Smederevac

Science Applications International Corporation (NASDAQ:SAIC) acquired companies with capabilities in digital transformation and artificial intelligence know-how. Also, with recent contracts in the cybersecurity market, I believe that SAIC could receive significant business growth from growing industries. Given the total backlog of approximately $22.8 billion, noted in the most recent quarter, and agreements with the United States government, SAIC will most likely deliver net sales growth. There are several risks from dependence on government institutions and fierce competition. With that, I think that the stock remains undervalued at 12x EBITDA.

Business Model

SAIC is an engineering, and information technology company. With more than half a century of experience, it provides first-class solutions that change secure and resilient digital environments, including engineering, technology updating, and system management.

Having strong connections with various government entities, I believe that SAIC has a deep understanding of its clients’ goals, and provides customized services to meet complicated demands. It has around 25,000 employees, and has solid long-term contracts that provide sustainability.

The company primarily conducts its operations through agreements with the United States government and other related companies. Over the past three fiscal years, more than 98% of its profits came from these sources, with a particular focus on the United States military.

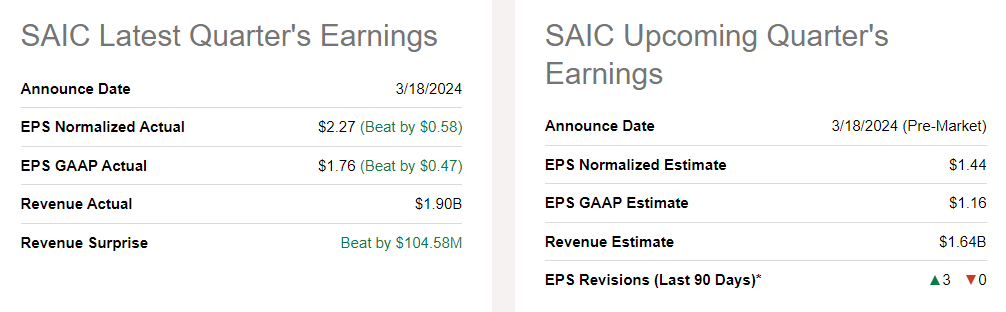

There is quite a complete report about SAIC giving a few details about the recent stock market dynamics. However, I really failed to understand the recent stock price declines. Considering the most recent EPS and quarterly net sales growth, which was better than expected, I believe that it is a great time for having a look at the company’s expectations. I also appreciate quite a bit the recent increases in EPS revisions noted in the last 90 days. SAIC also reported a five year growth rate of 3.6%. There seems to exist significant optimism out there.

Source: Seeking Alpha Source: Seeking Alpha

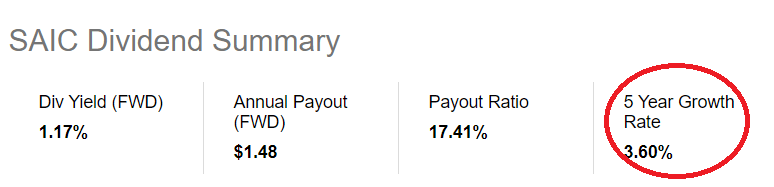

Management made several commentaries with respect to the fiscal year 2025, which I believe show certain enthusiasm. SAIC noted that recent investments will most likely lead to value generation for shareholders in 2025. In addition, I believe that guidance appears beneficial with positive FCF of close to $490-$510 million as well as Adjusted Diluted EPS of about $8-$8.2 per share.

As we embark on the next phase of our corporate strategy to become the premier mission integrator in our market, I am confident that the investments we are making in Fiscal Year 2025 will accelerate our ability to drive value for all our stakeholders. I want to thank all of our employees for a strong Fiscal Year 2024, their enthusiasm towards embracing our vision, and their focus on execution of our strategy. Source: Quarterly Press Release

Source: Quarterly Press Release

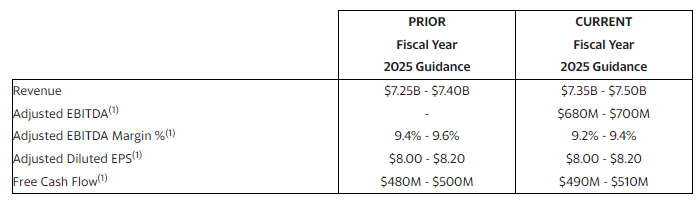

A Lot Of Accounts Receivables, And Acquisitions Paid In Cash

The company’s balance sheet includes a significant amount of accounts receivable, which most investors will most likely appreciate. SAIC receives money a bit late from governmental agencies, and needs to finance its operations with some debt. Given that the main client appears to be the government of the United States, I think that SAIC will most likely get paid.

Source: Quarterly Press Release

The company also reports a significant amount of goodwill from previous acquisitions. I researched a bit about the acquisitions and the type of payment used. SAIC paid all its recent acquisitions with cash and debt. The company did not use equity, which I believe is beneficial. Companies that use their equity usually report an expensive stock. It does not seem to be the case here.

The Company completed the acquisition of Halfaker and Associates, LLC, a mission focused, pure-play health IT company, which grows the Company’s digital transformation portfolio. Additionally, on May 3, 2021, the Company acquired Koverse, a software company that provides a data management platform enabling artificial intelligence and machine learning on complex sensitive data. Source: 10-k

We completed the acquisition of Unisys Federal, a former operating unit of Unisys Corporation, which enhances our capabilities in government priority areas, expands our portfolio of intellectual property and technology-driven offerings, and increases our access to current and new customers. Source: 10-k

The current ratio is close to 1x, so I do not really see a liquidity issue here. Given the clients reported by SAIC, I believe that banks would most likely offer financing if necessary. The asset/liability is also close to 1x, so I believe that the balance sheet appears quite solid.

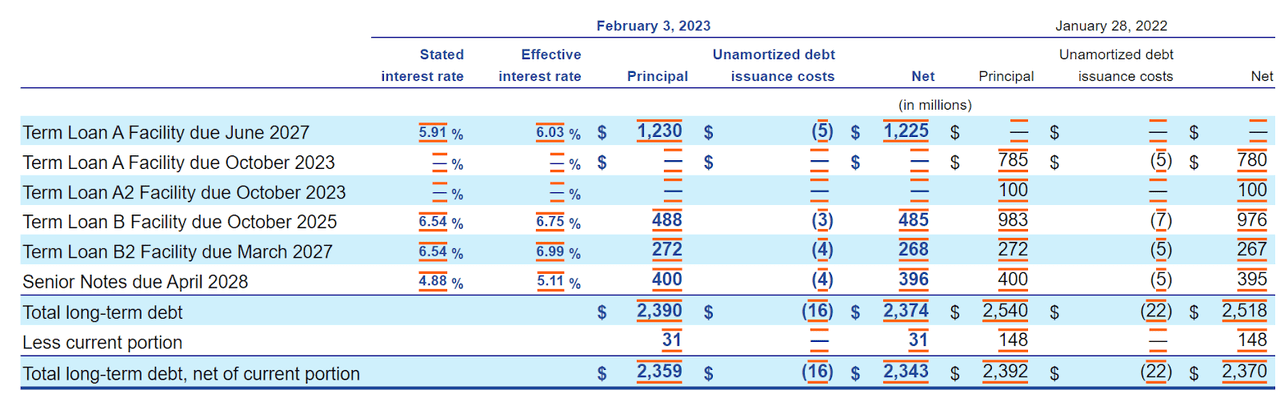

I did study carefully the obligations reported by SAIC. SAIC reports a $1 billion secured credit facility. The company has entered into numerous amendments and modifications to its credit agreements to finance acquisitions and extend terms, incurring costs associated with these transactions. I believe that SAIC knows well how to negotiate debt agreements. In the last 10-k, the company noted interest rates close to 6% and 5%. With this in mind, I believe that a WACC higher than 6% would most likely be conservative.

Source: 10-k

New Acquisitions To Enhance Digital Transformation Capabilities, But Also Divestitures

According to the annual report, SAIC plans to expand through strategic acquisitions, joint ventures, and selective divestitures. I believe that these transactions will most likely strengthen the company’s presence in the market, and diversify its service offering. In my view, divestitures could bring cash in hand, which may help reshape the balance sheet.

I also believe that new acquisitions could increase operational efficiency, and promote innovation in each of its operations. In addition, with further improvement in the organizational structure to enhance customer engagement and the development of advanced technological solutions, I would expect FCF growth to trend north. In this regard, it is worth mentioning that the acquisition of Halfaker and Associates as well as Koverse is expected to enhance digital transformation capabilities as well as bringing new skills with regard to artificial intelligence and machine learning.

Demand For Cybersecurity Could Enhance Net Sales Growth

With the recent information about the acquisition of companies offering digital transformation capabilities, SAIC also received a five-year contract with the Army to provide cybersecurity and network availability among other services.

During the quarter, SAIC was awarded a five-year, $141 million contract to provide system support to the USARC through their United States Army Reserve Command Information Technology Support Services contract. This effort will focus on delivering mission value and enhanced user experience, while improving cybersecurity, network availability and reliability for USARC and its customers. Source: Quarterly Press Release

Even considering that the contract was small, the news is quite relevant. If SAIC continues to offer cybersecurity solutions, I believe that the company may get exposure to the Military Cyber Security market growth, which is expected to stand at close to 11% in the coming years.

The Military Cyber Security market is projected to reach a substantial $7.2bn by 2029, expanding at a Compound Annual Growth Rate of 11% from 2021 according to figures from Adroit Market Research. Source: Military Cyber Security Market

Existing Backlog Means That We Can Expect Net Sales Generation

In the last quarter, SAIC reported total net bookings of close to $1.4 billion and a backlog of approximately $22.8 billion. Given the total amount of backlog and the amount of financing received to execute the orders commanded by clients, I believe that we could expect net sales generation in the coming years. In this regard, readers may want to have a look at lines offered below from a recent quarterly release.

Net bookings for the quarter were approximately $1.4 billion, which reflects a book-to-bill ratio of approximately 0.8. Net bookings for the year were approximately $6.7 billion, which reflects a book-to-bill ratio of approximately 0.9. SAIC’s estimated backlog at the end of fiscal year 2024 was approximately $22.8 billion of which $3.5 billion was funded. Source: Quarterly Press Release

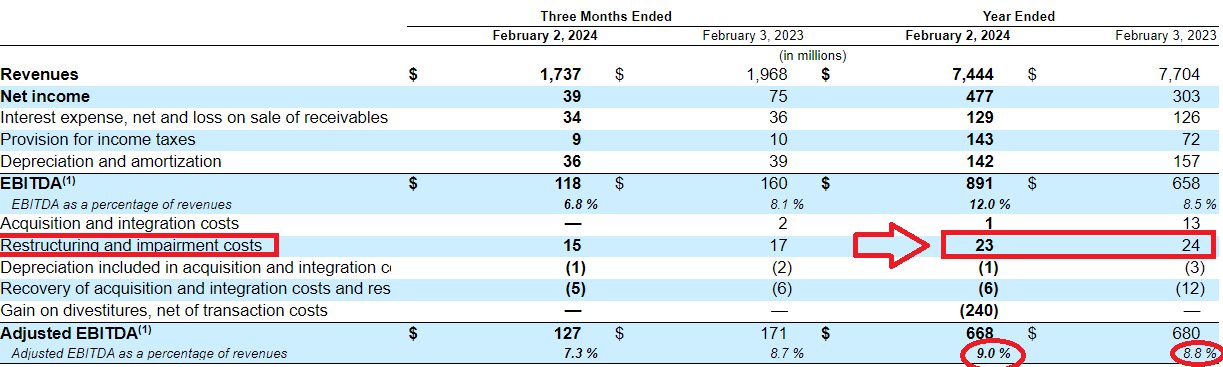

Restructuring May Continue To Bring Adjusted EBITDA Margin Growth

SAIC recently reported a meaningful amount of restructuring costs and impairment costs. I could not find specific information about the amount of restructuring included in the total restructuring costs and impairment costs. However, I believe that the company’s efforts could bring significant financial flexibility as well as Adjusted EBITDA margin growth in the coming years. In particular, the company noted an increase in the Adjusted EBITDA margin in 2024 as compared to the same figure in 2023. I believe that the increase in the margins clearly indicate that SAIC is doing a few things right.

Source: Quarterly Press Release

Under My Base Case Scenario, I Obtained A Target Price Of $159 Per Share

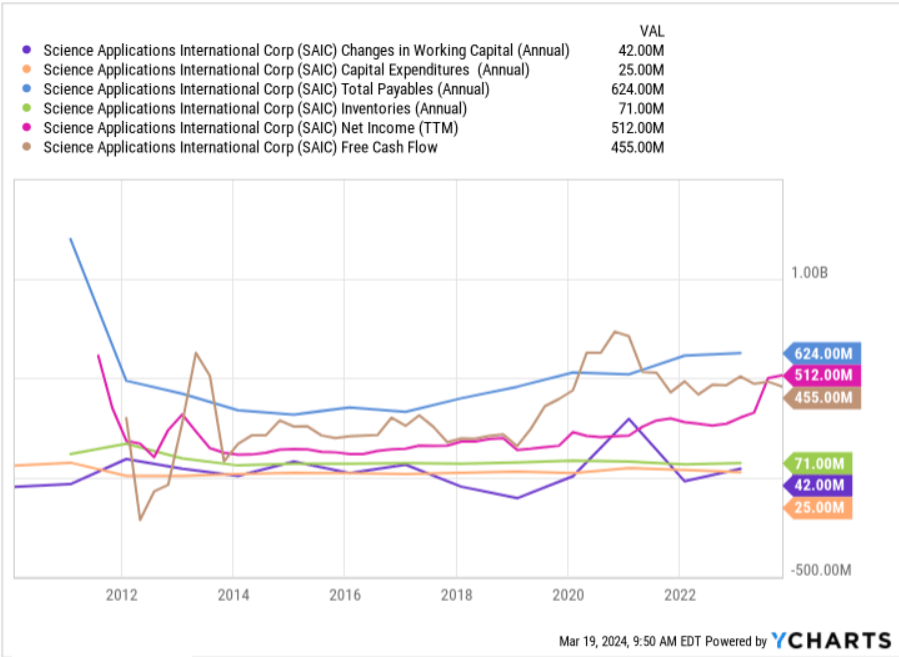

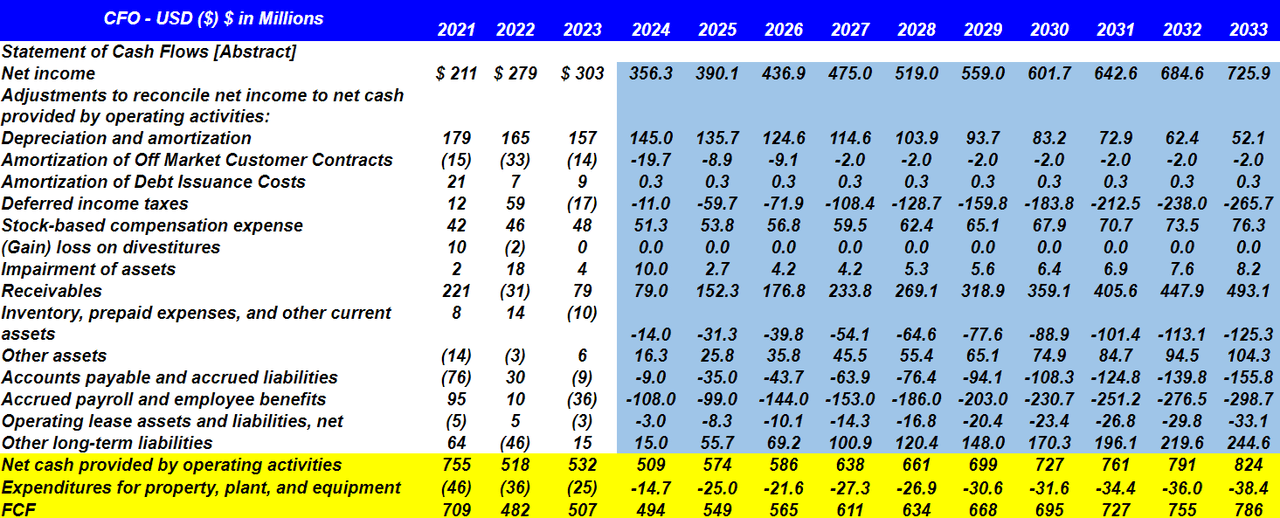

For the assessment of future cash flow statements, I took a look at previous cash flow statements, including changes in working capital, capital expenditures, net income, and FCF growth. I believe that most variables do not change significantly over the years, which I took into account in my DCF model. Also, I think that previous increases in FCF and net income could continue in the next decade.

Source: Ycharts

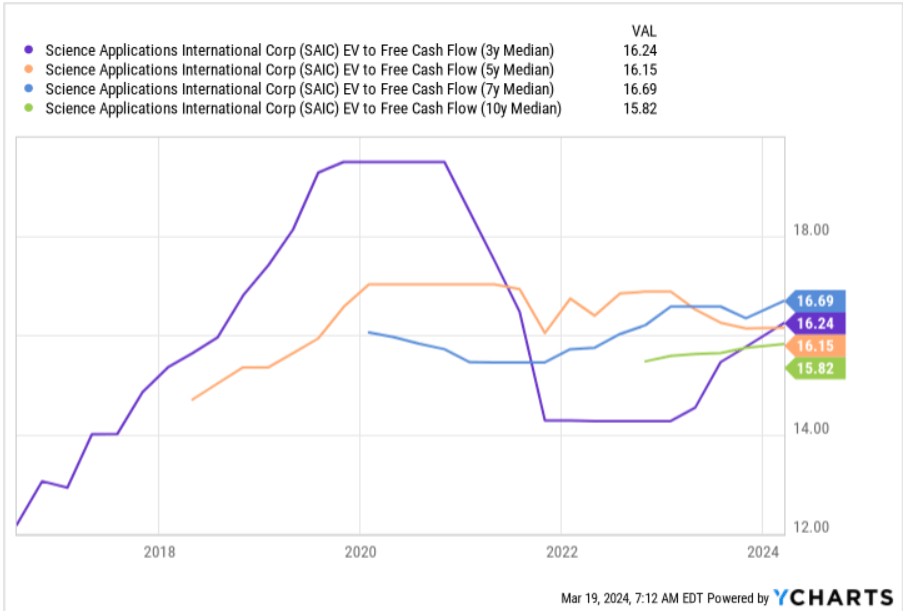

For the assessment of the exit multiples, I checked the previous EV/FCF multiples. According to the 3 years, 5 years, 7 years, and 10 years median, the EV/FCF stood between 18x and 14x. With this in mind, I included an EV/FCF of 16x in my best case scenario and 15x in my bearish case scenario.

Source: Ycharts

With the previous assumptions, I included 2033 net income of about $725 million, with the following adjustments to reconcile net income to net cash provided by operating activities. First, I assumed 2033 depreciation and amortization of $52 million, with amortization of off market customer contracts close to -$2 million, but no amortization of debt issuance costs.

In addition, with 2033 deferred income taxes worth -$266 million and 2033 stock-based compensation expenses of $76 million, I also assumed impairment of assets worth $8 million.

Moreover, I also included changes in accounts receivables of $493 million as well as inventory, prepaid expenses, and other current assets worth -$126 million. Besides, taking into account changes in other assets worth $104 million, changes in accounts payable and accrued liabilities worth -$156 million, and accrued payroll and employee benefits of -$299 million, I also assumed operating lease assets and liabilities of -$34 million.

Finally, my results showed net cash provided by operating activities worth $824 million, and with expenditures for property, plant, and equipment of -$4 million, 2033 FCF resulted in $820 million.

Source: My DCF Model

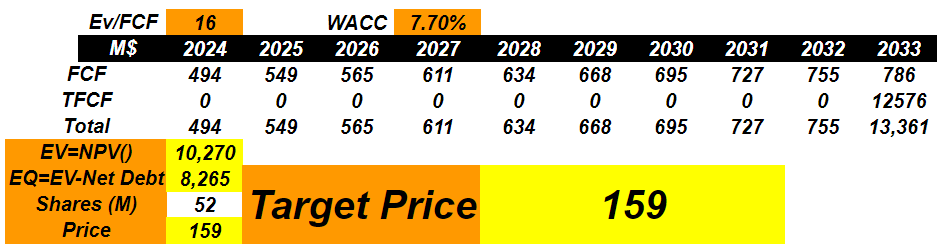

With the previous assumptions, I also included the cost of capital figures pretty much in line with that of other advisors. Also, with an exit multiple of 16x, the implied equity valuation would stand at $8.26 billion with an implied price of $159. Given the current stock valuation, I believe that there is upside potential in the stock price.

Source: My DCF Model

Under My Bearish Case Scenario, I Obtained A Fair Price Of $116 Per Share

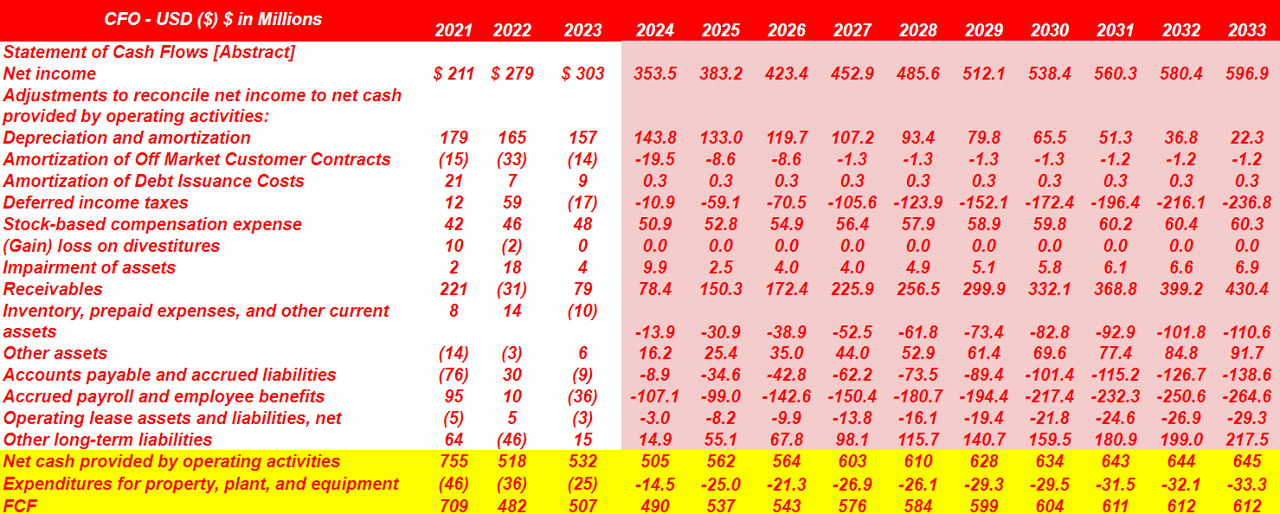

My bearish case scenario is not that different from the previous case scenario. I only lowered my expectations for future net income growth and FCF growth. Other changes in assets and liabilities and changes in working capital are also not different from the base case scenario. SAIC does not really report a lot of FCF volatility or net income volatility, so my business cases reflect that reality.

With 2033 net income of about $596 million, I included 2033 depreciation and amortization worth $22 million, with amortization of off market customer contracts of about -$2 million and 2033 stock-based compensation expense of $60 million.

In addition, taking into account impairment of assets of about $6 million, I also assumed receivables close to $430 million as well as inventory, prepaid expenses, and other current assets worth -$111 million.

Finally, with changes in other assets worth $91 million and changes in accounts payable and accrued liabilities worth -$139 million, I also assumed operating lease assets and liabilities of about -$30 million. Finally, taking into account net cash provided by operating activities worth $645 million, I obtained 2033 FCF of $611 million.

Source: My DCF Model

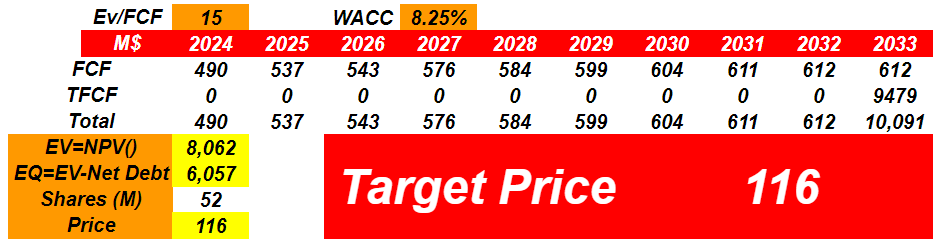

My expectations are a bit lower than that in the base scenario, so I assumed an EV/FCF of 15x, which is a bit lower than that in the other case. I also assumed a WACC of 8.25%, which is also a bit higher than that in the base case. I assumed that demand for the stock may lower, which could lead to higher cost of capital. With these assumptions, I obtained an equity valuation of $6 billion and a target price close to $116 per share.

Source: My DCF Model

Risks From Government Regulations, And Competition

SAIC faces significant risks related to compliance with United States laws and government regulations. Contracts may contain institutional conflict of interest clauses that restrict competition and the ability to enter into other contracts. Government investigations can lead to civil or criminal penalties, such as loss of contracts and fines, impacting reputation and the ability to gain new clients. Fines are common in the sector, and any violation could negatively affect the profitability and future of the company.

SAIC faces strong competition from large international companies, smaller, specialized companies, and US government capabilities. It regularly collaborates with other companies to compete for major contracts, despite the challenges of increasingly intense price competition and the decline in the number of contracts awarded to a single supplier. Key elements of competition include technical expertise, innovativeness, track record of successful execution, reputation, pricing, and company size. Government initiatives can decrease opportunities, thereby increasing rivalry within the industry.

My Opinion

SAIC recently proved that it is ready to acquire other companies in the IT industry offering digital transformation, artificial intelligence, and machine learning capabilities. Moreover, considering the expected growth of the military cybertechnology market, I think that SAIC could enjoy many net sales drivers. Besides, given the total backlog of approximately $22.8 billion recently noted, I think that future net sales volatility may not be that significant. Dependence on government institutions and fierce competition demand caution, however I believe that the stock remains undervalued after recent declines.