-

Total revenue excluding interest expense increased 11% year over year, resulting in strong revenue growth.

-

Net income increased to $2.4 billion, reflecting strong financial performance.

-

Continuous investment in customer engagement and loyalty drives business success.

-

Competitive pressures and regulatory changes are potential threats to profitability.

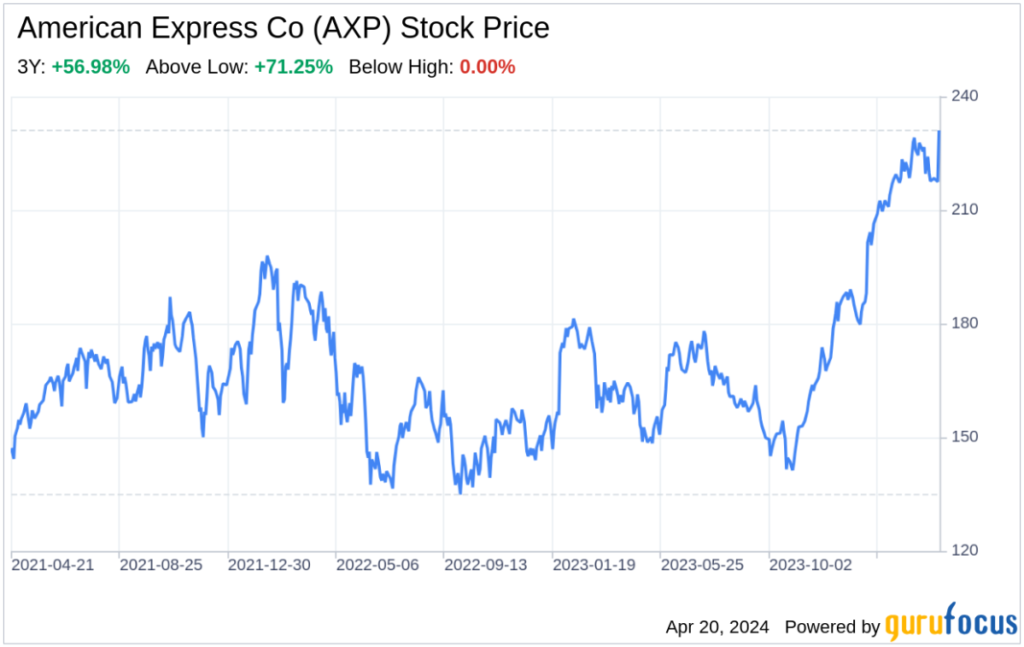

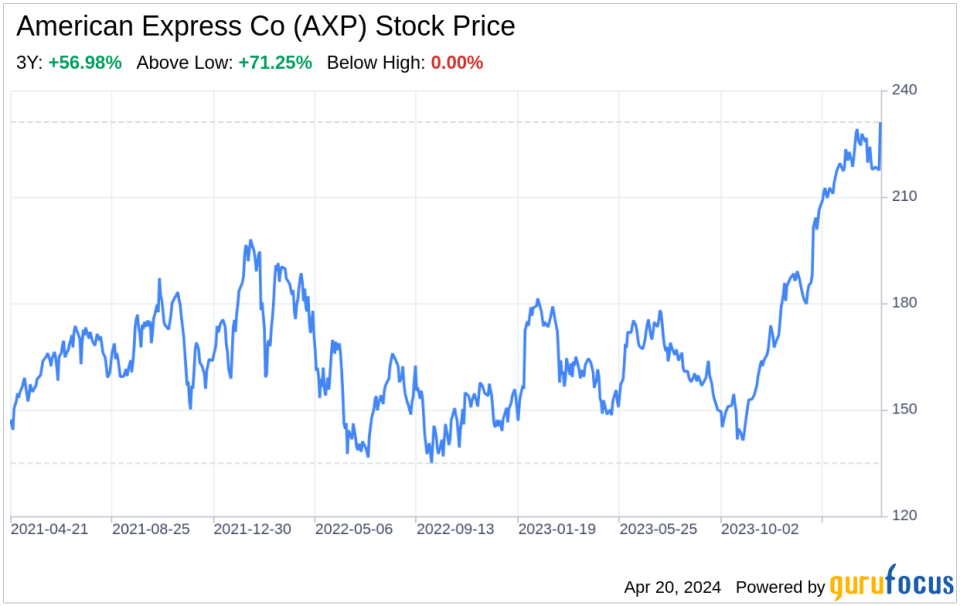

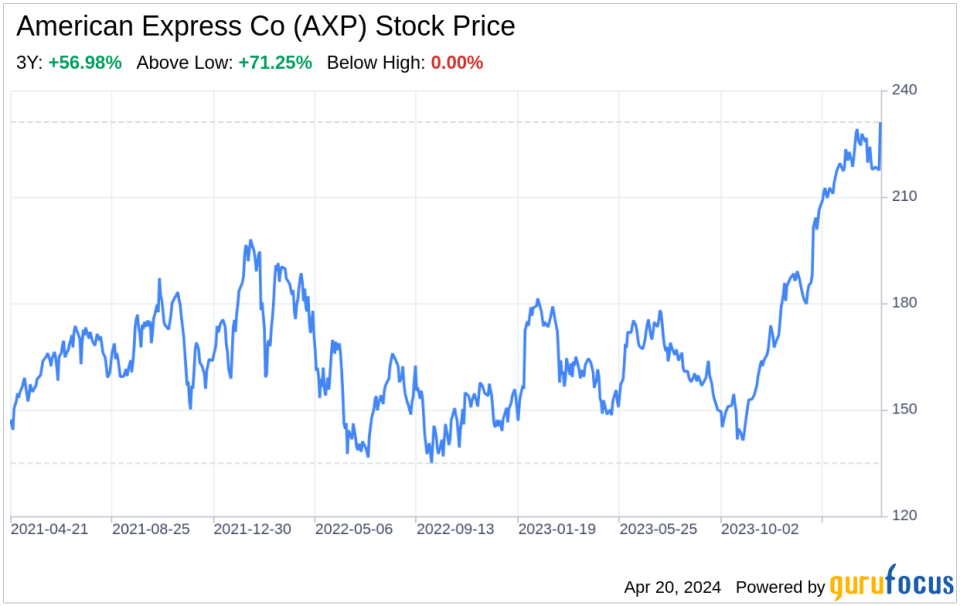

On April 19, 2024, American Express Co. (NYSE:AXP) released its 10th quarter report, providing a detailed explanation of its financial performance for the first quarter of this year. The company is a global financial institution with operations in approximately 130 countries and is known for its charge and credit card payment products and highly profitable merchant payments network. American Express Co. (NYSE:AXP) is in a strong position, with a financial summary showing that total revenue excluding interest expense increased 11% year-over-year and net income increased significantly to $2.4 billion. It shows the financial situation. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats revealed by the latest SEC filings, providing readers with a comprehensive view of the company's strategic positioning.

Strengths

Brand Strength: American Express Co (NYSE:AXP) continues to leverage its strong brand reputation, which is synonymous with premium service and customer loyalty. The strength of the company's brand is evident in its ability to retain and attract customers, as reflected in the 15% year-over-year increase in card net fees. This growth demonstrates high levels of new card acquisition and cardholder retention, powered by the company's product refresh cycles. As stated in the filing, the brand's appeal to the Millennial and Gen Z demographics underscores its cross-generational relevance and potential for sustained growth.

Financial Performance: Our strong financial performance is a testament to our operational efficiency and strategic initiatives. American Express Co. (NYSE:AXP) saw net interest income increase 26%, primarily due to higher revolving loan balances and higher interest rates, demonstrating its ability to take advantage of market conditions to improve profitability. Additionally, the company's disciplined approach to risk management is reflected in best-in-class net charge-off and delinquency rates, supporting a strong and stable financial foundation.

Weakness

Operating costs: Despite strong financial results, American Express Co. (NYSE:AXP) faces challenges in controlling operating costs. Filings show operating expenses were flat year over year, indicating room for improvement in terms of efficiency. Increased compensation costs to support business growth were offset by a net loss from its investment in Amex Ventures last year, but the need for the company to continue to explore ways to optimize expenses while investing in its growth strategy It suggests something.

Regulatory and Compliance Burden: As a global financial institution, American Express Co (NYSE:AXP) is subject to extensive government regulation and oversight. The Company's status as a bank holding company under the Bank Holding Company Act of 1956 creates additional regulatory and compliance burdens that may impact its operational flexibility and cost structure. Addressing these complex issues requires sustained attention and resources and can divert focus from other strategic initiatives.

opportunity

Global Expansion: American Express Co. (NYSE:AXP) is well-positioned to take advantage of global market opportunities, as evidenced by an 11% year-over-year increase in paid business for international card services. The company's strategic investments in international markets and ability to cater to local customer preferences provide significant growth opportunities, particularly in regions where digital payments are rapidly expanding.

Innovation: The shift to digital payments and the need for advanced technology solutions is giving American Express (NYSE:AXP) an opportunity to innovate and lead the payments industry. Investing in mobile and online applications and partnering with technology companies can strengthen your company's competitiveness and help you meet the evolving needs of consumers and businesses alike.

threat

Competitive Environment: The payments industry is highly competitive, with new and non-traditional competitors constantly entering the market. American Express Co. (NYSE:AXP) must contend with pressures on merchant discount rates, the popularity of its card products, and the success of its marketing and rewards programs. The company's ability to maintain its market position depends on continued investment in its value proposition and customer engagement.

Economic and Geopolitical Uncertainties: The filing acknowledges the uncertainties in the geopolitical and macroeconomic environment that pose a threat to American Express Co.'s (NYSE:AXP) business model. Factors such as changes in interest rates, changes in consumer spending behavior, and regional instability can impact a company's performance and require agile strategic responses.

In conclusion, American Express Co (NYSE:AXP) exhibits strong financial fundamentals and brand strength, and is well-positioned in the competitive payments industry. However, the company must navigate operational cost challenges and regulatory complexities while seizing opportunities for global expansion and innovation. The threats posed by a highly competitive environment and economic uncertainty require careful management and strategic foresight. Overall, American Express Co. (NYSE:AXP) is well-equipped to leverage its strengths and opportunities, address weaknesses, mitigate threats, and maintain a sustainable and profitable growth trajectory. Looks like it's in good enough shape.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.