On May 16, 2024, Daniel Reeve, Chief Executive Officer of Donnelly Financial Solutions, Inc. (NYSE:DFIN) completed a significant transaction, selling 30,000 shares of the company's stock. The stock was sold at a price of $62.67 per share, as detailed in an SEC filing. This transaction is part of a broader pattern in which insiders sold a total of 110,000 shares over the past year with no purchase records.

Donnelley Financial Solutions Inc (NYSE:DFIN) specializes in providing financial communications, data services and regulatory compliance solutions. The company plays an important role in the global capital markets by helping clients effectively manage and communicate financial and strategic information.

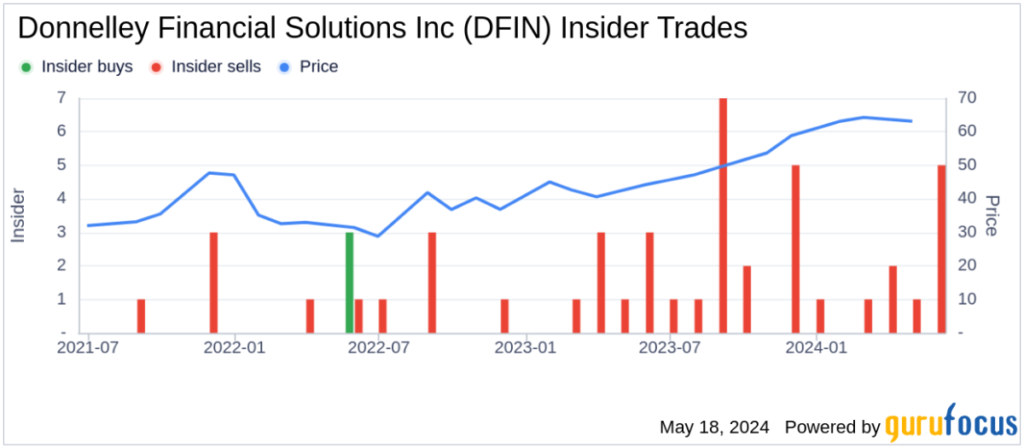

The recent insider sales come in the context of no insider purchases for the company and 26 insider sales over the past year. This trend can be visualized in the following insider's image of his trend.

As of the sale date, Donnelly Financial Solutions (NYSE:DFIN) had a market capitalization of approximately $1.89 billion. The company's price-to-earnings ratio of 19.24x is slightly higher than the industry median of 19.18x, indicating a high valuation compared to its peers.

The stock's valuation relative to its intrinsic value, as estimated by the GF value, suggests that it is significantly overvalued. At his GF value of $40.08 compared to the current price of $62.67, the price to GF value ratio is 1.56. This assessment is supported by his GF value image below.

GF value is derived from historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio, and price-to-free cash flow, adjusted for a company's past performance and expected future business results. will be done.

This sale by an insider could provide market observers with insight into an insider's view of the stock's current valuation and future prospects, taking into account broader market and company-specific factors.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.