In his latest press conference on May 1, Federal Reserve Chairman Jerome Powell praised Biden's economy. When a reporter asked whether the U.S. economy was entering a period of stagflation, Chairman Powell said, “I don't see any stagflation or stagflation.'' “Flation”.

Therefore, we aim to eliminate stagflation.

Some alarmists think they are seeing signs of that happening, which will please Biden's critics who are hoping for an economic collapse that will doom the president's re-election bid. However, the term stagflation, as it originated in the United Kingdom in the 1960s and in the United States in the 1970s, refers to a struggling economy in which inflation and unemployment rates are both near or reaching double digits.

Inflation is currently 3.5% and unemployment is 3.9%, which is why President Powell scoffed at the idea.

But no one seems happy in America. The Conference Board's consumer confidence index has fallen for the third month in a row and is now at levels seen in July 2022, when inflation was near its recent peak and shoppers were in shock. The rise in gasoline prices heading into 2024 is one of the factors pushing down confidence.

Meanwhile, stock market investors are having whiplash as they try to figure out whether inflation, which fell sharply from its peak in 2022 to the end of 2023, is fighting back or becoming more diversionary.

Annual inflation rose from 3.1% to 3.5% in the past three months. The Fed hopes to eventually bring inflation down to around 2%, and the fight against rising prices appears to be slow.

Other inflation indicators closely monitored by the Fed are flashing yellow as well.

Given that the main drivers of current inflation are auto insurance, which is one of the last sectors to catch up with coronavirus-related distortions, and rent, which is months behind real-world conditions, these inflation signals may be abnormal. Another concern is above-average wage growth, which is good for workers but could mean inflation is more entrenched than usual.

Leave a note for Rick Newman, Follow him on Twitteror sign up for his newsletter.

Second, April's employment report was weak, suggesting that inflation concerns may be overstated.

Employers added 175,000 jobs in the month, a healthy number but about 65,000 fewer than economists expected. Wage growth was also slightly weaker than expected.

This weak data suggests a weakening labor market, which could have a positive impact on inflation.

One of the things that typically happens when the Fed has raised interest rates aggressively over the past two years is that employment and economic growth slow, sometimes significantly. That's how the Fed lowers interest rates. When the economy cools, investment and consumption slow, and lower demand causes prices to fall.

The big economic surprise of 2023 was that the economy did not cool down even though the Fed raised interest rates. Inflation-adjusted GDP in 2023 grew steadily at his 2.5%, faster than the previous year. Employers added his 3 million jobs and grew at an almost unprecedented pace.

But now, that slowdown may finally have arrived. GDP growth slowed to an annualized pace of 1.6% in the first quarter.

April employment numbers were the lowest since October of last year, which is much more normal than the rise in growth rates for most of the past two years. “The labor market is gradually cooling from overheating,” Capital Economics explained in a May 3 research note. “As a result, hourly wage growth has also slowed.”

The stock market also took the bait on the weak employment news, with the S&P 500 index rising more than a point. That's not because investors are rooting for fewer jobs than expected, but because they're seeing signs that inflation may not be so scary after all.

If deflation picks up again, the Fed could cut rates modestly at some point over the next six months, which would be bullish for stocks unless there is a recession.

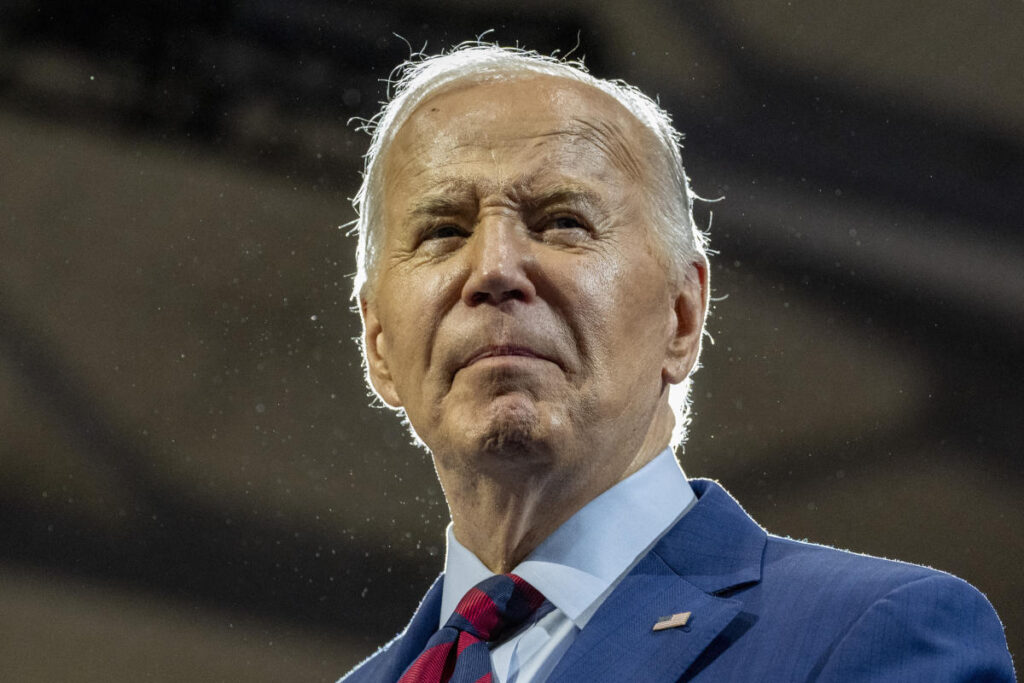

Biden welcomed the jobs news as usual, declaring that “America's great comeback continues.” But voters don't seem to agree, and a weak job market over the next six months could have the opposite effect on them as it would on investors who want easy conditions that would allow the Fed to cut rates. .

Voters never trusted Biden to do well with the economy, overlooking record job growth and a strong recovery from the coronavirus pandemic. Instead, they have focused on the scourge of inflation that erodes purchasing power.

Biden's approval rating declined in 2022 due to worsening inflation, and it has not recovered even though inflation has improved dramatically. Biden's dismal approval rating of about 40% is the most disconnected from economic fundamentals in recent history.

There are now early signs that workers are becoming aware of the tight labor market.

The Conference Board's Consumer Survey shows that the percentage of people who say jobs are plentiful has decreased this year, while the percentage who say jobs are hard to come by has increased. If this trend continues, voters may start punishing Biden for a tougher labor market before they begin to hold him responsible for lower inflation.

Even without stags or “inflation,” there's a lot to worry about for a president seeking re-election.

Rick Newman is a senior columnist in the United States. Yahoo Finance. Follow him on Twitter @rickjnewman.

Click here for political news related to business and monetary policy that will determine tomorrow's stock prices.

Read the latest financial and business news from Yahoo Finance