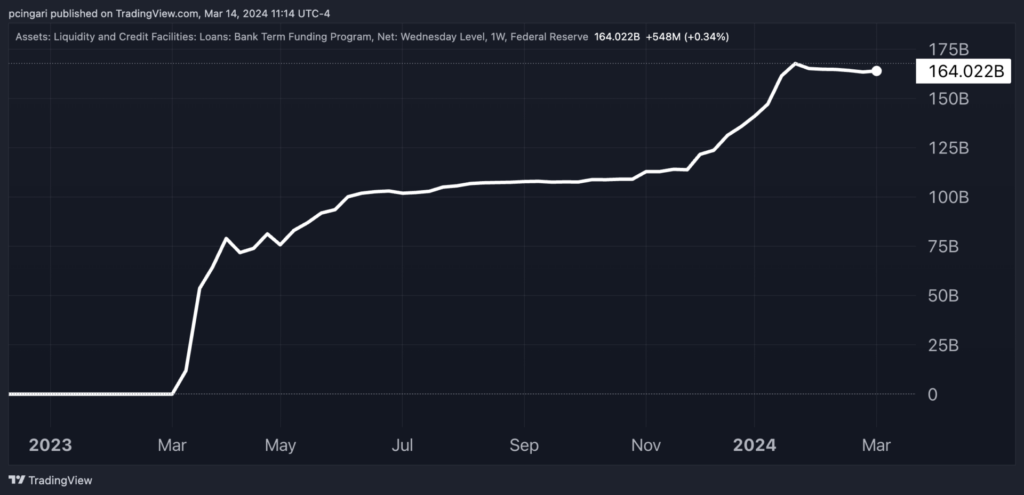

The safety net put in place by the Fed in the wake of the collapses of Silicon Valley Bank and Signature Bank in March 2023 ceased operations this week.

of Federal Reserve Bank Term Funding Program (BFTP) is designed as an emergency bulwark against the imminent threat of a regional banking crisis, providing an additional source of affordable liquidity to eligible depository institutions.

The suspension of this program could raise serious concerns about the future of financial market liquidity and could change the landscape of the bullish risk sentiment that has so far buoyed investors.

The Fed quickly activated the BFTP last year in response to the financial collapse, ensuring banks remained well-positioned to meet depositor demands and business lending demands.

The initiative successfully pumped $164 billion into the banking system, avoiding the risk of a bank run or a credit crunch.

For investors, the program provided a much-needed liquidity injection that partially cushioned the negative effects of the Fed's balance sheet tightening.

Among other factors, the Fed's emergency umbrella has been a useful support in driving asset gains over the past year, with riskier assets particularly outperforming defensive, high-quality assets. There is.

of SPDR S&P Regional Banking ETF (NYSE:KRE) has soared 8% from a year ago and is up nearly 40% since its May 2023 low. The S&P 500 index is up 33% from its previous low during the local banking crisis, and the Dow Jones Industrial Average is up. We saw a 22% increase.

As you move up the risk ladder, you become represented by tech stocks. Invesco QQQ Trust (NASDAQ:QQQ) soared 51%; Bitcoin (CRYPTO: BTC) witnessed an astonishing 218% rally.

According to Bank of America analysts mark cabanaa borrower relying on a BFTP may face three choices: renew the loan before expiration, secure alternative financing, or let the loan expire without seeking alternative financing.

The Fed has not yet released data revealing whether banks drew on liquidity lines in the last week before they expired.

Kavanagh predicts that the suspension of BFTP could lead to an outflow of reserve balances held at the Fed if banks choose not to replace this source of funding.

So far, this situation has not materialized, indicating banks' reluctance to reduce cash levels.

The liquidity situation remains evolving as the Fed continues to pursue quantitative tightening, with the risk that interest rates will remain high for an extended period given recent increases in inflationary pressures.

Read now: Producer inflation rate exceeds February expectations, indicating concerns about rekindling of upward pressure on prices (updated)

Photo: Shutterstock