cyber security company palo alto networks (NASDAQ:PANW) The stock had a strong start to the year, hitting a 52-week high of $380.84 on February 9th. Then, on February 20th, when the company announced its financial results for the second quarter (ending January 31st), the stock price immediately plummeted.

The stock is still well below its 52-week high at the time of writing. Could this drop in stock prices be a buying opportunity? Or is this a warning sign not to invest in Palo Alto Networks?

To answer this question, we need to investigate the company in more detail. Also, digging into why Palo Alto Networks' stock price has plummeted could help assess whether the company is a good long-term investment.

Why Palo Alto Networks stock price fell

Several factors contributed to the decline in the price of Palo Alto Networks stock. One is the weakness in US government spending. “This weakening of the U.S. federal government was a significant headwind to our billings in the second quarter,” said CFO Dipak Golechha.

But perhaps the most important factor is increased oversight among companies regarding cybersecurity spending. CEO Nikesh Arora said, “What's new is that even though there are many demand drivers, customers are starting to realize that they are facing spend fatigue in cybersecurity.” .

Palo Alto Networks executives noted that most customers spend more on cybersecurity than on IT. This has led customers to wonder how to reduce their spending on cyber threat protection products.

Palo Alto Networks sees opportunity in this trend and has decided to make a strategic shift to its business this year to take advantage of this.

Going forward, the company plans to pursue customers by encouraging them to move away from using multiple cybersecurity vendors and consolidate their security needs onto the Palo Alto Networks platform. In this way, customers can reduce their overall cybersecurity costs.

To facilitate this, the company announced that it will not charge any fees while customers migrate from their existing cybersecurity vendor to Palo Alto Networks. This aggressive approach to customer acquisition means the company expects its revenue to take a hit in the short term. This makes sense since Palo Alto Networks accepts customers without charging them for a period of time.

This period of reduced income is estimated to continue for the next 12 to 18 months. As a result, the company lowered its fiscal 2024 revenue forecast from a minimum of $8.15 billion to a minimum of $7.95 billion. This change in projected earnings also contributed to the decline in Palo Alto Networks stock.

Benefits of Palo Alto Networks' new strategy

Despite the short-term impact on Palo Alto Networks' revenue, the company's management is confident the new strategy will work in the long term. “We believe that by approaching customers well before their points product contracts expire, we can build customer trust in our platform,” Arora said.

According to Palo Alto Networks management, this strategy will lead to significant annual recurring revenue (ARR) growth over the long term. ARR measures the total revenue that a company can collect from customer contracts over the course of a year.

Here's how Palo Alto Networks sees ARR growth: The company expects fiscal 2024 ARR to reach at least $3.95 billion. With the new strategy the company has introduced, Palo Alto Networks expects ARR to grow to $15 billion by 2030.

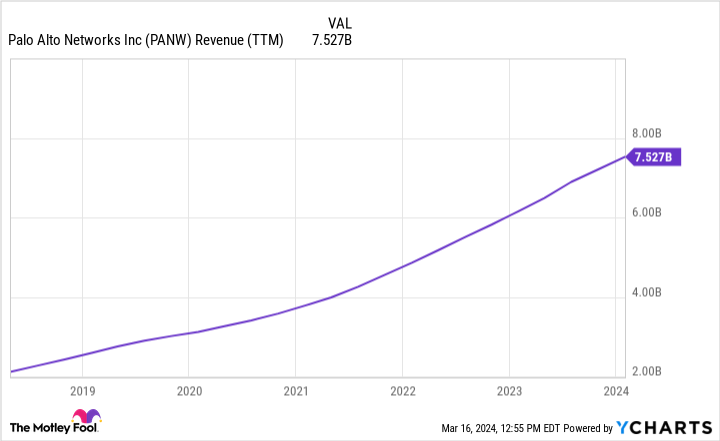

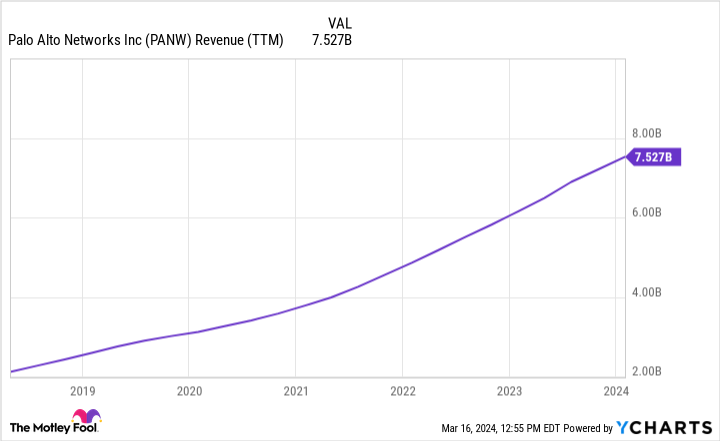

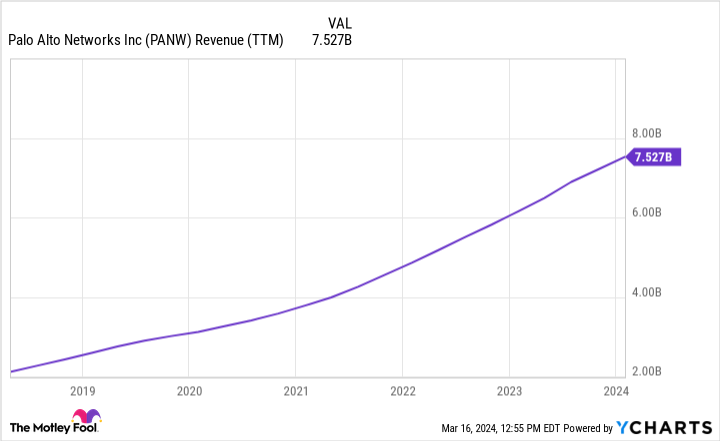

The company seems capable of achieving this significant revenue growth. Since Arora took over as her CEO in 2018, the company has been on a rocket ride with rapid revenue growth.

This trend continues today. Palo Alto Networks' revenue in the second fiscal year he reached $ 2 billion, an increase of 19% over the previous year. The company expects third-quarter sales to reach at least $1.95 billion, up from $1.7 billion a year ago.

Deciding whether to buy Palo Alto Networks stock

Palo Alto Networks' earnings could have a short-term impact on its path to long-term revenue growth. But even with the lowered guidance, the company's fiscal 2024 revenue is expected to be at least $7.95 billion, still a double-digit increase from $6.9 billion in the previous year.

Additionally, Palo Alto Networks' ability to generate free cash flow (FCF) is solid. Through the first half of fiscal 2024, Palo Alto Networks generated FCF of $2.1 billion, up from $1.9 billion the year before.

Another point to consider when evaluating Palo Alto Networks stock is the insight provided by Wall Street analysts. They believe the company's stock price will rise, with a median price target of $335.

Combine this with the company's consistent revenue growth, solid FCF generation, and aggressive customer acquisition strategy, and Palo Alto stock looks like a worthy long-term investment.

Should you invest $1,000 in Palo Alto Networks right now?

Before buying Palo Alto Networks stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palo Alto Networks wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 18, 2024

Robert Izquierdo has a position at Palo Alto Networks. The Motley Fool has a position in and recommends Palo Alto Networks. The Motley Fool has a disclosure policy.

Can I buy Palo Alto Networks stock now? Originally published by The Motley Fool