(Bloomberg) — Chinese companies are rushing to capitalize on a recent stock rebound, taking advantage of a brief window before markets tank again.

Most read articles on Bloomberg

Mining company MMG has proposed to raise HK$9.08 billion ($1.2 billion) through a rights issue in Hong Kong, while Yanguang Energy Group is seeking $634 million through a share issue, and Poly Development Holding Group is looking to raise up to 12 billion yuan ($1.7 billion) through equitable bonds.

The companies join other Chinese companies seeking cheap financing through equity or equity-linked bonds as life returns to China's stock market.The additional issuance is a bright spot for bankers who have watched mergers and acquisitions and initial public offerings dry up.

Yang Kuan's offering would be the largest by a Hong Kong-listed company since sportswear developer Anta Sports Products Ltd. raised $1.5 billion in a similar offering in April 2023, according to data compiled by Bloomberg.Buoyed by Yang Kuan, share sales by Hong Kong-listed companies this quarter surged to $1.7 billion, already the highest in a year.

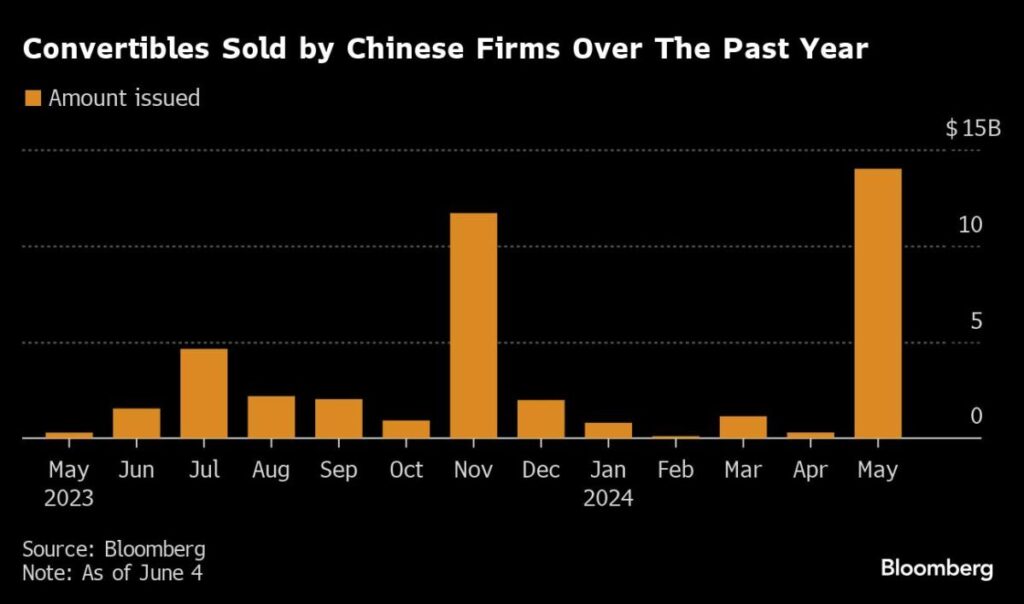

Chinese companies are also issuing convertible bonds at a record pace, as the instruments give companies the flexibility to raise money cheaply without immediate equity dilution and at lower interest rates than traditional borrowing. Alibaba Group Holding Ltd. and JD.com Ltd. raised a combined $7 billion this way last month.

“Chinese companies see the Chinese market booming right now and are seizing the opportunity to raise the capital they need,” said Kenny Ng, a strategist at China Everbright Securities International Co. As for convertible bonds, the domestic market offers an added advantage because interest rates are low and costs are even cheaper, he said.

If Poly goes public, it will be rare as only three Chinese real estate companies have raised more than $1 billion through convertible bonds in the past two decades, according to Bloomberg data.

Signs that the rebound in Chinese stocks is slowing could create urgency for companies and accelerate fundraising efforts, as companies need to take advantage of a likely reversal of the stock market rally given investor concerns over China's policy uncertainty and geopolitical risks.

The CSI 300 index of mainland Chinese stocks has fallen after rising about 16% from this year's low through mid-May, while the Hang Seng China Enterprises Index also failed to extend gains after rising nearly 40% from its trough to its peak.

The rally in real estate developer stocks prompted some hedge funds to take profits, while others built up short positions, according to JPMorgan Chase & Co.

An index of property developers tracked by Bloomberg Intelligence soared more than 70% in the month through May 17, when the Chinese government announced a housing rescue package that included lower mortgage rates and down payments. In the two weeks since, the index has slumped as doubts have grown about the package's effectiveness.

“If stock prices in China's property sector continue to rise — and that's a big assumption — we may see more developers tapping into the credit card market,” said Zerlina Zeng, senior credit analyst at CreditSights Singapore LLC.

(Updated chart with new details and additional share sale)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP