(Bloomberg) — Tech stocks fell while broader indexes slumped after ASML Holding NV reported orders were significantly lower than analysts expected.

Most Read Articles on Bloomberg

The Stoxx Europe 600 index was little changed, with the Stoxx Europe 600 index largely unchanged as LVMH's encouraging results led luxury stocks to rise, but this was offset by weakness in ASML, which hit tech companies. The decline comes as the Stoxx 600 tech index has risen 25% over the past year, with ASML leading the sector with gains of more than 50%.

For Swissquote senior analyst Ipek Ozkardeskaya, this is a “sour cocktail of factors” weighing on the market. He said it is becoming increasingly clear that the US Federal Reserve will delay rate cuts and ASML's mixed results are some of the main concerns prevailing in the market.

Federal Reserve Chairman Jerome Powell on Tuesday noted that there has been no further progress on inflation since the rapid decline seen late last year, and officials have warned that price inflation is rising. He noted that it is likely to take more time to gain the necessary confidence that this is the case. Borrowing costs fall before the Fed reaches its 2% target.

A series of positive U.S. economic data in recent weeks has dampened expectations for interest rate cuts, weighing on European stocks after a strong first quarter in April. Volatility indicators have entered the area of concern for the first time since last year, with all eyes on earnings amid geopolitical tensions.

Geopolitical concerns further dampened sentiment as Israel considers its response to Iranian missile and drone attacks.

“Risk aversion continues to rise, supporting the dollar and gold prices, while increasing risk assets to the detriment of equity markets,” said Daniel Varela, chief investment officer at Piguet Garland & Cie SA. It continues,” he said. Still, with investor sentiment so low, the stock market “could gradually recover lost ground in the coming days once political tensions ease to some extent,” Varela added.

Focus areas:

-

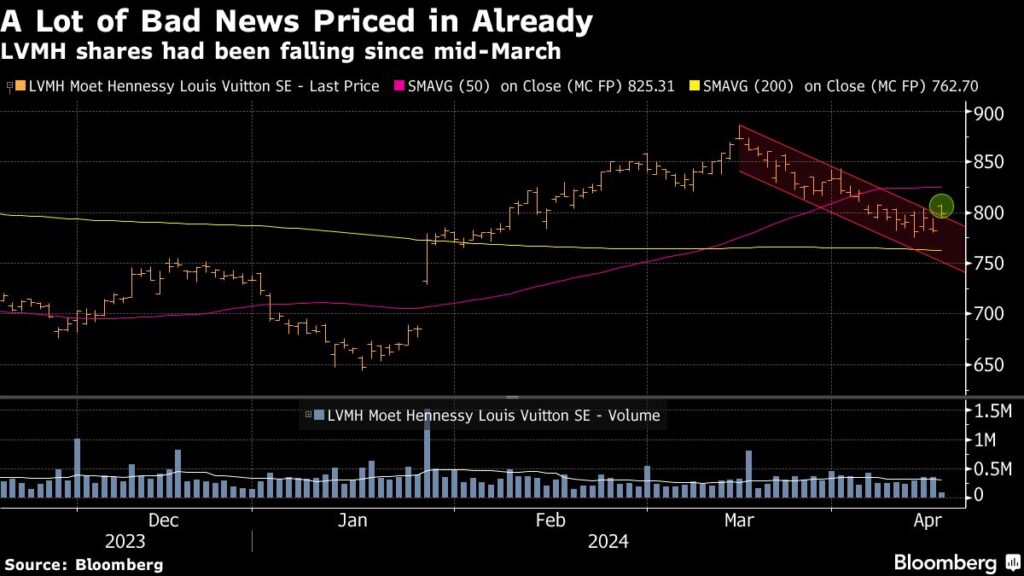

European luxury goods stocks could be buoyant after industry bellwether LVMH reported a slightly disappointing start to the year with slowing sales growth. Investors may have been bracing for worse results after peer Kering issued a sales warning last month.

-

Tobacco giants Imperial Brands and British American Tobacco could take action today after British ministers voted last night to ban people born after 2009 from buying cigarettes.

For more information on the stock market, please see below.

-

The stock market is on a really slippery slope right now: Understanding the stock market situation

-

M&A Watch Europe: Vinci, Naturgy, UniCredit, Alpha Bank, Talgo

-

Luxury grocer offers unusual private sector IPO to UAE: ECM Watch

-

US stock futures rose.United Airlines, Tesla Gain

-

Superdry withdraws from LSE: London Rush (corrected)

Want more news on this market? Click here to visit our First Word channel, packed with actionable news from Bloomberg and selected sources. You can customize it to your liking by clicking Actions on the toolbar or pressing the Help key for assistance. Click here to subscribe to the daily list of European analyst rating changes.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP