(Bloomberg) — Copper prices have soared to record levels, continuing months of strong gains as financial investors flooded the market in anticipation of worsening supply shortages.

Most Read Articles on Bloomberg

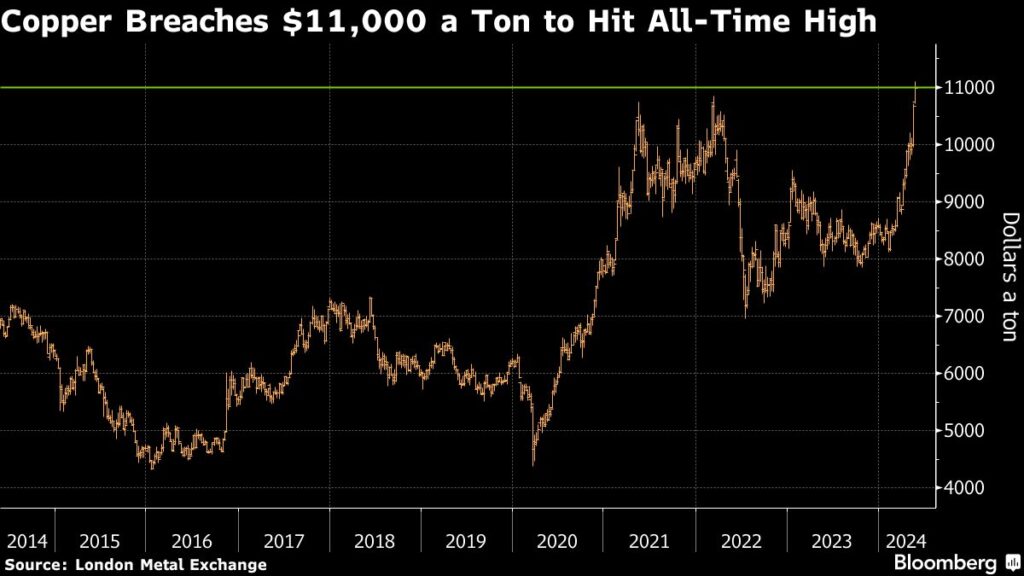

Futures on the London Metal Exchange rose more than 4% in early trading on Monday, with copper above $11,000 a tonne for the first time. There are many optimistic predictions in the market, with BHP Group hoping to acquire rival Anglo American, primarily for its copper mines.

Several developments have encouraged copper bulls in 2024, inviting increased speculative money flows. Tight supplies of copper ore have fueled talk of smelters cutting production, while this month's short squeeze in New York futures markets has sparked a global rush to secure copper ore.

“Prices have risen to another level and it's very difficult to call them the top in this environment,” Craig Lang, principal analyst at research firm CRU Group, said by phone from Singapore. “Commodity markets tend to overshoot.”

Read more: New York copper short squeeze shakes up metals markets

Investors, traders and miners have long warned that the world faces a critical copper shortage as demand for green industries from electric vehicles to renewable energy infrastructure grows. Commodities industry veteran Jeff Currie said last week that copper is the best long trade he's ever seen.

LME copper rose 3% to $10,992.50 per tonne by 12:04 pm Shanghai time on Monday.

Prices have risen by more than a quarter since the beginning of the year, leading gains across the board for major industrial metals. Gold, along with copper, has risen to record highs, with both metals gaining support for optimism that the U.S. Federal Reserve will start cutting interest rates this year.

Read more: Copper market grapples with critical issues

Many participants in the spot trade have warned that copper prices are ahead of reality. Demand remains relatively weak, especially in top buyer China, where inventory levels remain high.

appropriation of metal

A series of setbacks at major mines has raised fears that a long-awaited production shortage could arrive sooner than expected. Smelter processing fees, a measure of the tightness of the ore market, fell below zero in April.

And a short squeeze on the New York Comex exchange pushed the price of the Comex exchange to an unprecedented premium to the LME. This led to a sudden increase in the rerouting of metal supplies to the United States, which meant fewer metals were available in other countries.

“The Comex short squeeze is pushing copper to the U.S. and tightening supplies elsewhere,” Gong Ming, an analyst at Jinrui Futures, said by phone. “Inventories in the Chinese market are expected to be cleared soon due to increased exports.”

–With assistance from Liezel Hill and Jason Scott.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP