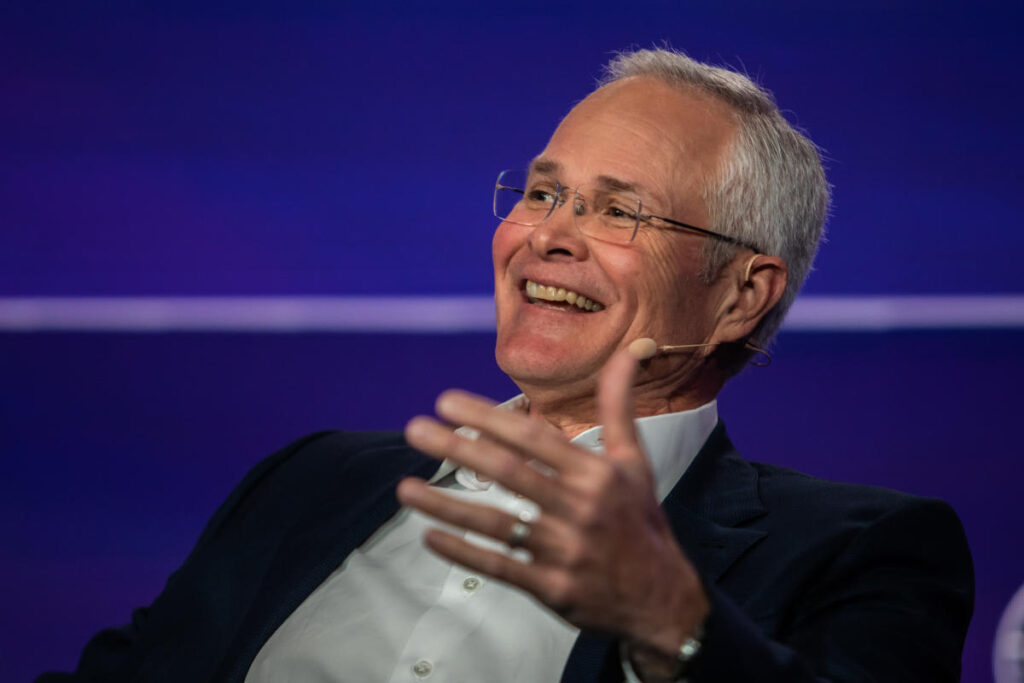

A majority of Exxon Mobil Corp. (XOM) shareholders on Wednesday backed the company in its fight against activist investors and the nation's largest public pension fund, voting to keep Chief Executive Officer Darren Woods and 12 other current directors on the oil giant's board.

Support for current directors was at 95% of shares outstanding, down slightly from 96% last year.

Approval for individual directors ranged from 87% to 98%, down slightly from last year's range of 91% to 99%.

Shareholders also rejected environmental proposals that would have called on Exxon to reassess executive compensation incentives for greenhouse gas emissions and expand reporting on plastics production.

“Today, our investors sent a powerful message that rules and value creation matter,” an Exxon Mobil spokesperson said in an email to Yahoo Finance. “Their vote demonstrates their belief that we are moving in the right direction.”

The vote marked a key test of the balance of power between companies and activist investors.

ExxonMobil faced an attempted revolt led by the California Public Employees' Retirement System (CalPERS), which has a $1 billion stake in the company and oversees the nation's largest public pension fund.

CalPERS recommended that shareholders vote at the company's annual meeting to remove Woods and the entire board of directors after he refused to drop a lawsuit filed in January against activist investors Follow This and Arjuna Capital.

Exxon filed the lawsuit to block an activist shareholder proposal to adopt greenhouse gas emissions reduction targets known as “Scope 3” targets that are being adopted by Exxon's competitors.

Exxon continued the lawsuit after the activists withdrew their proposal, arguing that the court needed more clarity about shareholders' ability to resubmit proposals.

“We expect activists will try to claim victory in today's vote, but common sense dictates that this is unlikely given the large margin of defeat,” an Exxon Mobil spokesman said.

“CalPERS did not take today's vote lightly, but we cannot underestimate the importance of what is at stake,” CalPERS CEO Marcy Frost said in a statement.

“ExxonMobil's lawsuit threatens to silence shareholders around the world, stripping them of their rights and their role in driving company profits.”

Eric Tully, an economist and law professor at Columbia Law School, said the vote to retain the board endorses the view that Exxon aims to make profits within the law and that resisting environmental proposals is consistent with that goal.

He added that those vote margins matter, noting that a significant drop in support would send a message to Exxon that it needs to act more quickly to address shareholder concerns.

“I think from a shareholder perspective, if he gets re-elected on a bad note, it will be a warning that this could happen again in the next election,” Tully said before Exxon's votes were counted.

Tully said Exxon's ongoing litigation sends a message to future activists that the company will take a tough stance.

In a posting to the Financial Times, Exxon's CEO said the lawsuit aims to clarify SEC rules governing how many times shareholders can make repeat proposals.

Woods said the defendants' proposal, which has been rejected twice and has been submitted for three consecutive years, amounts to a request to “limit sales and allow other companies to meet the world's energy needs.”

Essentially, Exxon's lawsuit seeks to override SEC rules that allow shareholders with a certain level of support to submit proposals up to three times.

“It's like cutting a birthday cake with a chainsaw,” Tully said of Exxon's tactics of filing lawsuits before the SEC regulatory process has even begun. “It opens up Pandora's box of immediately taking anything they don't like to court.”

“It's clear that what they're essentially trying to do is play the long game,” Tully added.

Last week, a federal district judge in Texas denied requests from Follow This and Arjuna to dismiss the lawsuit.

However, the judge removed Follow This from the lawsuit, concluding that Exxon had no jurisdiction over the Netherlands-based organization.

Ahead of Wednesday's vote, Frost and CalPERS board chair Teresa Taylor argued that Exxon's directors were allowing Woods to pursue a “reckless and destructive initiative.”

The company said in the letter that management was improperly using U.S. courts to violate shareholder rights, adding that the fate of the contested shareholder resolutions should be decided by the SEC, not a judge.

After Arjuna and Follow This withdrew their offer in February, Natasha Lamb, chief investment officer at Arjuna Capital, said Exxon saw no basis for continuing its offensive.

“It is disappointing to see Exxon circumvent the SEC shareholder proposal process and sue directly in federal court, silencing investors who raise concerns about climate risks,” Lamb said.

At a shareholder meeting on Wednesday, Woods said Exxon is working to reduce its carbon emissions, but stressed there are limits to decarbonization.

“The solutions needed to simultaneously reduce energy poverty and emissions do not currently exist at scale,” Woods said. “The world needs governments, academia and the private sector to use their full capacities to develop more solutions.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on Twitter. Alexis Weed.

For in-depth analysis of the latest stock market news and events that are moving stock prices, click here..

Read the latest financial and business news from Yahoo Finance