-

Reported earnings per share (EPS) was $0.40 The first quarter of 2024 is in line with analyst expectations.

-

Net profit reached $41.54 million The first quarter of 2024 met the expectations set by analysts.

-

Revenue was $54.56 million Results were in line with expectations during the quarter, as expected by analysts.

-

Acquired or originated $652 million We have recorded an increase in home loans, indicating solid growth in our portfolio.

-

Securitization completed We benefited from a $3.2 billion interest rate swap position, resulting in $29 million of net positive carry.

-

Net interest margin and net interest spread Reported interest income was 2.88% and 2.06%, respectively, indicating better performance of interest income compared to interest expense.

-

Issued $115 million of 8.875% senior unsecured notes. Adds an additional $75 million in 9.00% senior unsecured notes, providing additional financial flexibility.

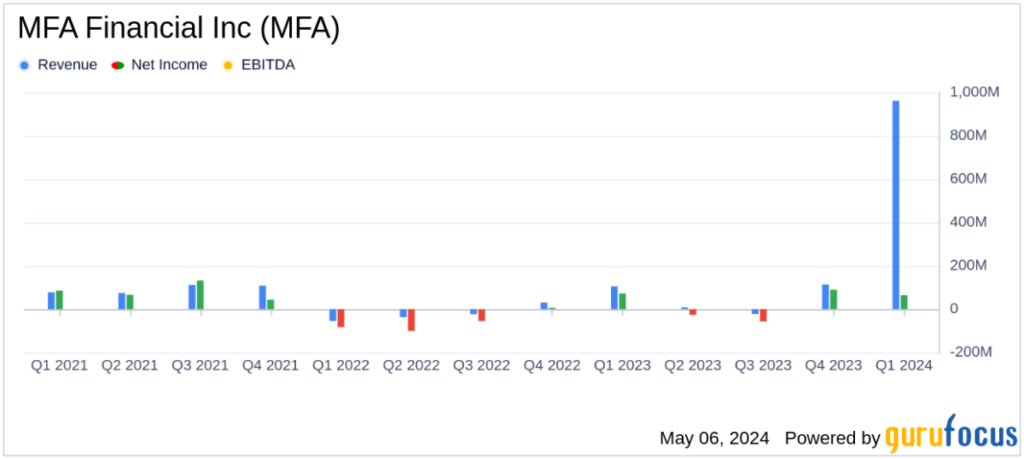

MFA Financial Inc. (NYSE:MFA) disclosed its financial results for the first quarter ended March 31, 2024 through its recent 8-K filing. The prominent player in the mortgage and real estate investment sector weathered the complexities of a volatile interest rate environment to record strong distributable profits, broadly in line with analyst expectations for the period.

MFA Financial Inc. is an internally managed real estate investment trust (REIT) that invests primarily in mortgages, securities and other real estate assets. The company's strategic operations through its subsidiary Lima One Capital are critical to the origination and servicing of business loans and contribute significantly to its revenue stream.

Financial performance summary

For the first quarter of 2024, MFA Financial reported revenue in line with analyst forecasts. The company achieved his 2.06% net interest spread and his 2.88% net interest margin, demonstrating effective risk management and a disciplined investment approach. The acquisition and origination of mortgage loans amounted to him $652 million, and the large contribution from business purpose loans brought him over $400 million.

The company's CEO, Craig Knutson, noted the resilience the company has shown by maintaining a healthy portfolio despite the rate hikes. He announced a strategic repurchase of $40 million in convertible debt and $190 million in new senior unsecured debt, designed to strengthen the company's financial structure against future interest rate and credit spread fluctuations. I mentioned publication.

Asset allocation and portfolio activities

As of March 31, 2024, MFA Financial's asset allocation has been strategically diversified to reduce risk and take advantage of market opportunities. The total fair value of performance loans purchased was approximately $8.025 billion, the majority of which were non-QM loans and transitional loans. The company's skillful handling of loan agreements and securitized debt underscores its robust asset management capabilities.

The investment portfolio had a net increase, with residential whole loan and real estate owned (REO) assets increasing to $9.225 billion from $9.151 billion at the end of the previous quarter. This growth reflects MFA Financial's active portfolio management and ability to adapt to market trends.

Strategic initiatives and market positioning

MFA Financial continues to strengthen its market position through strategic initiatives that increase the resilience and growth potential of its portfolio. The company's significant cash position and aggressive capital management strategy are designed to protect its balance sheet while providing flexibility to capture emerging market opportunities.

The company's commitment to delivering shareholder value is evidenced by its consistent dividends totaling $4.7 billion since its 1998 IPO. MFA Financial's strategic focus on high-yield investments and effective cost management enables it to maintain stable distributable profits, strengthening its attractiveness to shareholders. Investors seeking a reliable source of income from real estate investments.

conclusion

In conclusion, MFA Financial Inc.'s first quarter 2024 results demonstrate a well-executed strategy in a challenging economic environment. The company's focus on high-quality mortgage assets, combined with prudent financial strategies, positions it to successfully navigate future uncertainties in the real estate and financial markets. Investors and stakeholders can look forward to MFA Financial's continued strong management and strategic growth initiatives as it leverages its strong market position and comprehensive asset portfolio.

For more information, please see the full 8-K earnings release from MFA Financial Inc. here.

This article first appeared on GuruFocus.