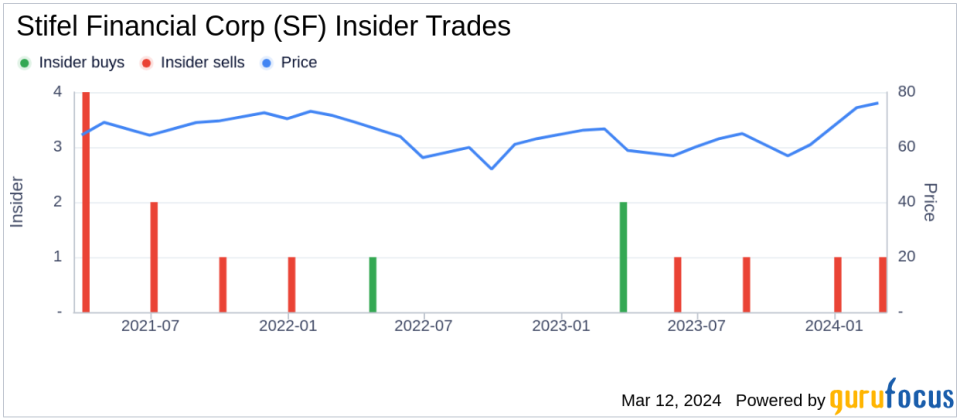

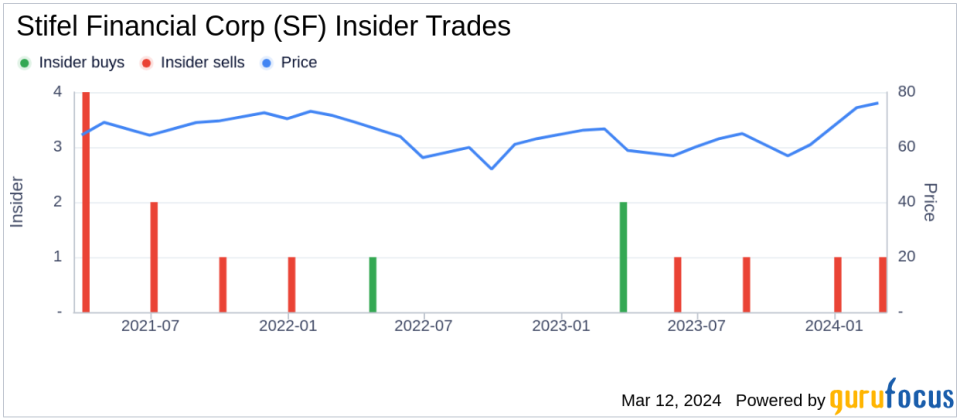

Senior Vice President Thomas Michaud sold 25,421 shares of Stifel Financial Corp. (NYSE:SF) on March 11, 2024, according to recent SEC filings. The trades were executed at an average price of $74.26 per share, for a total value of $1,887,739.46. Stife Financial Corp is a financial services holding company that operates banking, securities and financial services businesses through several wholly owned subsidiaries. Its principal broker-dealer subsidiary, Stifel, Nicolaus & Company, Incorporated, is a full-service retail and institutional wealth management and investment banking firm. Thomas Michaud sold a total of 84,457 shares of the company's stock over the past year. Purchased stocks. Stifel Financial Corp's insider trading history shows a pattern of more insider selling than buying over the past year, with him recording 1 insider buying and 5 insider selling.

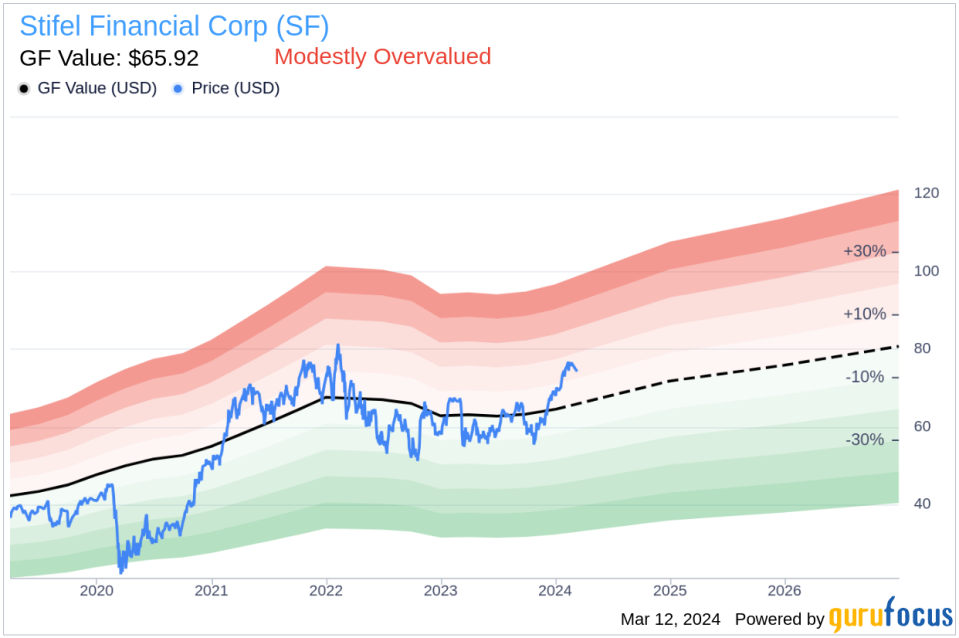

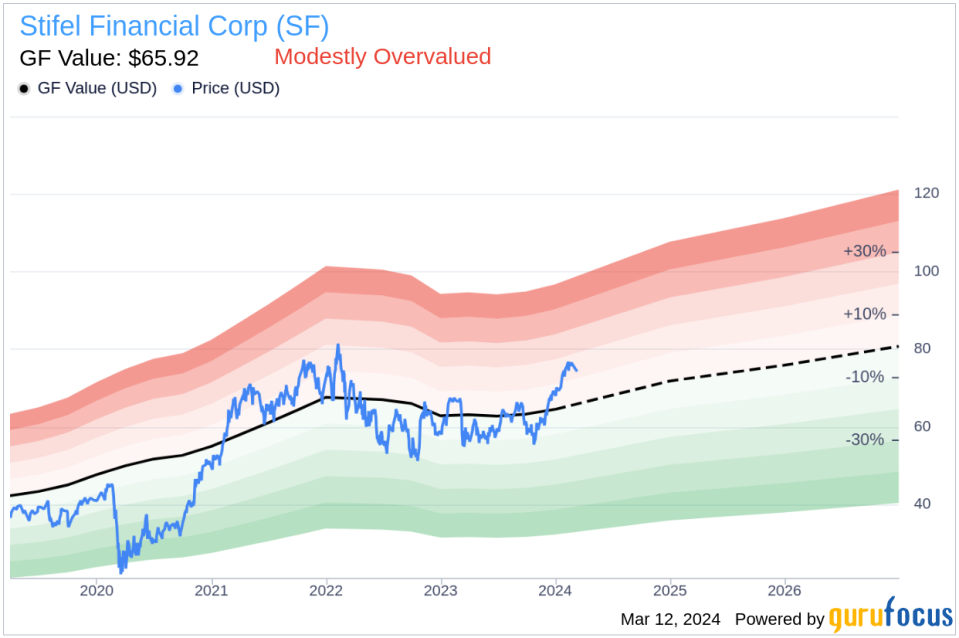

Stifel Financial Corp has a market capitalization of $7.635 billion and the stock traded at $74.26 on the day of the most recent insider sale. The company's price-to-earnings ratio is 17.36, which is slightly lower than the industry median of 18.07, but higher than the company's historical median price-to-earnings ratio. According to GF Value, the price is $74.26 and GuruFocus Value is $65.92. , Stifel Financial Corp's Price to GF Value ratio is 1.13, indicating that the stock is moderately overvalued.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors, and future performance estimates provided by Morningstar analysts. This intrinsic value estimate provides an additional reference point for investors when evaluating a stock. Recent insider selling could provide investors with an insight into how company executives view a stock's current valuation and future prospects. However, investors should also consider broader market conditions and a company's financial performance when making investment decisions.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.