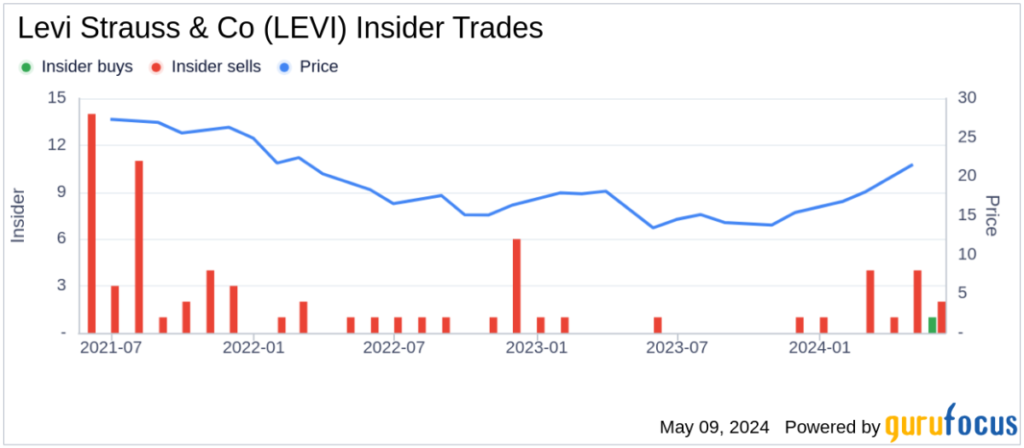

On May 8, 2024, Harmit Singh, Vice President and Chief Financial and Growth Officer of Levi Strauss & Co. (NYSE:LEVI), executed a major stock sale. As detailed in an SEC filing, the insider sold 629,000 shares of the company's stock. This transaction is part of a broader trend observed over the past year, where Levi Strauss & Co. has seen 14 insider sales and only 1 insider buy.

Known for its iconic denim products, Levi Strauss & Co operates worldwide and offers jeans, casual pants, dress pants, tops, shorts, skirts, jackets, footwear and related accessories for men, women and children. It offers.

On the date of the sale, the price of Levi Strauss & Co.'s stock was $22.1. The company's market capitalization was approximately $9.03 billion. His price-to-earnings ratio was 74.12, significantly higher than both the industry median of 19.645 and the company's historical median.

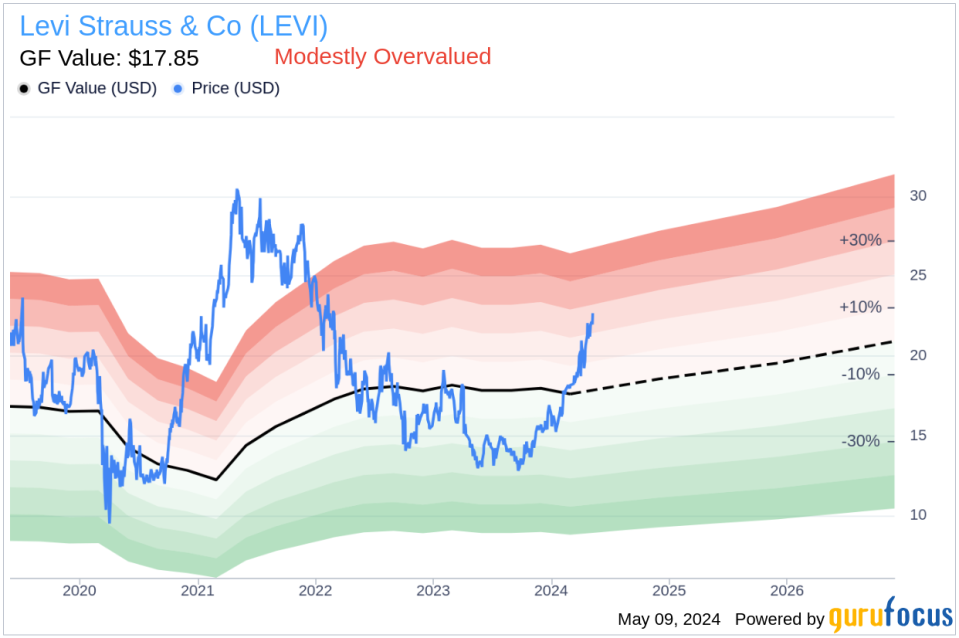

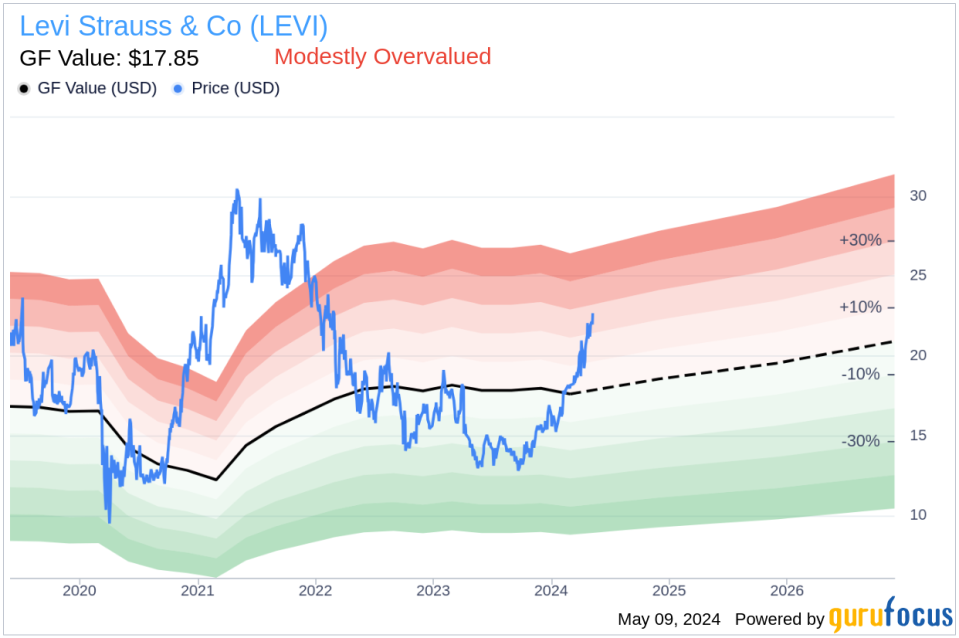

According to GF Value, Levi Strauss & Co has a price to GF Value ratio of 1.24, which suggests it is moderately overvalued. GF Value is a measure of intrinsic value and is calculated based on historical trading multiples, adjustment factors based on past earnings and growth, and future performance expectations.

This recent insider transaction may be of interest to investors who track insider actions and gauge stocks' valuation metrics relative to current market performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.