-

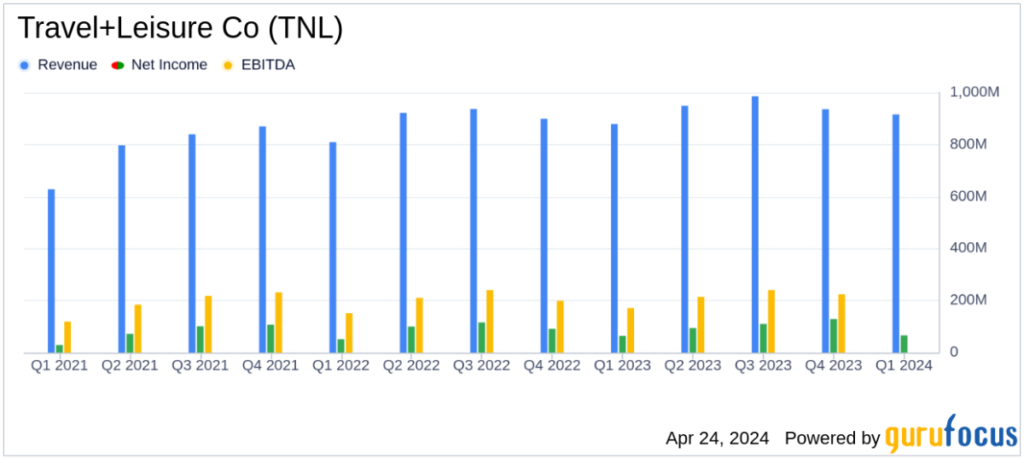

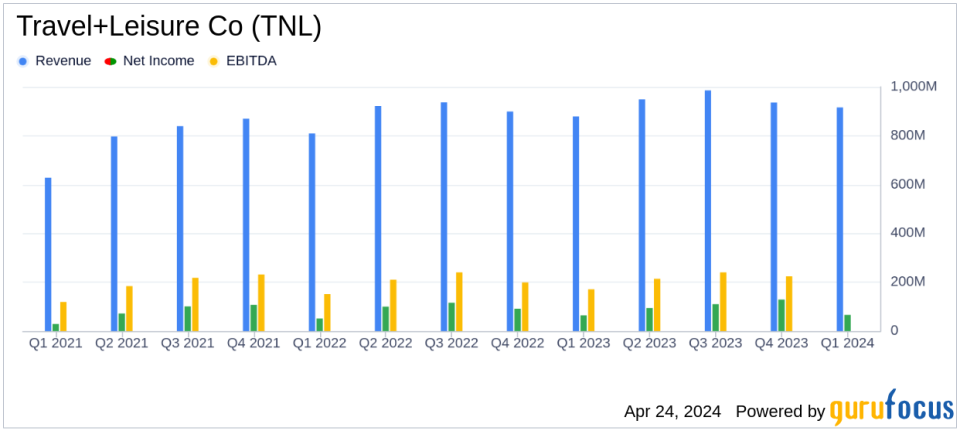

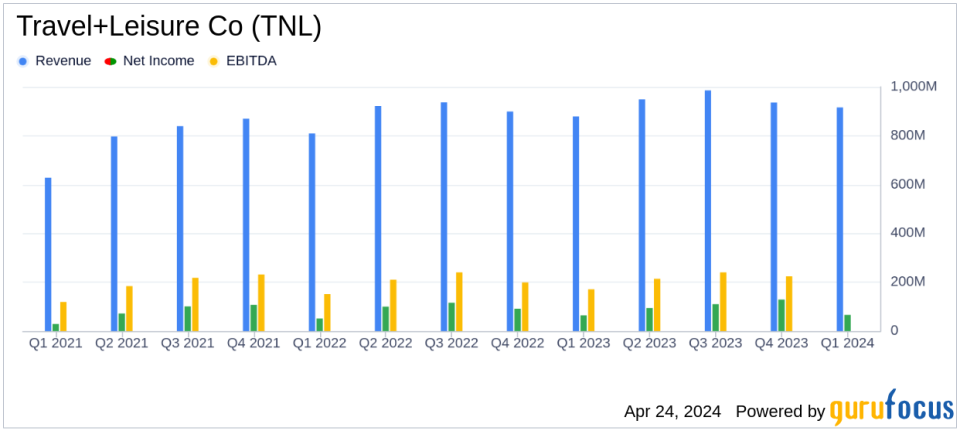

Revenue: It was reported at $916 million, higher than the estimated $906.16 million.

-

Net income: It grossed $66 million, exceeding expectations of $62.31 million.

-

Earnings per share (EPS): The price was $0.92, higher than the expected $0.86.

-

Adjusted EBITDA: Revenue for the quarter was reported at $191 million.

-

dividend: The company plans to pay a dividend of $0.50 per share and recommend a similar dividend for the next quarter.

-

Stock buyback: The company repurchased 600,000 shares for $25 million, an average price of $40.07 per share.

-

Cash flow: Net cash provided by operating activities was $47 million, significantly higher than the prior year's $7 million.

April 24, 2024 Travel+Leisure Co (NYSE:TNL), one of the world's leading membership and leisure travel companies, announced financial results for the first quarter ended March 31, 2024. The company reported net income of $66 million and diluted net income. Earnings per share (EPS) of $0.92 and net sales of $916 million beat analysts' expectations for EPS of $0.86 and sales of $906.16 million. A detailed earnings report is available in the company's 8-K filing.

Company Profile

Travel+Leisure Co primarily operates in two segments: Vacation Ownership and Travel and Membership. Revenue from its Vacation Ownership segment, its primary revenue driver, increased 6% year-over-year to $725 million in the first quarter of 2024. This division focuses on developing, marketing and selling vacation ownership (VOI) and providing consumer financing and property management services at resorts. However, the Travel and Membership segment saw revenue decline 4% to $193 million due to lower transactions, despite a slight increase in revenue per transaction.

Financial performance and market challenges

The company's strong performance in the Vacation Ownership segment was highlighted by a 9% increase in VOI net sales to $369 million. This growth was supported by a 15% increase in the number of tours and a 28% increase in the number of new owner tours. Despite these gains, this segment faces challenges such as a 6% decrease in volume per guest (VPG) due to a high proportion of new owner tours, which typically reduce his VPG. did. The segment's adjusted EBITDA increased 3% to $135 million.

On the liquidity front, Travel+Leisure Co reported strong conditions with cash and cash equivalents of $479 million and total liquidity of $1.2 billion as of March 31, 2024. The company maintains a stable financial structure with a leverage ratio of 3.5x.

Strategic initiatives and prospects

Michael D. Brown, President and CEO, expressed confidence in the company's strategic direction, highlighting growth in tour volume and per guest. He noted the company's readiness for a strong summer travel season and reaffirmed its full-year adjusted EBITDA outlook of $910 million to $930 million. The company also plans to spend $25 million on stock buybacks and continue its shareholder return program with a consistent quarterly dividend of $0.50 per share.

Investment and future growth

Travel+Leisure Co is well positioned for future growth due to its commitment to increasing shareholder value and its strategic efforts to capitalize on the growing travel and leisure market. The company's performance this quarter reflects its effective management and operational efficiency, making it a noteworthy factor for investors interested in the travel and leisure sector.

We encourage you to read the full earnings release for detailed financial statements and more information about the company's performance.

conclusion

Travel+Leisure Co's first quarter results show a strong start to 2024 with performance metrics that beat analyst expectations and strategic initiatives that will drive future growth. The company's strong financial health and proactive business strategy provide a strong foundation for continued success in the highly competitive travel and leisure industry.

For more information, please see the full 8-K earnings release from Travel+Leisure Co here.

This article first appeared on GuruFocus.