On May 24, 2024, Joel Edwards, the Chief Financial Officer of Coastal Financial Corporation (NASDAQ:CCB), executed a sale of 12,414 shares of the company's stock. The transaction was recorded in an SEC filing. Following this sale, the insider now owns 44,989 shares of Coastal Financial Corporation stock.

Based in Everett, Washington, Coastal Financial Corp operates as the bank holding company for Coastal Community Bank, which provides a variety of banking services to small businesses, professionals, and individuals. The company offers a variety of deposit products and loans in addition to other banking services.

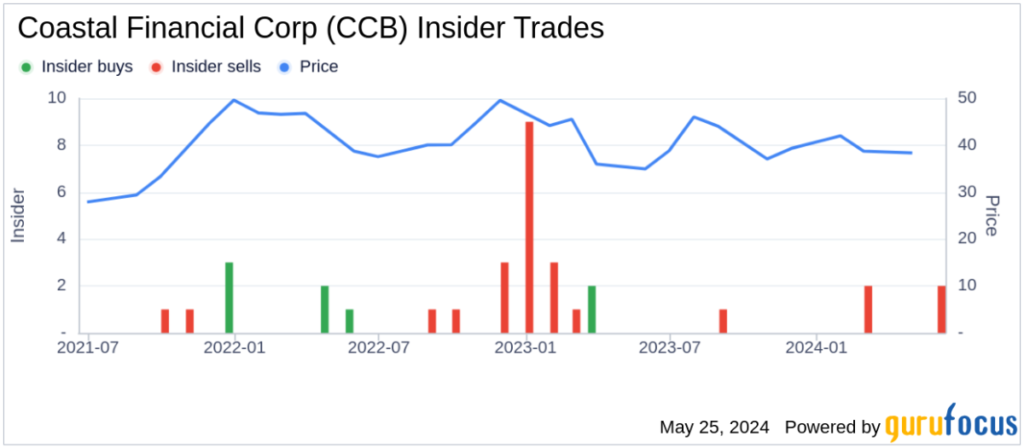

The shares were sold for $43.5 per share, for a transaction value of approximately $539,511.This sale was part of a broader trend observed over the past year, where Coastal Financial Inc. saw no insider purchases, but 5 insider sales.

Coastal Financial Corporation has a market capitalization of $595,289,000. The company’s price-to-earnings ratio of 15.51 is higher than the industry average of 9.61, which indicates a higher valuation compared to the industry average.

According to GF Value, Coastal Financial Corp's intrinsic value is estimated at $118.00 per share, and the stock's price-to-GF Value ratio of 0.37 makes the stock significantly undervalued. This valuation takes into account historical trading multiples, adjustments based on the company's past performance, and future business projections.

Insider trading trends and current valuation indicators suggest noteworthy activity and valuation conditions for potential investors. GF Value is showing significant undervaluation, which could be an interesting point for market watchers.

This article written by GuruFocus is intended to provide general insights and is not tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment guidance. It is not a recommendation to buy or sell stocks, nor does it take into account individual investment objectives or financial situation. Our objective is to provide long-term, fundamental data-driven analysis. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus has no position in the stocks mentioned herein.

This article was originally published on GuruFocus.