Major airline Delta Airlines (New York Stock Exchange: Dal) appears poised to continue benefiting from new business in the commercial air travel sector. The company's premium services have higher profit margins than other products, and royalty-related sales are also strong as the company works to repay debt caused by the pandemic.

All of these factors have led many Wall Street analysts to raise their price targets on DAL stock and label the stock a “buy.” I agree with this bullish assessment and believe Delta Air Lines offers investors many reasons to be excited. We'll take a closer look at some of them below.

DAL earnings momentum and outlook

In early April, Delta Air Lines reported operating revenue of $12.6 billion for the first quarter of this year, and adjusted earnings per share (EPS) of $0.45, up 6% from the same period last year. The average analyst estimate for adjusted EPS over the same period was $0.35, meaning Delta Air Lines significantly beat expectations.

Perhaps more importantly, the company said that strong travel demand expected in the coming months could lead to year-over-year total revenue growth of 5% to 7% this quarter. This forecast also exceeded many analysts' expectations, as did the company's full-year EPS guidance of $6 to $7.

Sunny skies continue

What's behind Delta Air Lines' high forecasts for the coming months? In its earnings report, the company said domestic unit revenue improved 3% year over year and demand from corporate flyers increased by 14%. He pointed to a series of travel demand data points, including an increase of 3.9%. International travel is also recovering from a pandemic-related downturn, with Delta Air Lines saying its revenue in this area rose 12% compared to last year's March quarter.

Strong travel demand is a major factor in Delta's business success, but it's not the only factor. Companies must balance the total revenue earned per available seat mile (an acronym known as TRASM) with the cost per available seat mile. In the most recent quarter, TRASM increased by just 1% year over year.

However, the cost per available seat mile actually decreased by 6%, as did aircraft fuel costs. Collectively, these shifts helped improve Delta's overall profitability.

Move towards capturing the premium market

Delta Air Lines plans to expand its premium tier service as demand for corporate travel soars. These include new technology available on select aircraft, luxury lounges at airports, and co-branded credit cards with perks.

The move toward premium could help Delta further differentiate itself from competitors, especially at a time when many consumers view airline “junk fees” (additional charges such as seat reservations) negatively. There is. These services are offered to business travelers and members of Delta Air Lines' SkyMiles Rewards Program and generally have higher profit margins than similar services offered at lower levels.

Delta Air Lines says it will likely spend $5 billion annually to improve the travel experience for SkyMiles customers. But that big upfront investment could pay off as the company continues to address concerns from customers upset by changes to its benefits program announced last September. These changes were later revised following customer backlash.

Addressing pandemic-related debt

Like most airlines, Delta Air Lines drastically reduced its operations during the early stages of the coronavirus outbreak, taking on significant new debt. However, the airline now finds itself in an enviable position compared to its competitors. Delta CEO Ed Bastian said he believes Delta will be the only major airline to be profitable in the first quarter.

With free cash flow estimated at $3 billion to $4 billion in 2024, Delta Air Lines could be well-positioned to reduce its debt levels. This could give Delta Air Lines a long-lasting operational advantage at a time when some of its peers are still struggling to achieve profitability.

Is DAL stock a buy, according to analysts?

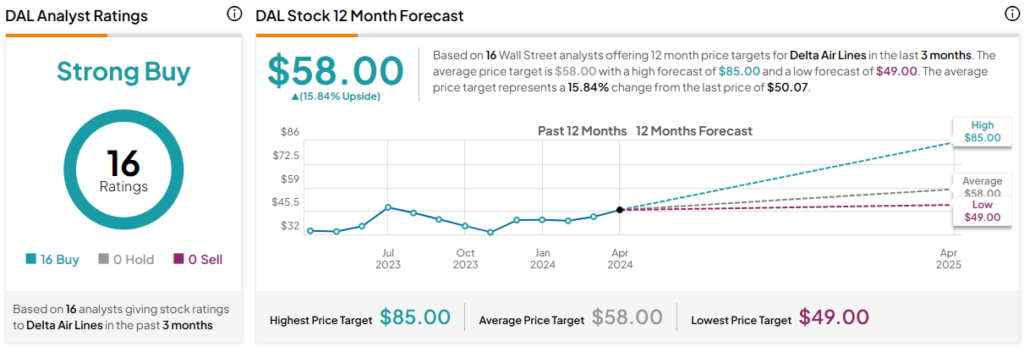

DAL's stock price rose 45% last year and has been steadily rising since late October. But despite these strong gains, analysts still think there is upside potential. DAL's average price target is $58.00, with upside potential of 15.8%. DAL stock is rated a Strong Buy across Wall Street, based on 16 Buy ratings, zero Holds, and zero Sells.

Lesson: Delta still has room to rise

Although its first-quarter earnings report beat expectations in many ways, Delta still has room to grow. The company's newly raised second-quarter and full-year EPS guidance shows it has the potential to capitalize on surging travel demand. Additionally, the company's strategy to introduce high-margin premium services while putting SkyMiles members' minds at ease could accelerate growth.

disclosure