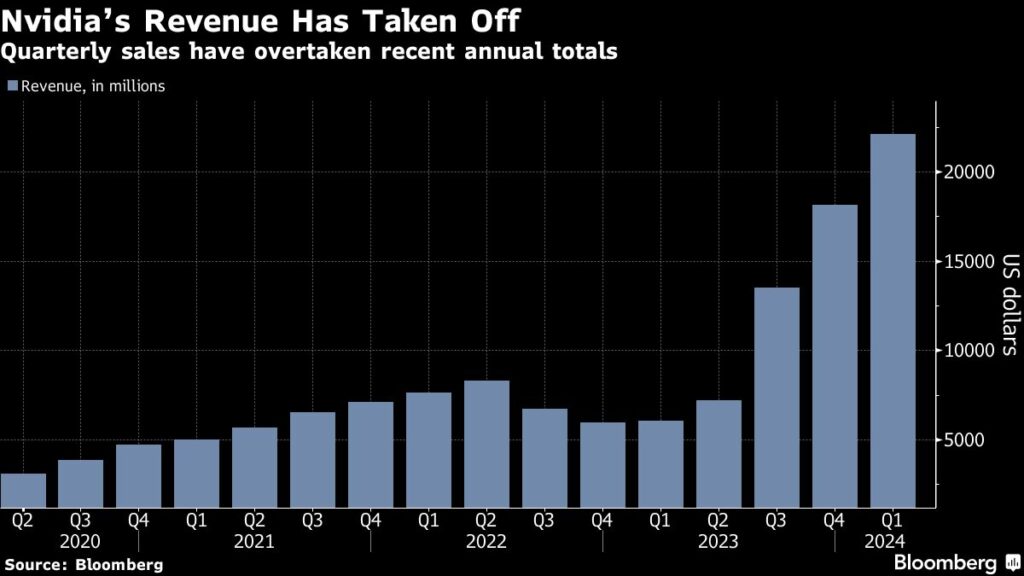

(Bloomberg) — U.S. stock futures rebounded after Nvidia Inc. announced strong results after the close of trading in New York, boosting optimism about a global artificial intelligence boom.

Most Read Articles on Bloomberg

The company reported second-quarter revenue of about $28 billion, beating analysts' expectations. It also announced a 1-for-10 stock split and raised its quarterly dividend by 150%, to 10 cents a share. Nvidia's shares rose 7% in after-hours trading following the results, and futures for the S&P 500 and Nasdaq 100 both rose. The dollar was little changed in Asia after three straight days of gains.

A gauge of Asian chipmakers rose to its highest since February 2021, led by Nvidia's earnings.

“In the face of high expectations, the company once again stepped up and delivered,” said Carson Group's Ryan Detrick, highlighting strong data center earnings.

Asian stocks were mixed. Stock indexes in Australia, China, and Hong Kong fell, but those in Japan rose. South Korean stocks reversed an early slide after central bank governor Lee Chang-yong said there was limited chance of raising interest rates at this time. The Bank of Korea left its main interest rate unchanged after the policy meeting.

Chinese stocks were the biggest drag on the region, with tech stocks leading the decline. An index of Hong Kong-listed tech stocks fell amid an intensifying price war between Alibaba Group Holdings Ltd. and Tencent Holdings Ltd. over cloud services.

Read more: Nvidia pave the way for AI stocks to continue rising

Asian government bonds were little changed after sliding on Wednesday. Policy-sensitive two-year Treasury yields rose 4 basis points in New York after Federal Reserve minutes showed officials remained in no rush to cut interest rates.

“Many” Fed officials expressed uncertainty about the extent to which policy was restraining the economy, but the minutes also note that policy was “viewed as restrictive.”

“The FOMC signaled a stronger likelihood of longer-term increases in interest rates, which we felt was negative for most Asian currencies and therefore capital markets,” said Xinyao Ng, investment director at Abledon. “This is a currency effect.”

Among currencies, a gauge of the dollar's strength maintained its gains from Wednesday, when it hit a one-week high. The yen was little changed against the dollar after falling to its lowest since late April. The People's Bank of China cut its fixed interest rate on the yuan to its lowest level since January.

The New Zealand dollar rose after Reserve Bank of New Zealand Governor Adrian Orr said the central bank did not want to risk a sudden rise in inflation expectations.

The benefits of technology

U.S. tech profits were among the strongest of the first-quarter earnings season, and the sector's earnings revisions outpaced the rest of the market, but the results also signal market expansion, according to Solita Marcelli of UBS Global Wealth Management.

“We remain positive on AI trends and continue to prioritize big tech given its favorable market position,” she said. “We expect global tech profit growth to be 20% and 16% this year and next, respectively, led by the semiconductor sector, where we see investment opportunities.”

In Asia, South Korea announced a $19 billion incentive package to bolster its chip sector, a boon for Samsung Electronics and SK Hynix as they seek to stay ahead in an increasingly competitive industry.

Gold fell for a second straight day after dropping 1.7% on Wednesday following the Fed minutes. West Texas Intermediate also fell, marking its fourth daily decline. Copper prices fell on signs of weakening demand.

Major events this week:

-

Eurozone S&P Global Services and Manufacturing PMI, Consumer Confidence, Thursday

-

G7 Financial Meeting, May 23-25

-

U.S. new home sales, new unemployment claims, Thursday

-

Fed's Rafael Bostic speaks Thursday

-

US Durable Goods, Consumer Sentiment, Friday

-

Fed's Christopher Waller to speak on Friday

The main movements in the market are:

stock

-

S&P 500 futures were up 0.6% as of 12:08 p.m. Tokyo time.

-

Nasdaq 100 futures rose 0.9%

-

Japan's TOPIX rose 0.4%

-

Australia's S&P/ASX 200 falls 0.5%

-

Hong Kong's Hang Seng fell 1.4%.

-

The Shanghai Composite fell 0.8%.

-

Euro Stoxx 50 futures up 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was little changed at $1.0829

-

The Japanese yen was almost unchanged at 156.77 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2536 yuan to the dollar.

cryptocurrency

-

Bitcoin remains almost unchanged at $69,434.88

-

Ether rose 0.6% to $3,769.09

Bonds

merchandise

-

West Texas Intermediate crude oil fell 0.6% to $77.07 a barrel.

-

Spot gold fell 0.3% to $2,370.88 an ounce.

This story was produced in partnership with Bloomberg Automation.

–With assistance from Zhu Lin.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP