ISEC Healthcare (Cat:40T) has had a tough three months, with its share price down 16%. However, a closer look at the company's healthy financials might make you think again. The company is worth keeping an eye on, given that fundamentals usually drive long-term market outcomes. In this article, we decided to focus on ISEC Healthcare's ROE.

Return on equity or ROE is a key measure used to evaluate how efficiently a company's management is utilizing the company's capital. More simply, it measures a company's profitability in relation to shareholder equity.

Check out our latest analysis for ISEC Healthcare.

How do you calculate return on equity?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, ISEC Healthcare's ROE is:

15% = S$13 million ÷ S$85 million (based on trailing 12 months to March 2024).

“Revenue” is the income a company has earned over the past year. This means that for every S$1 of a shareholder's investment, the company will generate a profit of S$0.15 for him.

What is the relationship between ROE and profit growth rate?

It has already been established that ROE serves as an indicator of how efficiently a company will generate future profits. Now we need to evaluate how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company's growth potential. All else being equal, companies with higher return on equity and profit retention typically have higher growth rates compared to companies that don't have the same characteristics.

ISEC Healthcare's revenue growth and ROE 15%

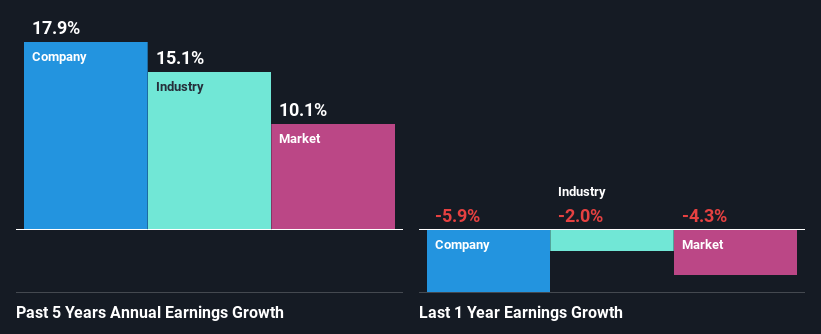

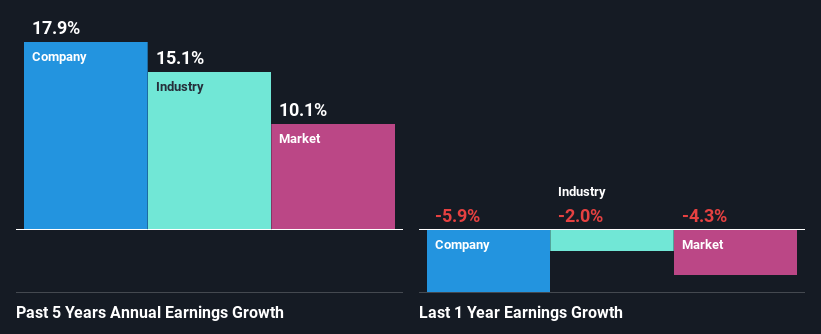

First, ISEC Healthcare's ROE looks acceptable. Moreover, his ROE for the company is very good compared to the industry average of 9.6%. Perhaps as a result of this, ISEC Healthcare has been able to grow at a respectable 18% over the past five years.

We then compared ISEC Healthcare's net income growth with the industry and found that the company's growth was on par with the industry's average growth rate of 15% over the same five-year period.

Earnings growth is an important metric to consider when evaluating a stock. It's important for investors to know whether the market is pricing in a company's expected earnings growth (or decline). That way, you'll know if the stock is headed for clear blue waters or if a swamp awaits. Is the market factoring in the future outlook for 40T? Find out in our latest Intrinsic Value infographic research report.

Is ISEC Healthcare reinvesting its profits efficiently?

ISEC Healthcare's high three-year median payout ratio of 79% (or retention rate of 21%) suggests that the company's growth has not actually been hampered, despite returning most of its profits to shareholders. It suggests that.

Additionally, ISEC Healthcare has been paying dividends for nine years. This means that the company is quite serious about sharing profits with shareholders.

summary

Overall, we feel that ISEC Healthcare is performing very well. In particular, high ROE has contributed to the remarkable growth in business results. Despite reinvesting only a small portion of its profits, the company has still managed to grow its earnings, which is commendable. So far, we've only taken a quick look at the company's growth data.So it might be worth checking this free Detailed graph Analyze ISEC Healthcare's historical earnings, revenue, and cash flow to gain deeper insight into the company's performance.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.