Chief Enterprise Risk Officer Kara West sold 1,212 shares of Capital One Financial Corp (NYSE:COF) stock on May 02, 2024. The transaction was reported in her recent SEC filing.

Capital One Financial Corp is a diversified financial services holding company headquartered in McLean, Virginia. Initially a pure credit card company, the company has expanded to include banking and lending products for consumers, small businesses, and commercial customers.

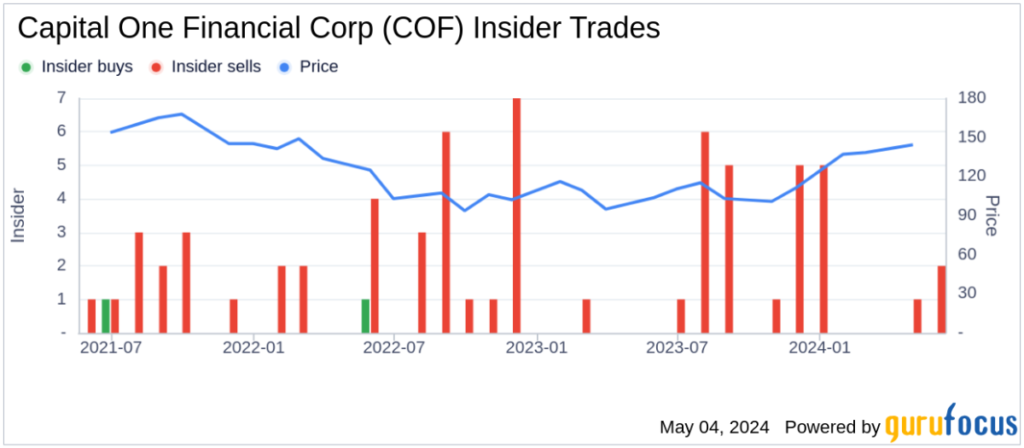

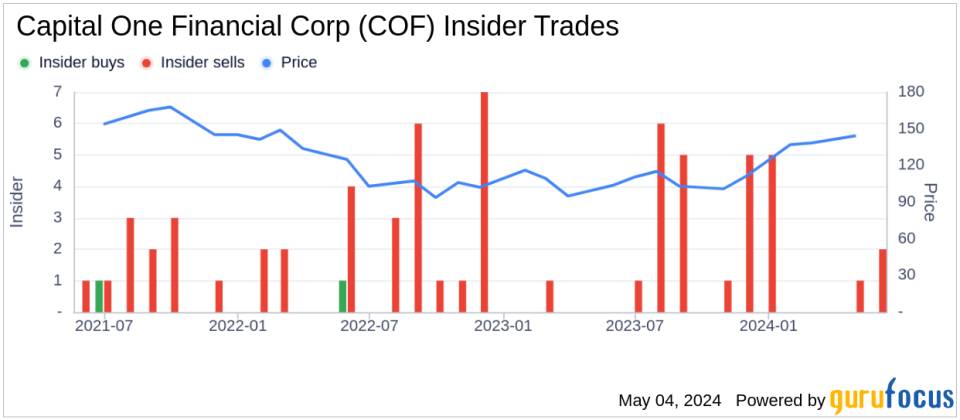

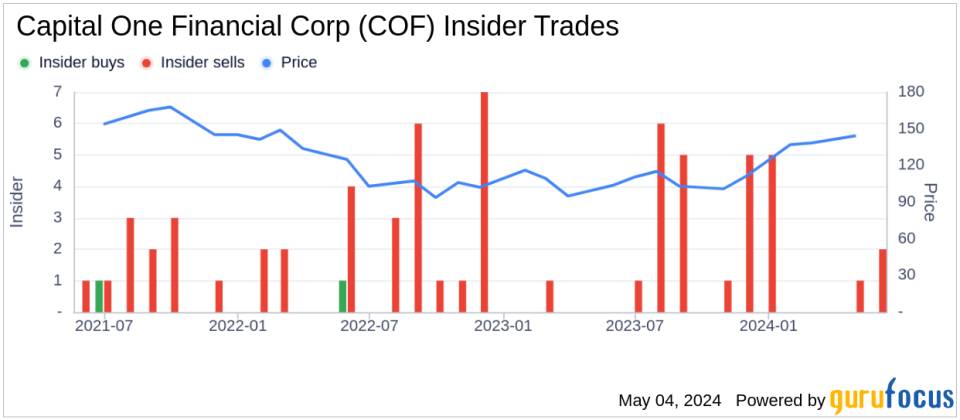

Over the past year, insiders sold a total of 3,574 shares of company stock, but did not buy any shares. The sale is part of a broader trend within the company, with 26 insider sales and zero insider purchases over the past year.

On the date of the sale, Capital One Financial Corp's stock price was $141.87. The company's market capitalization is approximately $54.39 billion.

Capital One Financial Corp's price-to-earnings ratio is 11.15, which is lower than the industry median of 14.71. This valuation metric suggests that the valuation may be low compared to the industry.

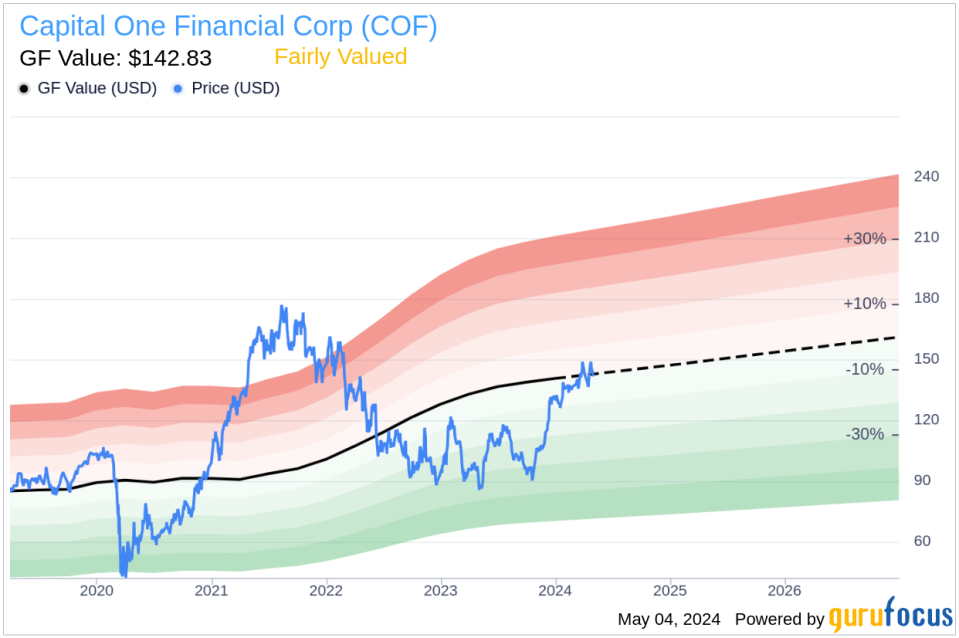

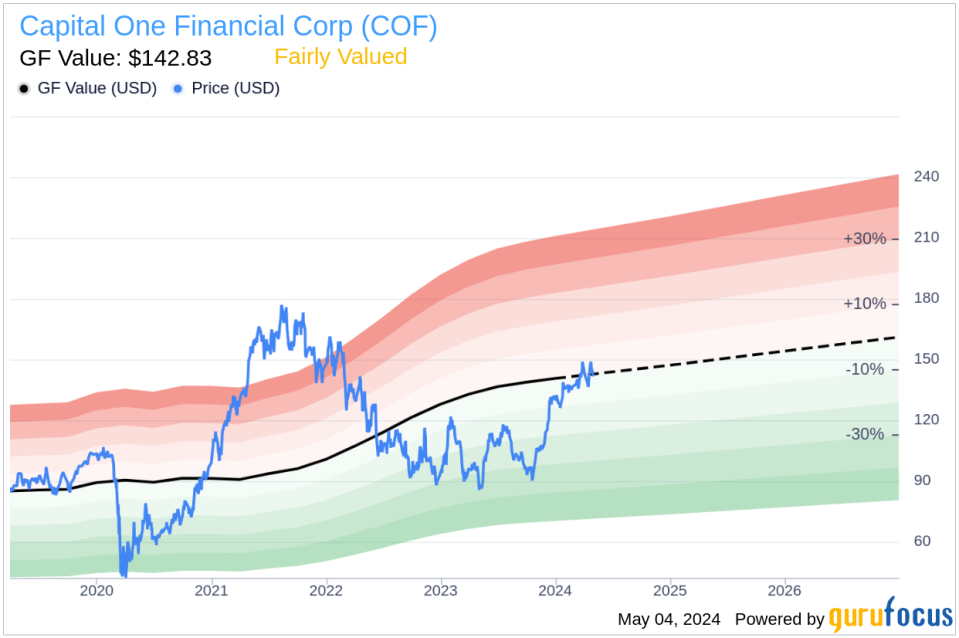

According to GF Value, the intrinsic value of the stock is estimated to be $142.83, giving a price to GF Value ratio of 0.99. This indicates that the stock is fairly valued.

GF Value is calculated based on historical trading multiples, adjustment factors from GuruFocus, and future performance estimates provided by Morningstar analysts.

This insider sale could be of interest to investors who monitor insider behavior and company valuation metrics.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.