Warren Buffett is one of the most followed investors in the world. CEO of berkshire hathaway We use a simple investment strategy.

Mr. Buffett holds positions at major blue-chip companies where he has built some of the world's most famous brands. Additionally, these businesses typically generate stable and consistent cash flows and reward investors in the form of dividends and stock buybacks.

The three stocks reviewed below have more in common than just being part of Buffett's portfolio. Each stock trades on a price-to-earnings ratio (PER) multiple. S&P500. Does this discount to the broader market suggest there is some potential for value investors? Let's dig deeper.

coca cola

The first company on my list is coca cola (NYSE:KO). The company's P/E ratio is currently 24.4x, significantly lower than the S&P's 28.2x.

I admit that Coca-Cola hasn't experienced impressive growth. But there's a reason Buffett has held on to stocks for decades. In addition to carbonated drinks, Coca-Cola also offers water, tea, and coffee brands.

This diversified portfolio helped Coca-Cola expand into new markets and mitigate potential losses caused by changes in consumer tastes and purchasing trends. Coca-Cola thus has a long history of steadily growing both sales and profits, and this is a key pillar of Buffett's investment style.

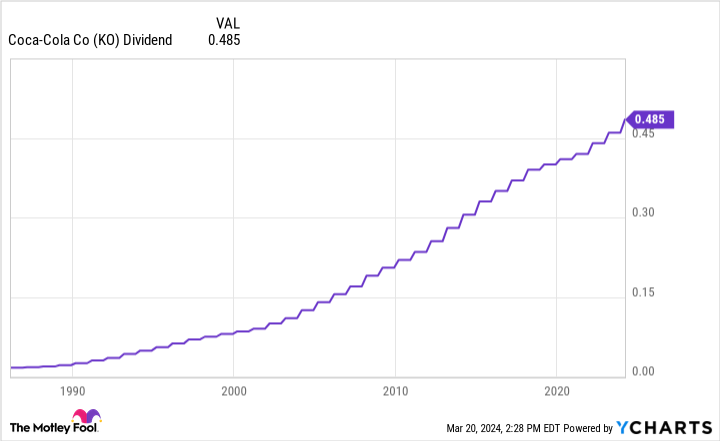

This dynamic gives Coca-Cola the financial flexibility to continually raise its dividend. In fact, the company is part of the esteemed Dividend Kings club of companies that have raised their dividends for at least 50 years.

So while Coca-Cola may not be the most exciting opportunity on the market, you can't ignore its consistency. Investing in financially healthy companies with strong brands and stable dividends has worked wonders for Buffett. Given the disparity in earnings multiples compared to the broader market, now could be a unique opportunity to scoop up Coca-Cola stock.

SiriusXM

The next company on my list is a satellite radio provider SiriusXM (NASDAQ:SIRI). Unlike the terrestrial radio business, which tends to rely on advertising, SiriusXM is unique in its subscription model. With 34 million subscribers, SiriusXM has built both a prestigious brand and a predictable revenue model.

SiriusXM's P/E ratio is just 12.5, making it appear to be significantly undervalued. Additionally, given that Buffett just increased his position by 30 million shares, investors may think now is a good time to buy the stock.

However, please note that there is a continuation of the photos here. Customer churn has been an issue for Sirius since the peak of the coronavirus pandemic. Working from home is more common than it was just a few years ago. Furthermore, the macroeconomy is currently experiencing unusually high inflation and rising borrowing costs. These variables likely influence consumers' spending habits, and SiriusXM is not immune to them either.

Sirius has spent significant capital in recent years acquiring exclusive rights to podcasts to combat declining engagement, but this strategy has had mixed results for competing streaming platforms. spotify.

The stock is trading at a deep discount to the broader market, which I believe is justified. My suspicion is that Mr. Buffett's recent purchasing activity was an attempt to lower his cost base. Sirius may be able to turn the ship around, but I'm not buying the stock right now.

mcdonalds

The last company on my list is a fast food restaurant mcdonalds (New York Stock Exchange: MCD). Now, no matter how much you dig into Berkshire's regulatory filings, you won't find any trace of its position at McDonald's. Rather, Buffett owns a small position in the conglomerate through a separate portfolio managed by Berkshire subsidiary New England Asset Management (NEAM). Although NEAM's assets are smaller than Berkshire's, it owns far more stocks, giving investors a broader preview of Buffett's other favorite businesses.

I look at McDonald's the same way I look at Coca-Cola. The company operates globally and is a unique business with the ability to grow through different economic cycles. Despite inflation weighing on consumer purchasing power, McDonald's still managed to achieve 9% same-store sales growth last year.

Additionally, with a dividend yield of 2.4%, McDonald's stock could be an option for passive income investors. And based on this metric, McDonald's has a P/E of 24.5, which puts it on par with Coca-Cola. This may indicate that investors broadly view the food and beverage sector as a growth opportunity with less confidence than the rest of the market.

I think now is a good time to consider McDonald's in your portfolio and plan to hold it for the long term.

Should you invest $1,000 in Coca-Cola right now?

Before buying Coca-Cola stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Coca-Cola wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Adam Spatako has no position in any stocks mentioned. The Motley Fool has a position in and recommends Berkshire Hathaway and Spotify Technology. The Motley Fool has a disclosure policy.

These three Warren Buffett stocks have lower price-to-earnings ratios than the S&P 500.Is it time to buy? Originally published by The Motley Fool