On May 7, 2024, Richard Bynum, Executive Vice President of PNC Financial Services Group (NYSE:PNC), sold 850 shares of the company's stock. The transaction was filed pursuant to his SEC filings.

PNC Financial Services Group Inc operates as a diversified financial services company in the United States. The company offers financial products such as retail banking, corporate and institutional banking, wealth management, and mortgage banking services.

The shares were sold at a price of $155.87, giving a transaction value of approximately $132,489.50. After this transaction, the insider's direct ownership in the company will be his 0 shares.

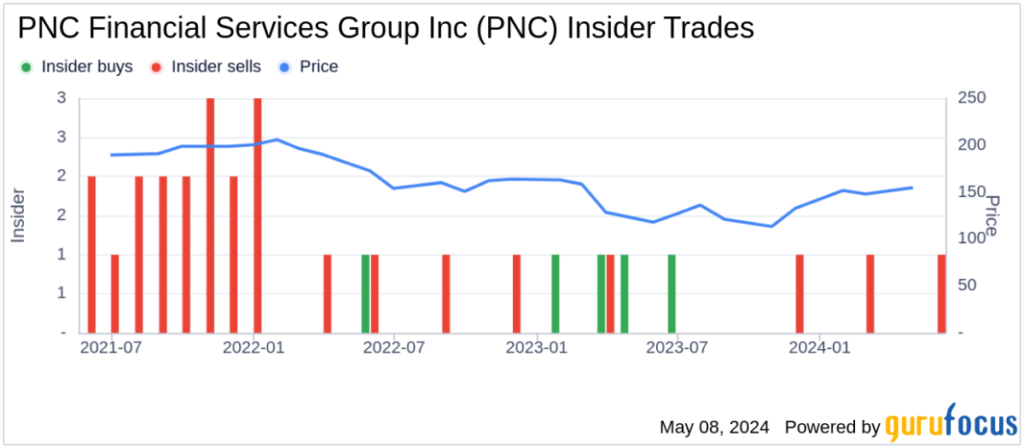

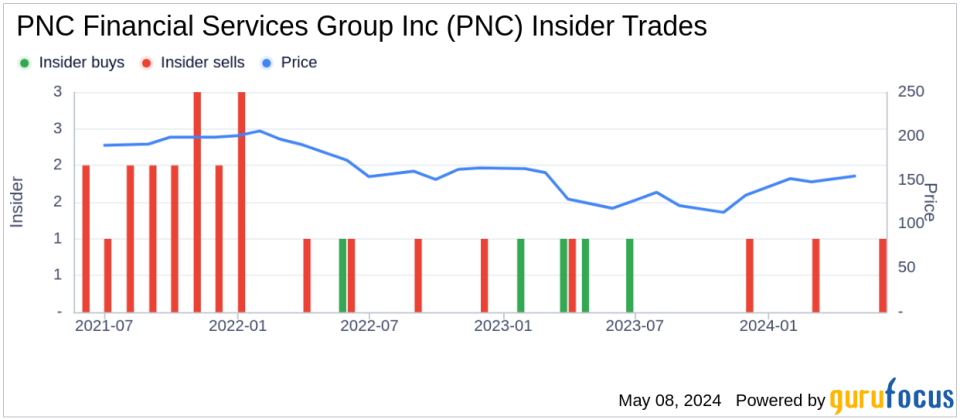

Over the past year, insiders sold a total of 850 shares, but bought none. According to the company's insider trading history last year, there was one insider buy and three insider sells.

PNC Financial Services Group Inc's current market capitalization is approximately $62.55 billion. The company's price-to-earnings ratio is 13.20 times, which is higher than the industry median of 9.505 times.

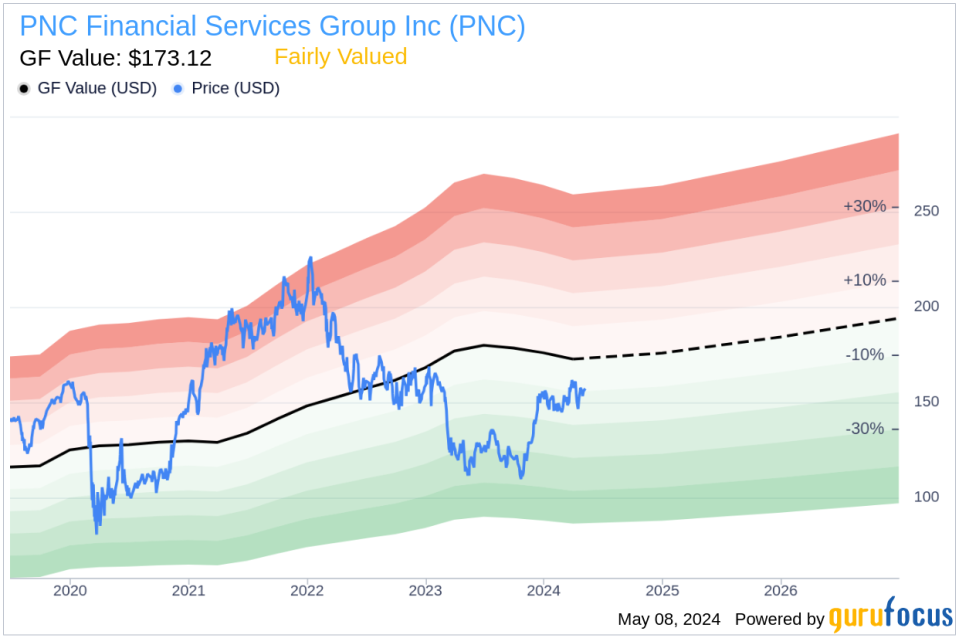

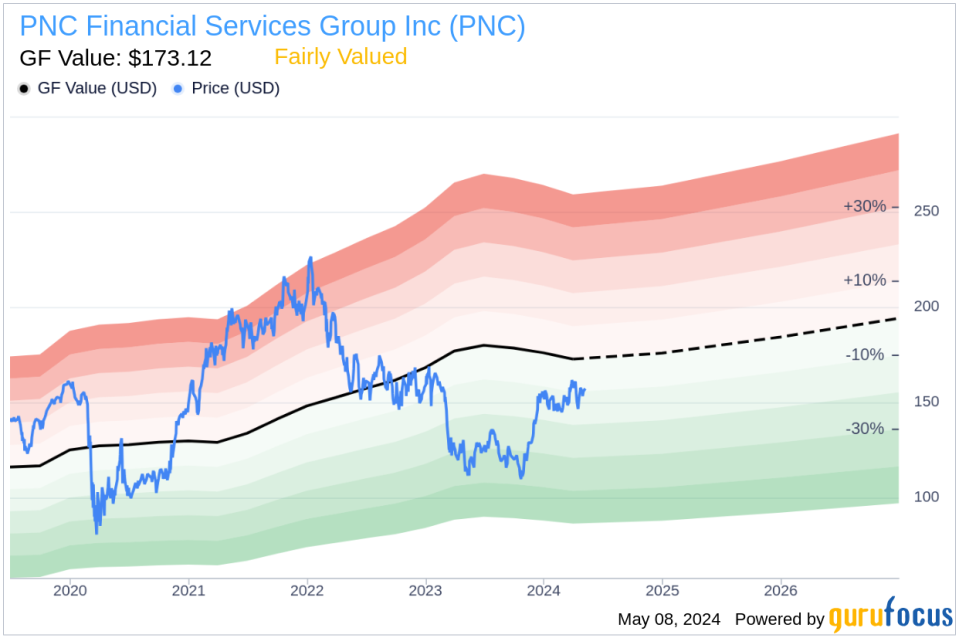

According to GF Value, the stock's intrinsic value is estimated at $173.12, with a price to GF Value ratio of 0.9 suggesting the stock is fairly valued.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors, and future performance estimates provided by Morningstar analysts.

This sale may be of interest to investors who follow insider actions as a gauge of a company's financial health and future prospects.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.