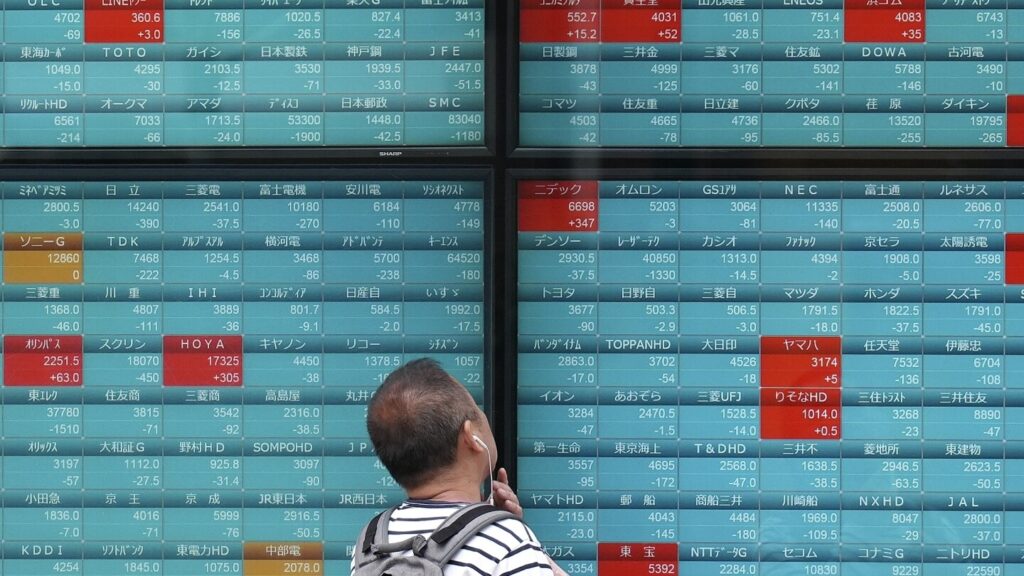

Asian stocks rose on Thursday even as Wall Street stocks fell on the S&P 500's worse losing streak since the start of the year due to a decline in technology stocks.

U.S. futures fell, but oil prices rose.

Tokyo's Nikkei 225 rose 0.3% to $38,090.87, while Hong Kong's Hang Seng rose 1.5% to $16,489.59.

The Shanghai Composite Index rose 0.6% to 3,089.93.

South Korea's Kospi led the region's gains, rising 1.8% to 2,631.15.

In Australia, the S&P/ASX 500 rose 0.6% to 7,651.30.

On Wednesday, the S&P 500 fell 0.6% to 5,022.21. It has fallen 4.4% since setting a record late last month.

The Dow Jones Industrial Average fell 0.1% to $37,753.31, and the Nasdaq Composite Index fell 1.1% to $15,683.37.

Tech stocks fell after Dutch company ASML, a major supplier to the semiconductor industry, reported lower orders for early 2024 than analysts expected. The company's shares fell 7.1% in U.S. trading.

Nvidia fell 3.9% and Broadcom fell 3.5%, making it the two heaviest weights in the S&P 500.

Weakness in tech stocks overshadowed better-than-expected profit reports from some major companies, including United Airlines.It has since soared 17.4%. Report stronger results Sales at the beginning of the year exceeded analysts' expectations, supported by strong demand from business flyers.

The plunge in oil prices eased investors' concerns about inflation, which led to lower U.S. Treasury yields.

The yield on the 10-year U.S. Treasury note fell to 4.58% from 4.67% late Tuesday. The yield on the two-year Treasury note, moving more in line with the Fed's expectations, fell to 4.92% from 4.99%.

Yields on Tuesday were back to November levels. top executive at the federal reserve was suggested The central bank may keep its key interest rate unchanged for a while. The central bank wants to be more confident that inflation is on a sustained path toward its 2% target. Key interest rates remain at their highest levels since 2001.

High interest rates depress investment prices and increase the risk of recession, but Fed officials have expressed concern in a series of reports this year. inflation rest hotter than forecast.

Most traders now expect the U.S. Federal Reserve to cut interest rates only once or twice this year, according to data from CME Group.it is less than expected 6 or more At the beginning of the year.

With little short-term support expected from interest rate easing, companies will need to achieve higher profits to justify the strong rise in stock prices since the fall.

Travelers fell 7.4% after the insurance company's quarterly results fell short of expectations. They had to contend with further losses from the catastrophe.

JB Hunt Transport Services fell 8.1% after reporting weaker-than-expected earnings and results. Competition in the country's east and rising worker wages and other costs hurt in part.

The winner on Wall Street was Omnicom Group. The company rose 1.6% after the company said its latest quarterly profit beat analysts' expectations. The marketing and communications company highlighted growth trends in most markets around the world except the Middle East and Africa.

Shares of Donald Trump's social media company also continued to soar, this time up 15.6%. After that, there were two consecutive losses of over 14%. Experts say the stock has been caught in a frenzy of trading driven more by public opinion about the former president than by the company's earnings outlook.

In oil trading, benchmark U.S. crude rose 19 cents to $82.88 per barrel. It was down $2.67 on Wednesday.

Brent crude, the international standard crude, rose 25 cents to $87.54 a barrel.

The dollar fell from 154.38 yen to 154.19 yen. The euro rose to $1.0678 from $1.0673.

___

AP Business Writer Stan Cho contributed.