While the big cybersecurity providers are getting all the attention, there's a niche in the industry that's often overlooked: identity access and privileged access management (IAM and PAM, respectively).

There is a good reason why this part of the digital security market is overlooked by many investors. One of the leaders in this space is Octa (Nasdaq: OKTA)has a lot of room for improvement. In contrast, its smaller competitors CyberArk Software (NASDAQ:CYBR) It's much more stable and has made big moves to concentrate market share in its own right.

Is CyberArk stock a better buy than Okta stock right now?

Identity Security is More Important than Ever

There has been no end to reports of data security breaches recently. Stealing large companies' data to resell or hold it for ransom is a very lucrative (and of course illegal) business scheme in itself. Often the most easily exploited attack vector is human user access credentials – passwords and other security measures, or the lack thereof.

This is where IAM and PAM (with PAM being a subset of the broader IAM market, i.e. identity access) come in. These are software tools that enable organizations to ensure that only authorized individuals have access to certain organizational services (such as email) or information (sensitive or private data, like the workings of a manufacturing operation).

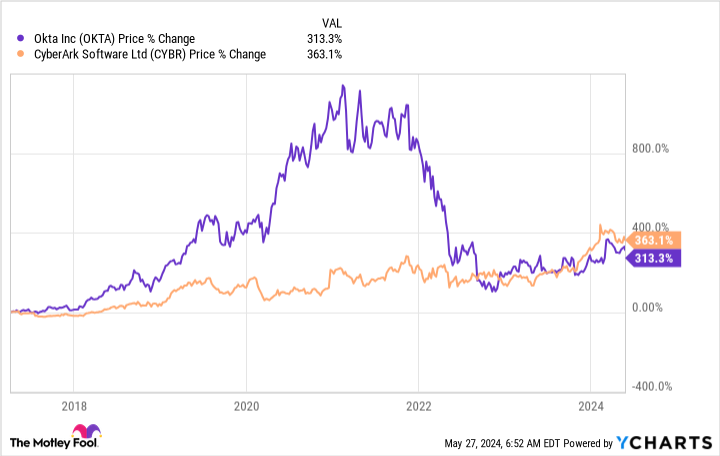

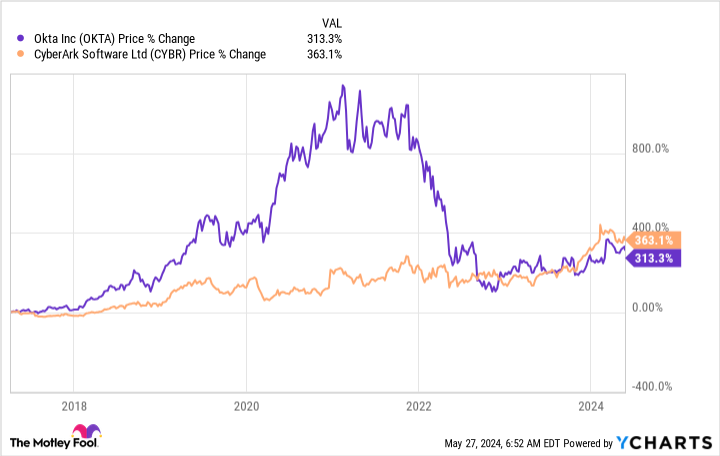

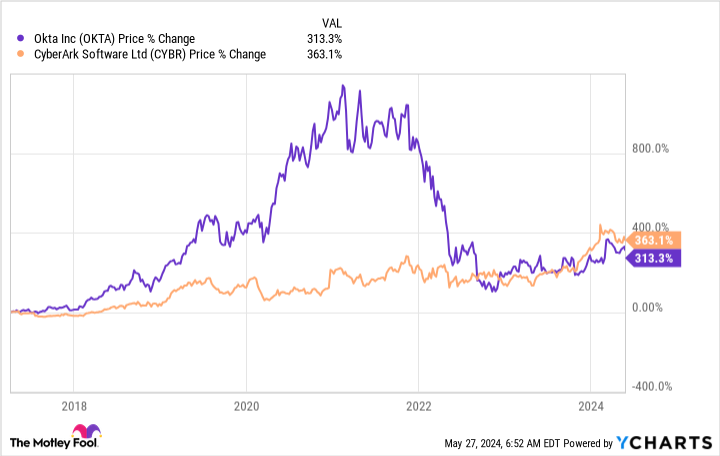

Okta has long been a leader in the space, but interestingly, CyberArk stock is performing better due to several factors, including lower profit margins, shareholder dilution from large amounts of stock-based compensation paid to management and employees, and several security incidents.

This timeline dates back to Okta's IPO in 2017. CyberArk has actually been public since 2014 and has boasted a total stock price return of over 700% since then.

CyberArk is a steadily growing stock that looks set to continue its pace with a new merger: Private equity software specialist Thoma Bravo is planning to sell one of its cybersecurity investments, Venafi.

Thoma Bravo made a strategic growth investment in Venafi in 2020, valuing the software security business at $1.15 billion at the time. CyberArk is now acquiring Venafi for $1.5 billion: $1 billion in cash, plus $540 million in new CyberArk stock (meaning Thoma Bravo will become a significant shareholder in CyberArk once the merger is complete).

Thoma Bravo has been active in recent years, acquiring smaller, financially distressed security software startups. With the cybersecurity industry undergoing consolidation, CyberArk's acquisition of Venafi gives it an opportunity to strengthen its market share.

As identity security grows in importance, adding Venafi to its solutions could help CyberArk maintain its positive momentum. Venafi addresses the growing need for machine identity (from robotic equipment on factories to software-based bots that help automate enterprises) as artificial intelligence (AI) creates new cyberattack risks that organizations need to manage.

Is CyberArk stock a good buy?

CyberArk had just $1.08 billion in cash and short-term investments and $573 million in debt as of the beginning of 2024. The company will likely take on a bit more debt to pay Thoma Bravo about $1 billion in cash to acquire Venafi, so its balance sheet won't be as clean in the quarter immediately following the deal.

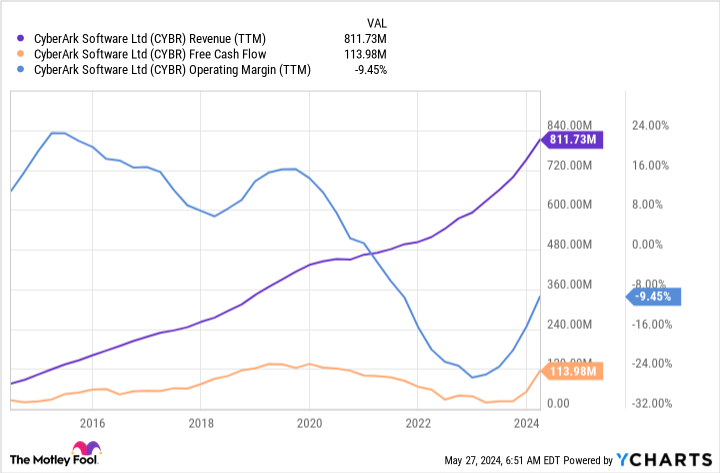

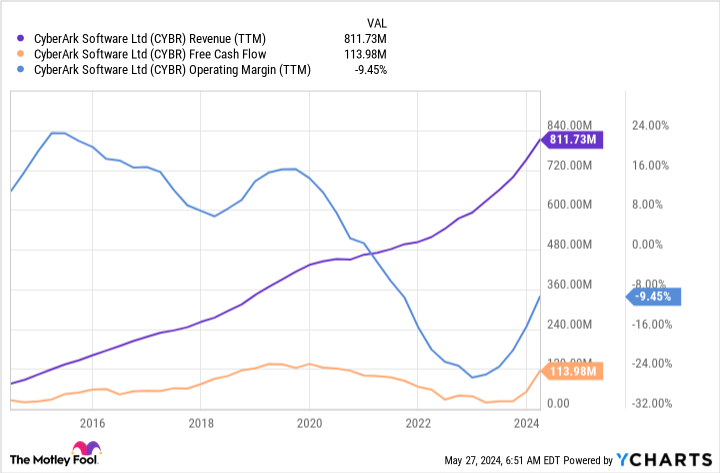

But CyberArk would gain a strong asset in Venafi, a smaller, privately held company with $150 million in revenue and growing (a nice addition to CyberArk's $811 million-plus in revenue over the past 12 months), which is also profitable and would immediately boost CyberArk's own margins and free cash flow generation.

At the time of writing, CyberArk's enterprise value (EV, market cap minus cash and debt) is valued at $9.9 billion. This means the company's stock is trading at roughly 10 times sales following the Benafi acquisition and just under 90 times trailing 12-month free cash flow. Admittedly, it remains to be seen how the profitable Benafi assets will be integrated; free cash flow could be significantly accretive.

CyberArk has my attention, and while I don't necessarily think it's the best buy in cybersecurity right now, it's an interesting business worth keeping an eye on, and Okta shareholders may want to do the same.

Should you invest $1,000 in CyberArk Software right now?

Before you buy CyberArk Software shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… CyberArk Software wasn't among them. The 10 stocks selected could generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $677,040.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 28, 2024

Nicholas Rossolillo and his clients have no investments in any of the stocks mentioned. The Motley Fool invests in and recommends Okta. The Motley Fool has a disclosure policy.

Disappointed with Okta? This cybersecurity stock is a buy. This was originally published by The Motley Fool.