While artificial intelligence (AI) has captured investors' attention, there's another big trend investors need to be aware of: cybersecurity. Bad actors have more tools and access to more digital information than ever before, and this trend will continue. Businesses must ensure the highest levels of security or risk becoming the target of cyberattacks that can cost millions of dollars and undermine trust in businesses.

As a result of this new reality, the cybersecurity industry is experiencing a lot of growth. However, with so many cybersecurity companies to choose from, it can be easy to get lost. There is one company that I would definitely pick that has the potential to become even more powerful in the industry.

CrowdStrike Earns Top Position in Cybersecurity

Crowdstrike (Nasdaq: CRWD) is my most recommended product in the cybersecurity space for many reasons. Firstly, it is a lightweight, cloud-native program, meaning it can be easily and quickly deployed to all endpoints in your business network and doesn't consume much bandwidth. Additionally, CrowdStrike has been integrating AI into their product lineup since its launch.

Unlike companies that use AI as a buzzword, CrowdStrike's platform is built on AI. The flagship product of the Falcon platform is endpoint protection, which protects network access points like laptops and mobile phones from external threats. CrowdStrike uses AI to analyze activity and determine if it is normal or a threat. If it detects a threat, it can terminate access to a company's servers without human intervention.

The company also has a generative AI product, Charlotte AI, which helps users automate workflows, speed up investigation times, and reduce the amount of skills needed to become a cybersecurity expert. Customer surveys show that Charlotte helps save about two hours per day through increased efficiency.

CrowdStrike has a vast product line that has been slowly growing over the past few years. Rather than cobble together cybersecurity solutions from different vendors, CrowdStrike aims to be a one-stop shop for all your cybersecurity needs. With products for endpoint protection, cloud security, identity protection, threat intelligence, and more, CrowdStrike has a lot of ground covered.

This strategy has worked well for CrowdStrike, with 64% of customers using at least five modules and 27% using at least seven modules. This indicates that there is plenty of room for product expansion within their customer base, and upselling to existing customers and acquiring new ones are two avenues of growth for CrowdStrike.

CrowdStrike's stock price is soaring

Speaking of growth, CrowdStrike has been on a roll for a while now. Annual recurring revenue (ARR) for the fourth quarter of fiscal year 2024 (ending January 31) was $3.44 billion, up 34% year over year. Looking ahead to fiscal year 2025, CrowdStrike expects revenue to grow 30% to nearly $4 billion. Even as CrowdStrike scales, its growth has barely slowed, a testament to the demand in the cybersecurity industry and the power of CrowdStrike. Wall Street analysts even see revenue growing 27% to over $5 billion in fiscal year 2026.

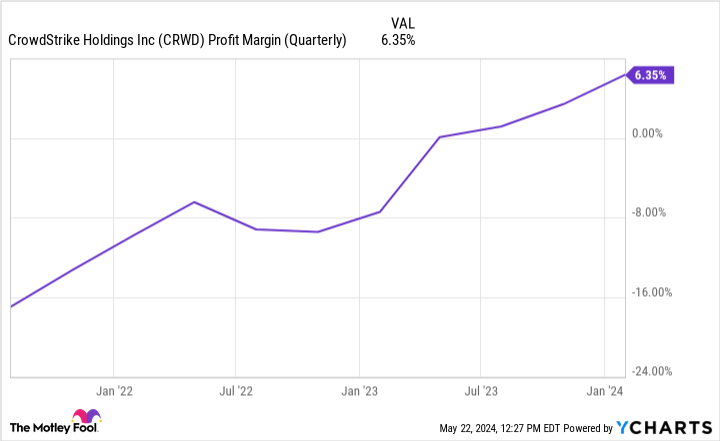

CrowdStrike has also seen profitability improve quarter after quarter.

Say you own a company that is an industry leader in a rapidly expanding field and has strong financials. That seems like an obvious buy, right?

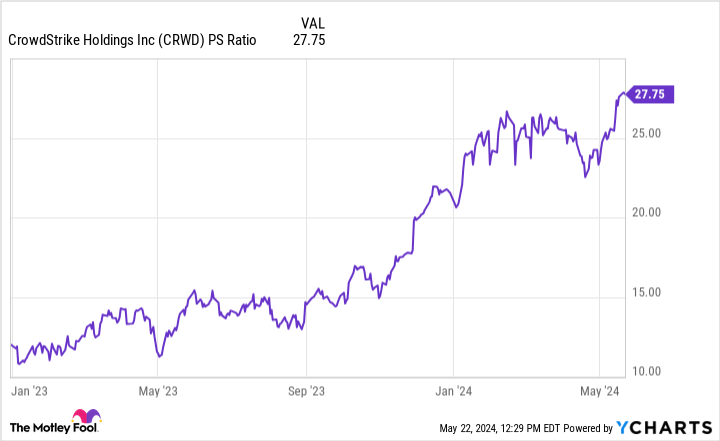

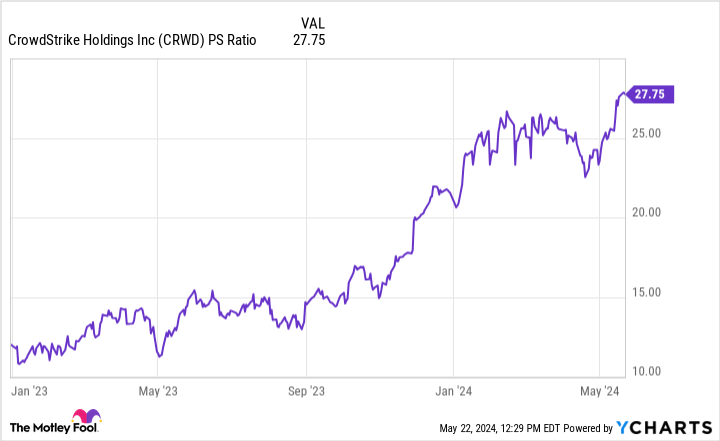

Investors should also consider the stock price. It's no secret that CrowdStrike is a great company, and its stock price is priced accordingly.

A price of 28 times sales is very expensive, which is the main drawback of CrowdStrike stock. I use a price-to-sales (P/S) ratio because CrowdStrike has not yet reached maximum profitability. Converting to a more conventional price-to-earnings (P/E) ratio would artificially give CrowdStrike a 30% profit margin, which is an excellent target for a software company like CrowdStrike.

That profit margin puts CrowdStrike at a price-to-earnings ratio of 93 at current prices. If we take analysts' fiscal 2026 revenue forecasts of $5.03 billion, CrowdStrike's price-to-earnings ratio would be 56.

This is too high for many investors' tastes, so we wouldn't blame investors for not buying at today's price, but we recommend keeping an eye on CrowdStrike as it's too good a company to forget even if the share price falls to more reasonable levels.

Where to invest $1,000 right now

When the analyst team has a tip on a stock, it's worth listening to — after all, the newsletter they've been running for 20 years is Motley Fool Stock Advisorthe market size has more than tripled.*

They made it clear what they believed. Top 10 Stocks Stocks investors should buy right now… and CrowdStrike made the list, but here are nine other stocks you might have missed.

View 10 stocks

*Stock Advisor returns as of May 13, 2024

Keithen Drury has invested in CrowdStrike. The Motley Fool has invested in and recommends CrowdStrike. The Motley Fool has a disclosure policy.

Here's My Top Cybersecurity Stocks (And It's Not Close) was originally published by The Motley Fool.