Insights into upcoming dividends and past performance

Regions Financial Corp (NYSE:RF) recently declared a dividend of $0.24 per share. The dividend is paid on July 1, 2024, with an ex-dividend date of June 3, 2024. As investors eagerly await this dividend payment, attention will also be focused on the company's dividend history, yield, and growth rate. Let's use GuruFocus data to examine Regions Financial Corp's dividend performance and assess its sustainability.

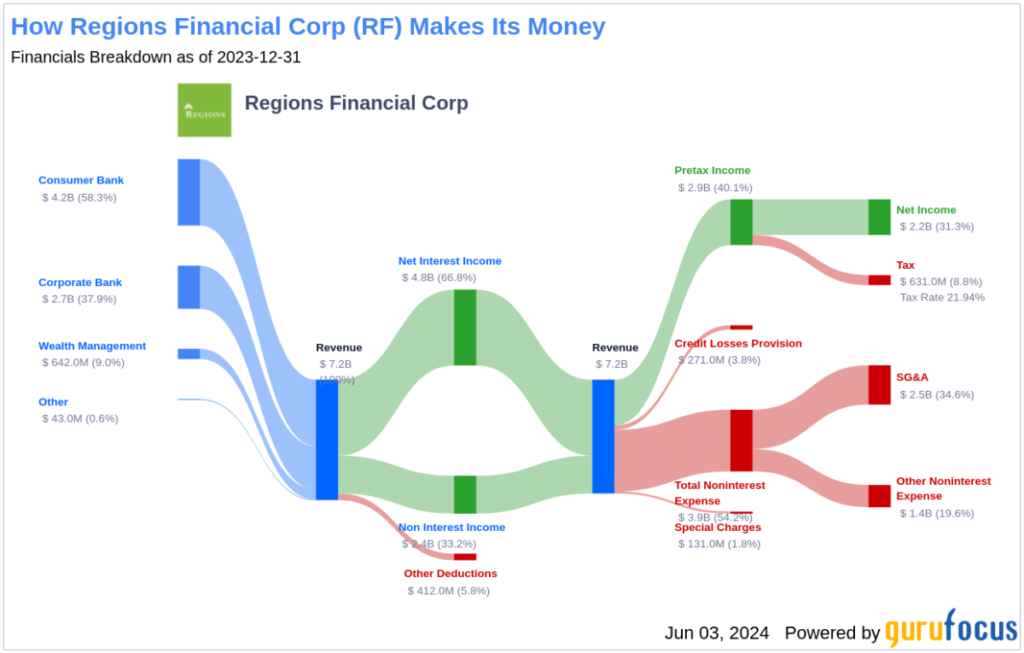

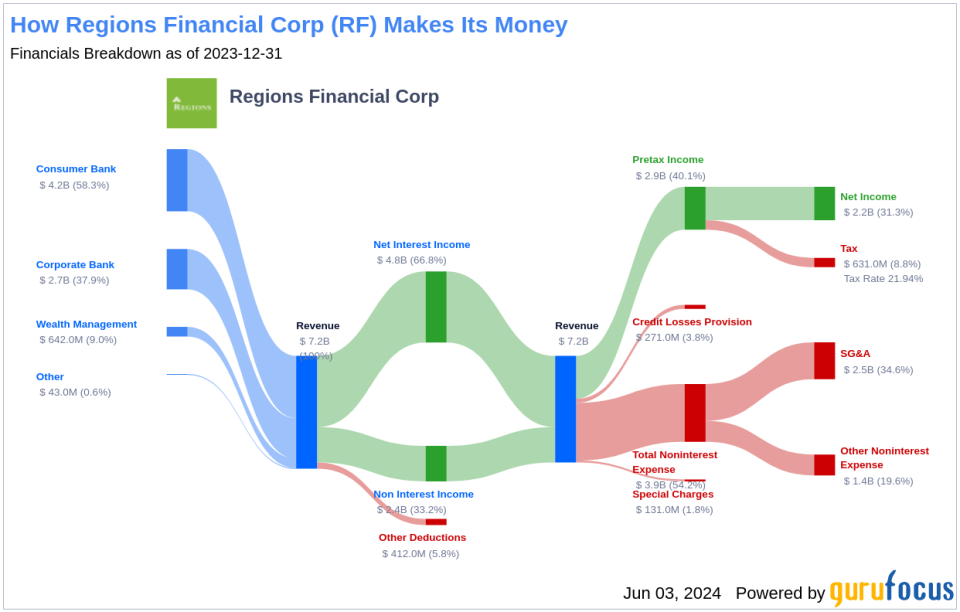

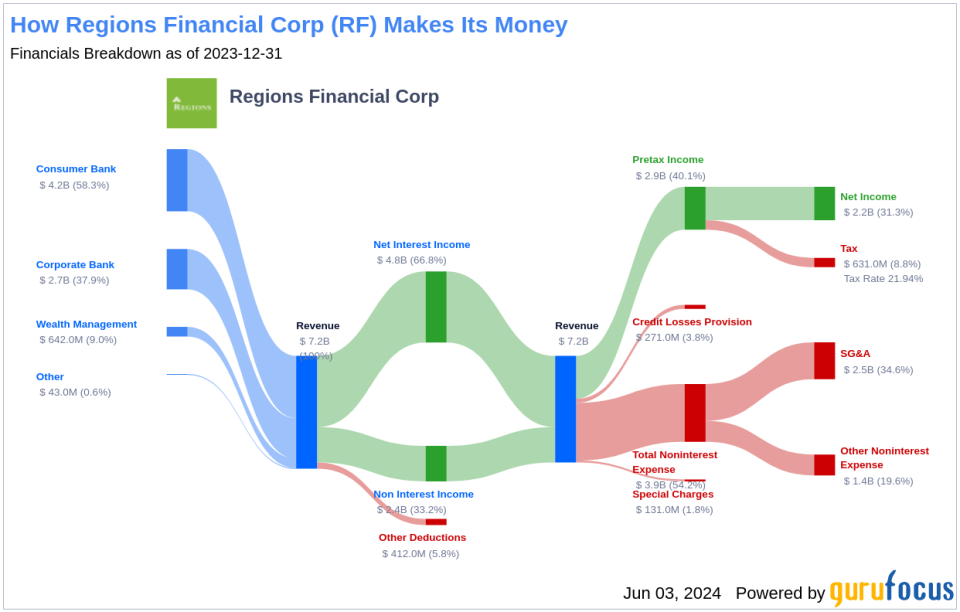

What does Regions Financial Corp do?

Regions Financial is a regional bank headquartered in Alabama with branches primarily located in the Southeast and Midwestern U.S. Regions primarily provides traditional commercial and retail banking services and also offers mortgage servicing, asset management, wealth management, securities brokerage and trust services.

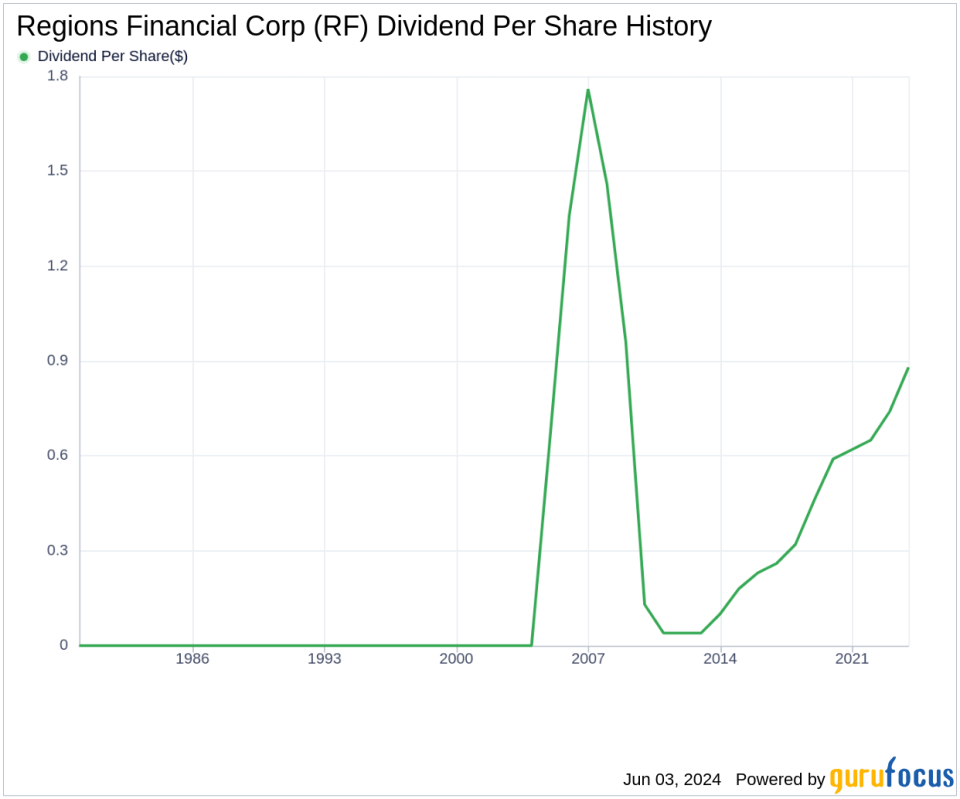

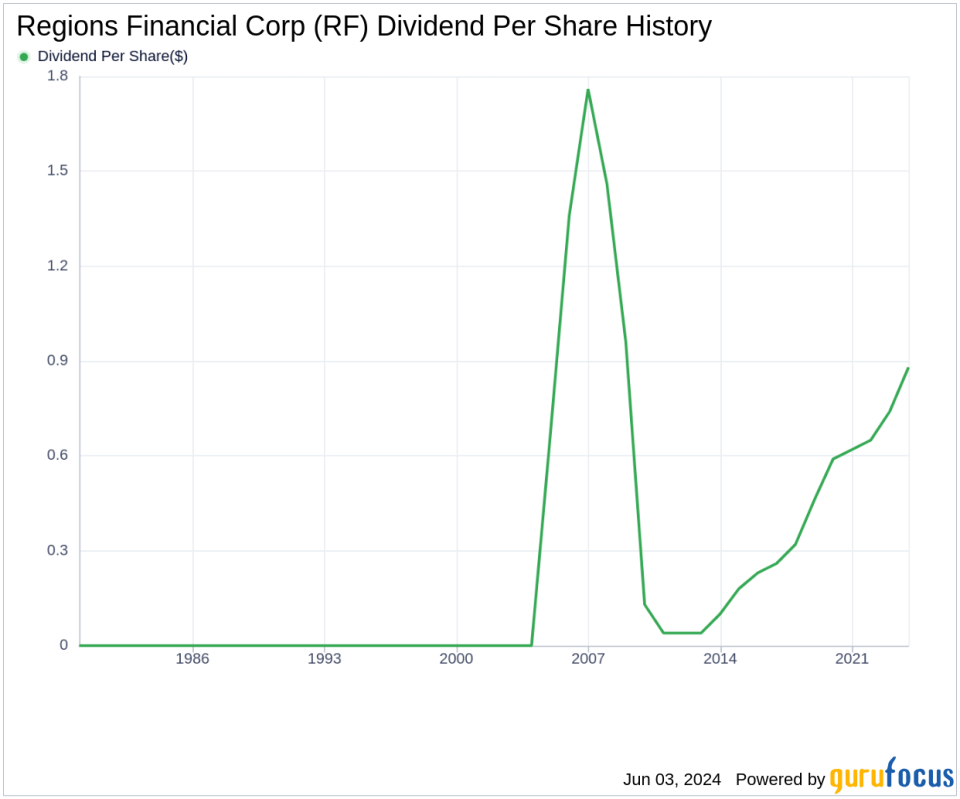

A glimpse into Regions Financial Corporation's dividend history

Regions Financial Corp has maintained a consistent dividend payment record since 2004. Dividends are currently distributed quarterly.

Regions Financial Corp has increased its dividend every year since 2010. As a result, the company's stock is listed as a dividend achiever, an honor given to companies that have increased their dividend every year for at least the past 14 years.

Regions Financial Corporation Dividend Yield and Growth Analysis

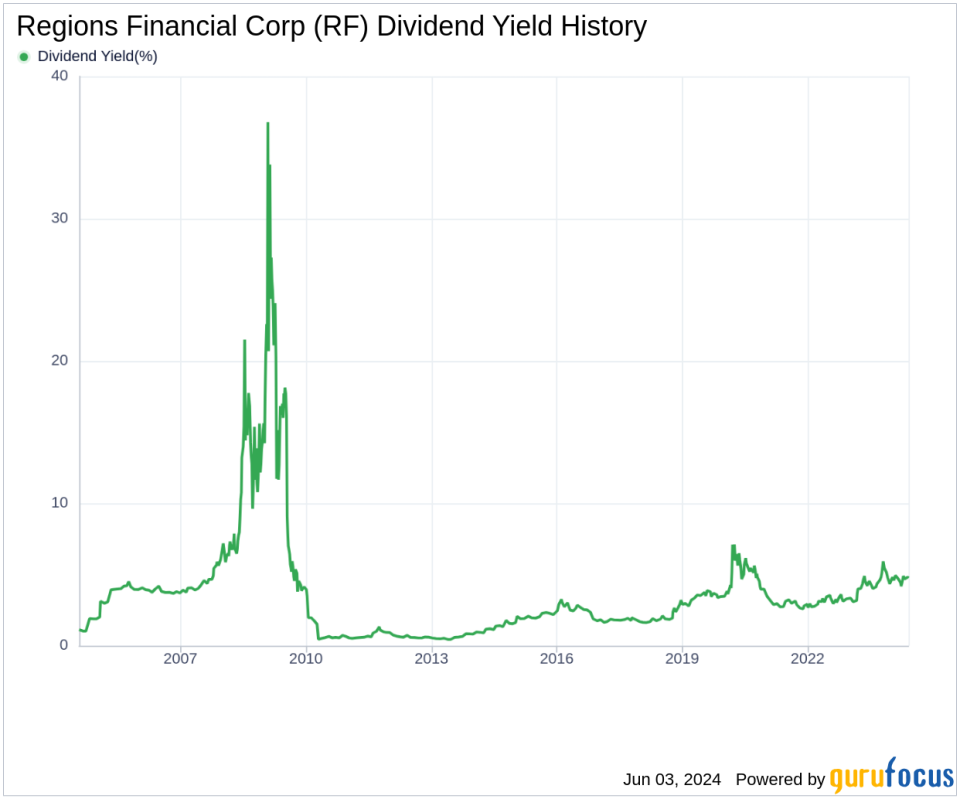

Currently, Regions Financial Corp has a trailing 12-month dividend yield of 4.75% and a future 12-month dividend yield of 4.96%, which indicates that the dividend is expected to increase over the next 12 months.

Over the past three years, Regions Financial Corp's annual dividend growth rate was 12.40%. Stretching out to five years, this growth rate declined to 12.00% per year. Also, over the past ten years, Regions Financial Corp's annual dividend growth rate per share was an impressive 22.20%.

Based on Regions Financial Corp's dividend yield and the 5-year growth rate, the 5-year yield on Regions Financial Corp stock as of today is approximately 8.37%.

Sustainability Issues: Dividend Payout Ratios and Profitability

To assess the sustainability of a dividend, we need to evaluate a company's dividend payout ratio, which provides insight into the percentage of earnings a company distributes as dividends. As of March 31, 2024, Regions Financial Corp's dividend payout ratio is 0.47.

Regions Financial Corp's profitability ranking is 6 out of 10, indicating that its profitability is decent. The company has reported positive net income in each of the past ten years, further reinforcing its high profitability.

Growth indicators: Future outlook

Regions Financial Corp has a growth rank of 6 out of 10, indicating that the company has reasonable growth prospects. Earnings are the lifeblood of any business, and Regions Financial Corp's earnings per share have grown at an average of about 7.40% per year, along with three-year revenue growth, pointing to a strong earnings model.

The company's three-year EPS growth rate demonstrates its ability to grow earnings, a key factor for sustaining a dividend over the long term. Over the past three years, Regions Financial Corp's earnings have grown by approximately 26.60% per year on average.

Lastly, the company’s five-year EBITDA growth rate is 13.60%, outperforming its global peers by around 69.73%.

Next steps

GuruFocus Premium users can screen for high dividend yield stocks using the High Dividend Yield Screener.

This article written by GuruFocus is intended to provide general insights and is not tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment guidance. It is not a recommendation to buy or sell stocks, nor does it take into account individual investment objectives or financial situation. Our objective is to provide long-term, fundamental data-driven analysis. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus has no position in the stocks mentioned herein.

This article was originally published on GuruFocus.