There remains a significant disconnect in the U.S. economy between continued growth and moderating inflation and widespread pessimism and uncertainty about the future among Americans.

“I think people are just nervous,” President Biden recently told Yahoo Finance in an exclusive interview. “And that's why we've got to stay steady, stay on course, and keep creating these great jobs.”

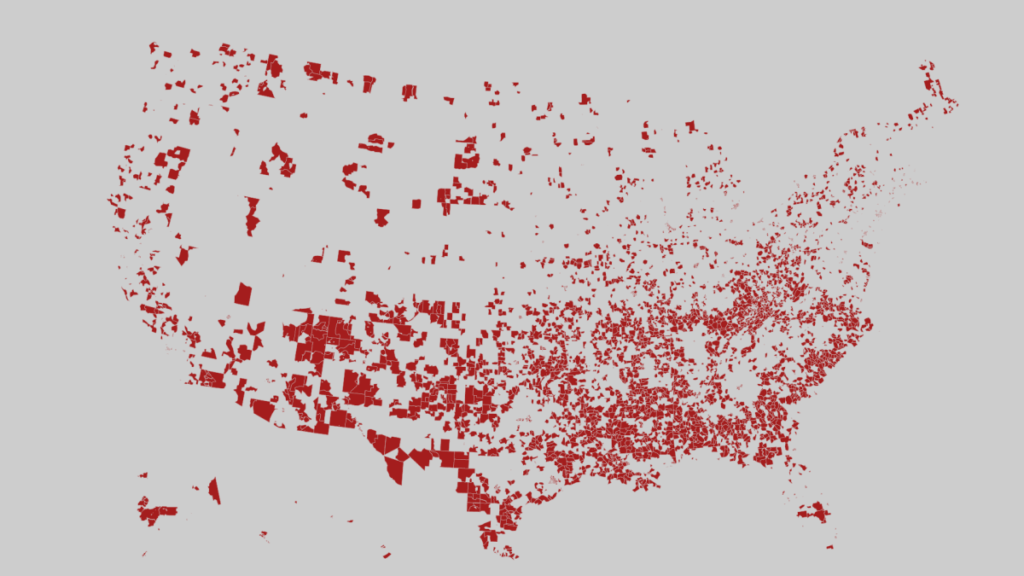

Insights into this disconnect can be gained by taking a closer look at the states, cities, and towns that power the U.S. economy: their economic lifeblood. As of 2023, local economies across the U.S. have yet to fully recover from the impacts of the COVID-19 pandemic, according to data from the Economic Innovation Group's (EIG) Distressed Communities Index.

About 52 million Americans live in “distressed” ZIP codes, up from 50 million in 2018, according to EIG, which uses U.S. Census Bureau data to classify neighborhoods by economic status.

The hardship score is calculated based on weighting factors, including the number of residents with a high school diploma, the poverty rate, the number of adults not working, the housing vacancy rate, the median income ratio, the change in employment, and the change in the number of business establishments.

EIG found that urban areas across the country have become increasingly “distressed” in recent years, while their surrounding suburbs are considered more “prosperous.”

Take Cleveland, for example: “Almost every zip code in the city is in recession, but the suburbs are definitely thriving,” EIG research leader August Benzow told Yahoo Finance.

“The pandemic has exacerbated this trend.”

The health of a local economy generally correlates with the size of its population, and the pandemic has caused big shifts in population across the country.

Large metropolitan counties, previously defined by EIG as intersecting with “urban areas with populations of 250,000 or more,” saw large population losses. Between July 1, 2020 and July 1, 2021, these counties lost a combined total of 812,000 residents.

“Following a large influx of domestic migration early in the pandemic, suburban and exurban counties continued to grow the fastest in 2022,” according to the report. After gaining 931,000 people in 2021, those same counties added an additional 832,000 residents in 2022.

“Obviously, the pandemic has exacerbated this trend, allowing people to live farther away from cities and still work remotely or with a hybrid model,” Benzow said.

A recent note from Goldman Sachs reiterated this point: “Domestic migration is leaving big cities, with roughly half moving to metropolitan areas with populations between 250,000 and 1 million. … The latest figures show that this demographic shift that began at the beginning of the pandemic, driven by fears of the virus and remote work opportunities, has not only not reversed, but is in fact continuing through mid-2023.”

The pandemic has also highlighted huge wealth disparities among the population, as those who can afford to move from cities to the suburbs have done so, while lower-income urban residents have been left behind.

Let's take a look at Fort Worth, Texas. The 13th largest city in the United States by population, Fort Worth is expected to grow 4.1% (by about 1 million residents) between 2020 and 2023.

However, 32.2% of residents live in zip codes rated by EIG as “distressed,” while 29.2% live in zip codes rated as “thriving.” The city center is the most distressed area compared to the “comfortable” and “thriving” suburbs.

“People have a good quality of life; [where] “They have an opportunity,” Fort Worth Mayor Mattie Parker told Yahoo Finance, “and that's why we're seeing a lot of migration to places like Fort Worth across the country.”

At the same time, increased demand for housing (the city's median property value increased 11.5% between 2020 and 2021) is exacerbating housing affordability issues.

“Mixed-income and moderate-income housing is a challenge for a lot of cities, which means that often the focus is on low-income housing and there are a lot of tools and government partnerships to make that happen,” Parker said, “but often the largest housing sector is middle-income — first-year teachers, first-year firefighters, young families who can't afford to live in the city because there's no moderate-income housing.”

According to the Goldman report, “Stronger population growth in non-metropolitan areas has led to somewhat faster home price appreciation compared to pre-pandemic trends compared to metropolitan counties. Post-pandemic migration trends are likely linked to changing housing preferences, with more people in the survey saying they prefer larger, more spacious homes.”

read more: Why are home prices so high?

Oklahoma City also faces a complicated economic situation.

Thriving communities make up 36.3% of the city and surrounding areas, while distressed communities make up 26.4%, mainly in the urban core.

The city's poverty rate of 15 percent is higher than the national average of 12.6 percent, while its homeownership rate is more than 5 percent below the U.S. average.

“We certainly recognize the inequities in our community and we're trying to do everything we can to at least address them,” Oklahoma City Mayor David Holt told Yahoo Finance.

Holt highlighted the Metropolitan Area Projects Program's significant investment in tourism in recent years, including the construction of the Oklahoma City Thunder arena, which is estimated to have created more than 3,000 jobs in the surrounding area and generated approximately $590 million in annual revenue.

Holt stressed that the city is focusing on distressed areas and trying to provide more equal opportunities for residents.

“We're not promising equal outcomes,” he said, “but if the outcomes continue to be unequal, then it's clear that we're not really providing equal opportunity.”

Adriana Belmonte is a reporter and editor covering politics and health policy for Yahoo Finance. You can follow her on Twitter. Adrian Bells Please contact me at adriana@yahoofinance.com.

Click here for the latest economic news and indicators to help inform your investment decisions..

Read the latest financial and business news from Yahoo Finance