Readers who wish to purchase MVB Financial Co., Ltd. Investors hoping to collect MVB Financial's (NASDAQ:MVBF) dividend should act soon as the stock approaches ex-dividend trading. The ex-date is usually set one business day before the record date, which is the deadline by which you must be on the company's books as a shareholder to receive the dividend. Knowing the ex-date is important because all stock transactions must have settled before the record date. So if you buy MVB Financial stock before May 31st, you'll be able to collect the dividend the company pays on June 15th.

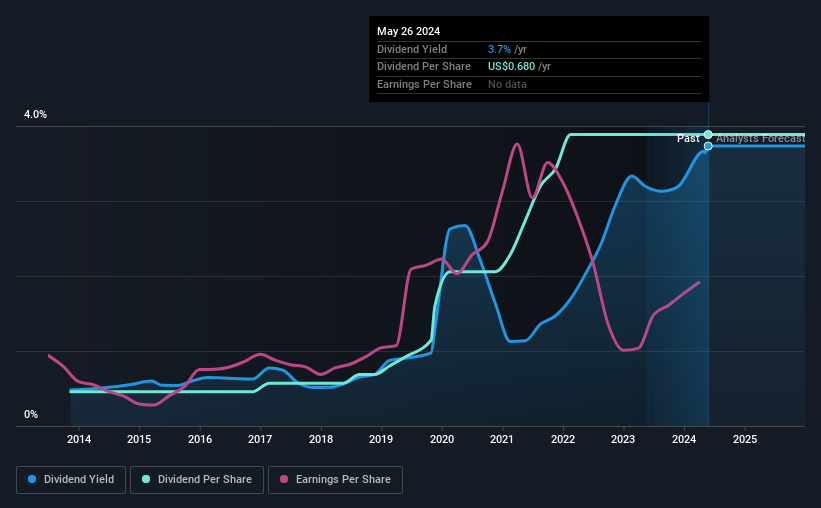

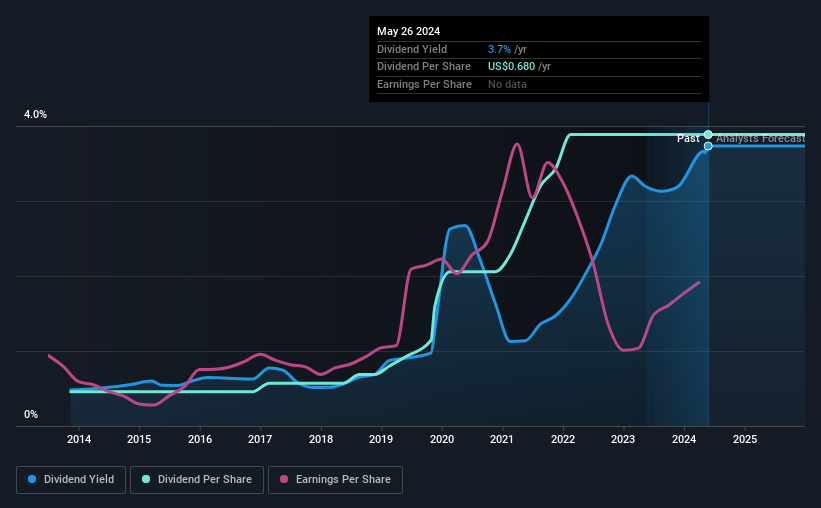

The company's next dividend will be US$0.17 per share, after paying a total of US$0.68 to shareholders last year. Based on last year's payments, MVB Financial has a historical yield of 3.7% on its current share price of US$18.22. Dividends are an important source of income for many shareholders, but the health of a business is crucial to maintaining a dividend. That's why we should always check whether dividend payments are sustainable, and if the company is growing.

Check out our latest analysis for MVB Financial

If a company pays out more in dividends than it earned, the dividend may become unsustainable – hardly an ideal situation, so it's good to see that MVB Financial pays out a modest 36% of its profits as dividends.

Generally speaking, the lower a company's dividend payout ratio, the more stable its dividend tends to be.

Click here to see the company's dividend payout ratio, plus analyst estimates of its future dividends.

Are profits and dividends increasing?

Companies with consistently growing earnings per share usually make the best dividend stocks, as it is easier to grow dividends per share. If earnings fall and the company is forced to cut the dividend, investors could watch the value of their investment disappear. Fortunately for readers, MVB Financial's earnings per share have grown at 13% per year over the past five years.

The primary way most investors assess a company's dividend prospects is to look at the historical dividend growth rate, and MVB Financial has averaged dividend growth of 24% per year over the past decade. It's good to see that both earnings and dividends per share have grown rapidly over the past few years.

Final conclusion

Does MVB Financial have the strength to sustain its dividend payments? Typically, fast-growing companies that pay out a small percentage of their profits as dividends retain the profits to reinvest in the business. This strategy can create significant value for shareholders in the long term, as long as they don't issue too many new shares. Overall, MVB Financial looks like a promising dividend stock in this analysis and we think it's worth investigating further.

Want to know what other investors think about MVB Financial? Visualize historical and future expected earnings and cash flows and see what analysts are forecasting.

If you're looking for stocks with high dividends, Check out our picks for the top dividend stocks.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.