Many fintech stocks have performed phenomenally over the past decade. These investments combine the huge addressable market of financial stocks with the rapid growth rates of technology stocks.

The only problem is that knowing when to buy fintech stocks can be difficult: Their valuations are often exorbitant, forcing investors to pay an exorbitant price for growth.

Luckily, two of the best fintech stocks on the market are currently on sale, and if you're looking for fintech bargains with big upside potential, these companies could be perfect for you.

Follow Warren Buffett's lead and invest in this growth machine

Warren Buffett is one of the greatest investors of all time, so it's worth keeping an eye on what he buys. Berkshire Hathawayhas a roughly $1.3 billion position in the little-known fintech stock. New Holdings (NYSE: NU).

Despite its $56 billion market cap, most U.S. investors have never heard of Nu. That's because Outside The main focus is Latin America, with a presence in Brazil, Colombia and Mexico.

What kind of fintech business is Nu? On the surface, it's a traditional bank. Users can open checking and savings accounts through Nu, as well as buy insurance and brokerage products.

Crucially, all these services are available on smartphones, which is crucial in Latin America, where a few powerful banks have dominated the market for decades. These incumbents charged high prices for simple financial products because of their market power and the vast, expensive infrastructure they operated, including physical branches.

A digital-first approach allows Nu to serve vast numbers of people at low cost, and it can roll out new services much faster than its competitors — all customers need to do is click a few buttons.

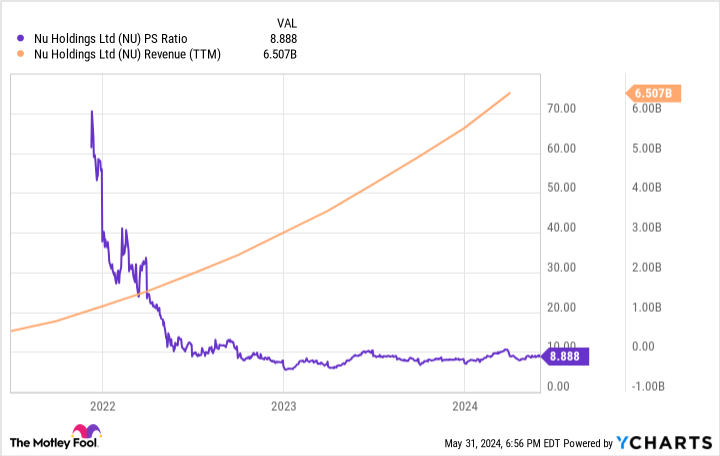

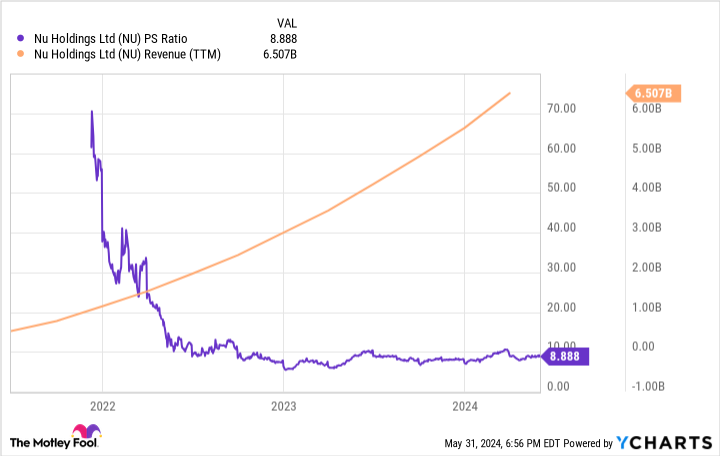

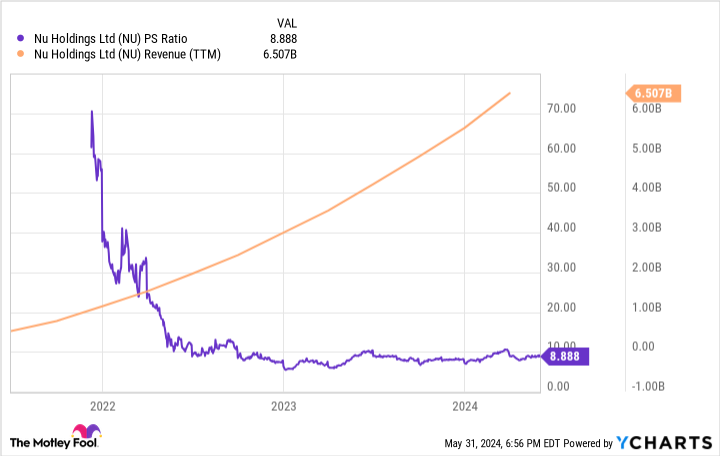

Nu already boasts an incredible track record of success: Over the past decade, it has grown its customer base from virtually zero to nearly 100 million, revenue has skyrocketed, and the company's price-to-sales ratio has fallen dramatically.

The stock recently traded at about nine times sales, which is expensive for a banking stock. But in reality, Nu is a fintech stock. It's a perfect example of how fintech stocks can combine the scale of the financial industry with the hypergrowth of technology companies.

Analysts expect the company's sales to grow an astounding 43% this year. In 2025, sales are expected to grow 22%. With a proven business model and a path for big growth, it's no surprise that Berkshire and Buffett are holding the stock for the long term.

NU PS Ratio Data by YCharts

Bet on Bitcoin with this cryptocurrency stock

I want to bet on an upswing BitcoinOf course, you can also buy Bitcoin directly, but there are other ways to get involved. block (NYSE: SQ) This is a fantastic opportunity and the current valuation is truly eye-catching.

As its name suggests, Block is focused on the growth of blockchain technologies such as Bitcoin. For example, its Square payments platform enables merchants to accept cryptocurrencies as a form of payment, while its peer-to-peer lending service, Cash App, already has millions of users buying, selling, and trading cryptocurrencies. The company also operates two business segments, TBD and Spiral, that are specifically focused on the long-term adoption of Bitcoin.

Finally, The Block acquired a controlling stake in music streaming service Tidal in 2021. While not explicitly blockchain-related, the creator industry represents one of the biggest opportunities for the rollout of blockchain-enabled micropayments, which means The Block is all-in on Bitcoin and blockchain in general.

SQ PS Ratio Data by YCharts

Like Nu, Block also has a strong history of revenue growth. However, revenue growth temporarily slowed in late 2021 and early 2022. The company also went from generating profits to posting quarterly losses. The market punished the stock for these developments, with its price-to-sales multiple falling from over 10 to just 1.7. Also, during that period, Bitcoin sales to customers began appearing as revenue on Block's income statement. While the Bitcoin revenue explosion is great for the company's long-term future, this mix shift toward lower-margin sales also contributed to the market's decision to price the stock cheaper based on its price-to-sales multiple.

Founder Jack Dorsey returned as CEO in 2023 to turn the company around, and Block returned to profitability last quarter. Growth has also picked up somewhat, but the company's valuation remains low.

Block is certainly in an attractive sector that is likely to maintain high growth for years, if not decades, to come, and it has a portfolio of quality businesses that could be profitable if managed well, but the market has yet to fully appreciate the success of the company's turnaround.

Don't be surprised to see Block stock perform extremely well in 2024 if it can build on its success with growth and profitability. If the market doesn't reward this success, the stock price will only have more room to rise in the long term.

Should you invest $1,000 in Nu Holdings right now?

Before buying Nu Holdings shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy now…Nu Holdings was not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $671,728.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 28, 2024

Ryan Vanzo invests in Bitcoin. The Motley Fool has invested in and recommends Berkshire Hathaway, Bitcoin and Blockchain. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The post 2 Fintech Stocks Set to Soar After 2024 was originally published by The Motley Fool.