(Bloomberg) — North America's largest companies are on track to post their best quarterly profits in at least two years, beating expectations as they seek to cut costs amid fears of a recession.

Most Read Articles on Bloomberg

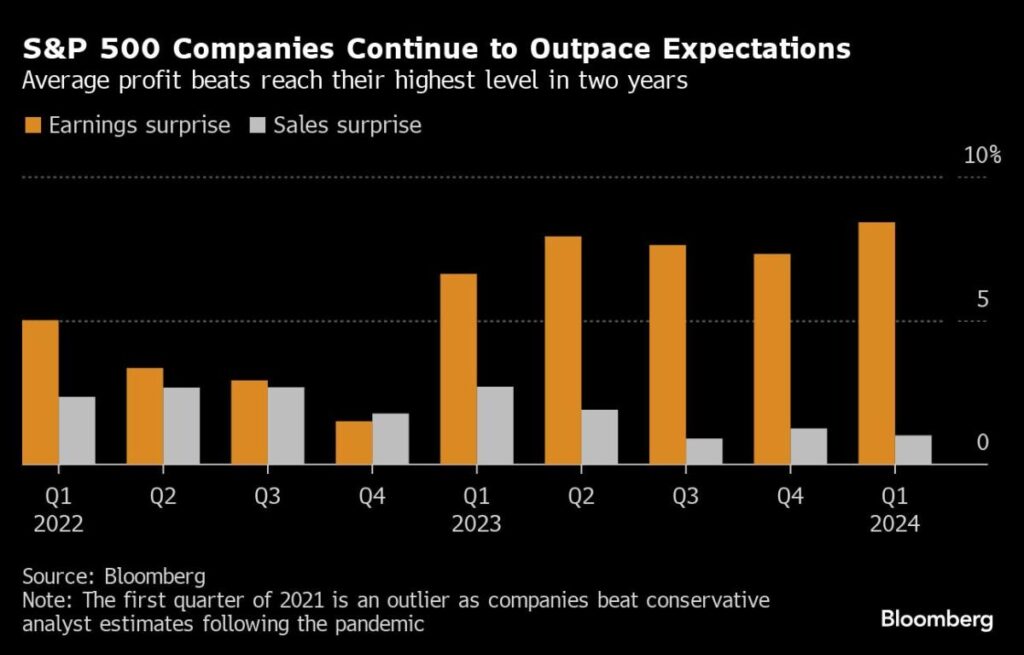

The 459 S&P 500 companies that reported earnings for the quarter reported profits that were 8.4% higher than expected on average, according to data compiled by Bloomberg. Approximately 79% beat earnings expectations (76% last quarter).

Expectations of a recession may be contributing to the notable outperformance. Companies are cutting costs and stockpiling cash to shore up profits to avoid the effects of the economic slowdown. Earnings revisions also declined heading into the first quarter, leaving room for further upside.

Florian Hierpo, head of macro research at Lombard Odier Asset Management, said in an interview that companies are “trying to achieve more with less.”

The average size of the S&P 500's so-called double misses (companies with both sales and profits that fall short of expectations) was also lower than average as of Thursday morning, according to a note from Julien Emanuel, chief equity and quantitative strategist at Evercore ISI. That's what it means.

“A prudent management team will continue to be prudent,” Emanuel said in an interview. “There's no reason to think American companies will continue to err on the side of caution because, frankly, it's working.”

Conversely, sales are moving closer to expectations because a stable macroeconomic environment has made it easier for analysts to predict sales and for companies to plan.

References to a “recession” in earnings reports and conference calls among S&P 500 companies are at their lowest level since the first quarter of 2022, according to data compiled by Bloomberg.

As a result, the surprisingly strong earnings have left analysts optimistic, raising their profit estimates at the fastest pace in two years.

Read more: U.S. companies talk about unprecedented cost reductions: Earnings Watch

–With assistance from Redd Brown.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP