-

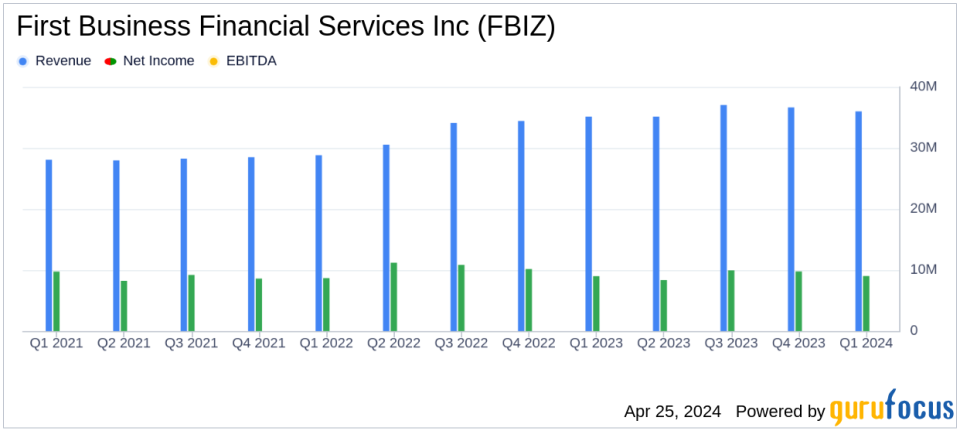

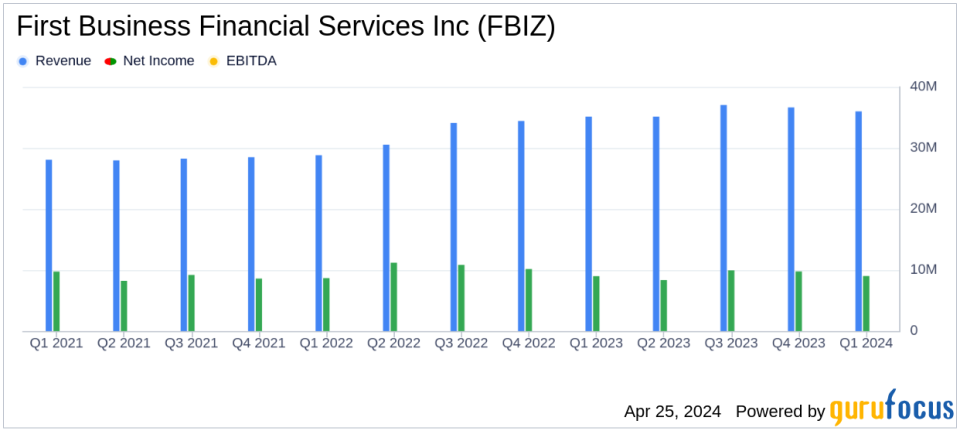

Net income: The reported value was $8.6 million, lower than the estimated $9.13 million.

-

Earnings per share (EPS): The price was $1.04, lower than the expected $1.12.

-

Revenue: The total amount was $36.28 million, slightly below the estimate of $37.58 million.

-

Loan growth: Loans totaled $60.6 million, up 8.5% annually, demonstrating strong growth across products and geographies.

-

Increase in core deposits: Average core deposits increased to a record $2.346 billion, reflecting an annualized increase of 17.6% sequentially.

-

Net interest margin: It decreased to 3.58%, reflecting the ongoing industry-wide compression.

-

Tangible book value: It grew at an annualized rate of 12.9%, demonstrating strong revenue generation and effective balance sheet management.

On April 25, 2024, First Business Financial Services, Inc. (NASDAQ:FBIZ) released its 8-K filing disclosing various financial results for the first quarter of 2024. The company reported net income of $8.6 million and earnings per share (EPS) of $1.04, below analyst estimates of $1.12 per share. Nevertheless, FBIZ showed solid growth in its loan and deposit portfolio.

First Business Financial Services Inc operates as a bank holding company specializing in commercial banking products for small businesses, business owners, executives, professionals and high-net-worth individuals. The company's comprehensive services include commercial lending, asset-based lending, equipment financing, financial management, and more.

Quarterly Financial Highlights

In the first quarter, FBIZ achieved significant growth in its core business areas. Loans increased by $60.6 million, representing an annual growth rate of 8.5%, and core deposits increased by $98.8 million, or an annualized growth rate of 17.6%. This growth confirms the company's strong market position and continued expansion efforts across product lines and geographies.

Despite these gains, the company's net interest income decreased slightly by $29,000 from the previous quarter to a total of $29.51 million. This is primarily due to his net interest margin dropping from 3.69% to 3.58%. A competitive deposit rate environment and industry-wide margin compression were key factors impacting net interest income.

Operational and strategic challenges

FBIZ CEO Corey Chambas highlighted the challenges posed by competitive deposit rates and external pressures on interest rates that are beyond the company's control. However, he also noted the effectiveness of FBIZ's matched funds balance sheet strategy in maintaining stable net interest margins. Our focus on growing our high-yield niche commercial and industrial loan portfolio is expected to support baseline net interest margin growth going forward.

The bank's strategy includes a focus on integrating technology and talent, with the aim of driving double-digit growth in loans, deposits, fee income and top-line revenue. This approach is expected to ensure sustainable growth and value creation for shareholders.

Financial status and future outlook

FBIZ's balance sheet remains strong, with total assets increasing to $3.53 billion as of March 31, 2024. The bank's capital position is strong, with tangible book value per share increasing 12.9% annually. Going forward, FBIZ plans to manage loan growth towards a long-term goal of 10%, reflecting its operational strategy and confidence in market conditions.

The company's efficiency ratio deteriorated slightly to 63.76% from 58.34% in the previous quarter, indicating an increase in operating costs as a percentage of revenue. This increase is due to increased compensation and technology investment costs required to support our expanded operations and infrastructure.

Considerations for investors

Although FBIZ's earnings per share were below analysts' expectations, its strong performance in loan and deposit growth and strategic initiatives for future growth could be attractive to long-term investors. The bank's focus on niche markets and operational efficiency, along with proactive management of market challenges, has established it as a notable competitor in the commercial banking sector.

Investors and stakeholders are encouraged to view the detailed investor presentation located in the Investor Relations section of the company's website, which provides further information about FBIZ's strategic initiatives and financial health. Masu.

Please see the entire 8-K filing for detailed financial numbers and additional information.

For more information, please see First Business Financial Services Inc.'s full 8-K earnings release here.

This article first appeared on GuruFocus.