The top regulator is resigning after an investigation into the Federal Deposit Insurance Corp.'s workplace culture found rampant sexual harassment and rampage by male employees with little accountability.

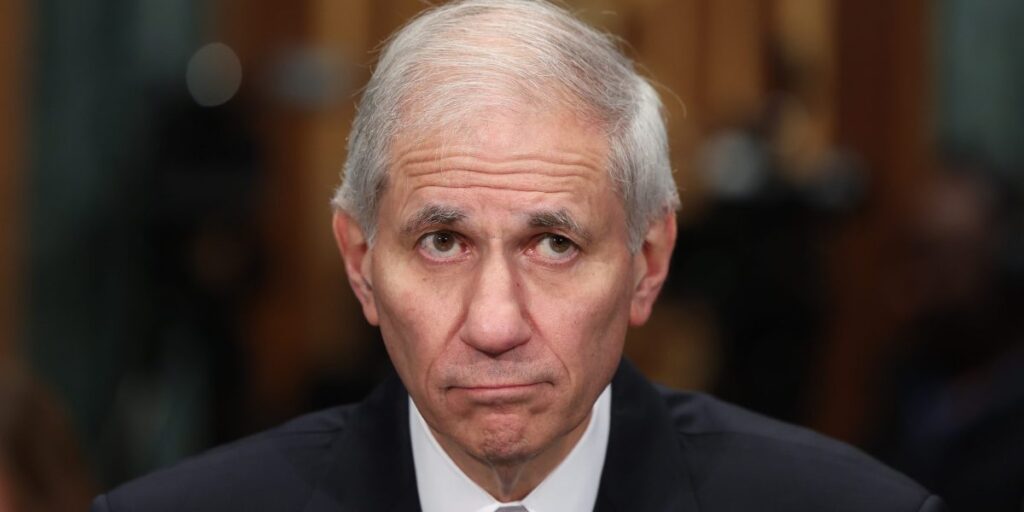

FDIC Chairman Martin Gruenberg managed to keep his job for several weeks after the report was released, but he was unable to drown out calls for change at the top of the organization. Gruenberg announced in a statement Monday that he will step down once his replacement is appointed. wall street journal report. Sen. Sherrod Brown (D-Ohio), chairman of the Senate Banking Committee, called for Gruenberg's removal earlier today, suggesting his retention is in shaky condition. There is.

“After chairing last week's hearing, reviewing the independent report, and receiving additional support from FDIC staff to the Banking and Housing Committee, I came to one conclusion,” Brown said in a statement. “We need fundamental changes at the FDIC.” “These changes must start with new leadership, fixing the agency’s toxic culture and putting the women and men who work there and its mission first.”

Mr. Gruenberg became FDIC Chairman in January 2023, served as a director since 2005, and served as Vice Chairman from August 2005 to July 2011. We have confirmed this,” Gruenberg said in a statement. “Until then, I will continue to fulfill my responsibilities as Chair of the FDIC, including transforming the FDIC's workplace culture.”

The appointment of Gruenberg's replacement, a Democrat, means the FDIC will no longer be in the hands of Republican Vice Chairman Travis Hill.

Despite the shocking revelations about the FDIC's workplace culture, there were few calls for Grunberg's resignation and little pushback from lawmakers in the days after the independent investigation was announced.

For example, in the following statement: luck Two weeks ago, Sen. Elizabeth Warren did not call for his resignation. “Everyone has the right to a workplace free from discrimination and harassment,” she said. “I supported this independent investigation into misconduct at the FDIC during Republican and Democratic administrations. Chairman Gruenberg has acknowledged responsibility and I have implemented a plan of action to improve the culture at the FDIC. I support his efforts.”

But he faced a grueling two-day hearing at the Capitol, drawing condemnation from both Democratic and Republican lawmakers.

Gruenberg's departure could deal a major blow to at least one proposed rule many regulators want to consider: The day before the report was released, the FDIC reissued an earlier rule harkening back to the Dodd-Frank era aimed at reining in compensation, a practice that has been used on Wall Street to scare off executives who took on excessive risks and later caused significant losses for investors. Previous policies have sparked strong backlash in the past, with accusations that the government is trying to bar the heads of some of the largest financial-services companies from having board seats.

It was first proposed in April 2011 and attracted more than 10,000 comments. In June 2016, regulators proposed a different version of the rule but have not acted on it again to date. Changes under consideration include mandatory clawbacks or asset seizure in certain cases, which would be up to regulators rather than corporate boards. The rule could also prescribe specific performance metrics that management must achieve and limit the power of director compensation committees to exercise discretion in adjusting dividends. The rule goes to the heart of an issue that could have major implications in the election campaign: Wall Street pay and the slow-growing wages of hourly and salaried workers.

Report findings

The FDIC's scathing report was the result of a special investigation committee of the agency's board of directors appointed to investigate the agency's workplace culture, sexual harassment allegations, executive misconduct, and management's past actions.it came after that wall street journal We reported on culture at the 2023 FDIC.

The agency's review was conducted by the law firm Cleary Gottlieb Steen & Hamilton and included interviews with more than 500 people, most of them women and minorities. called the hotline. In the review, executives said they found it painful and emotional to talk about their experiences with sexual harassment and other types of misconduct. Some had previously reported to the FDIC and were disappointed in the process, while others didn't care. “Virtually all expressed hope that by reporting their experiences, they might be able to change and make the agency they care about better.” It is stated here.

The commission found that “for too many employees, for too long, the FDIC has failed to provide a workplace safe from sexual harassment, discrimination, and other interpersonal misconduct,” the preamble states. It has been stated. “We also believe that a patriarchal, insular and risk-averse culture contributes to the conditions that allow this workplace misconduct to occur and persist, with fear of retaliation pervasive and We also found that there was a lack of clarity and credibility regarding internal misconduct, and a lack of reporting channels led to a long history of underreporting of workplace misconduct.”

The report lists numerous examples of FDIC working conditions that are difficult and unsafe for female employees, some of which occurred just weeks ago. One woman testified that she was being stalked by her co-worker, who also sent her unsolicited sexual text messages about half-naked women. Another female inspector said a senior FDIC inspector texted her a photo of his genitals out of nowhere. Other employees reported that the senior inspector liked to visit brothels during his business trips. Many of the examples included in the report include unwanted sexual contact, rubbing, marriage proposals, and excessive drinking.

Women were not the only ones exposed to indecent acts. Employees endured bosses calling gay men “little girls.” At least one employee believed her boss had to hide her sexual orientation. Employees of color were demoralized when they heard they were being hired to meet quotas.

“These incidents, and many others like them, did not occur in isolation,” the report states. “They are born into work cultures that are ‘misogynistic’, ‘patriarchal’, ‘closed’ and ‘outdated’, where favoritism is common and management It's a 'good old fashioned boys' club' where wagons roll around and senior executives with notable talent surround them. A reputation for pursuing romantic relationships with subordinates enjoys long careers with no apparent consequences.”

The FDIC reported that between 2015 and 2023, there were 92 harassment complaints, but none resulted in disciplinary action beyond termination, pay reduction, pay reduction, or suspension. The FDIC's paralysis in holding harassers accountable appears to be rooted in the agency's risk aversion and “over-emphasis” on the risk of disciplinary action. But years of not holding people accountable for their actions have caused significant damage to the system, the report said.

Mr. Gruenberg did not escape unscathed, and at times in his report appears oblivious to the effect his temper has on others. Employees reported that Mr. Gruenberg's aggressiveness made them worry that delivering bad news would ignite his anger. However, others said he had a prosecutor-like style and was otherwise “soft-spoken.” The WSJ article sparked debate among senior staff, including Gruenberg. One executive confirmed that the paper's reporting about Mr. Gruenberg's temperament was accurate, but it led to “tense and awkward discussions among senior staff about their respective interactions with him.”

The report says that while Mr. Gruenberg's conduct is not at the root of sexual harassment or discrimination problems at the FDIC, the tone at the top is critical to turning around the agency's culture. The investigation found that Gruenberg oversaw numerous male employees at field offices and corporate headquarters who stalked and harassed female co-workers and inappropriately sent sexually explicit photos and texts. . The report found that when employees reported misconduct, perpetrators were rarely held accountable and were instead transferred to other offices and new roles.

“As one FDIC executive said, the FDIC's response to interpersonal misconduct is 'pay me, promote me, or transfer me.'”