key insights

-

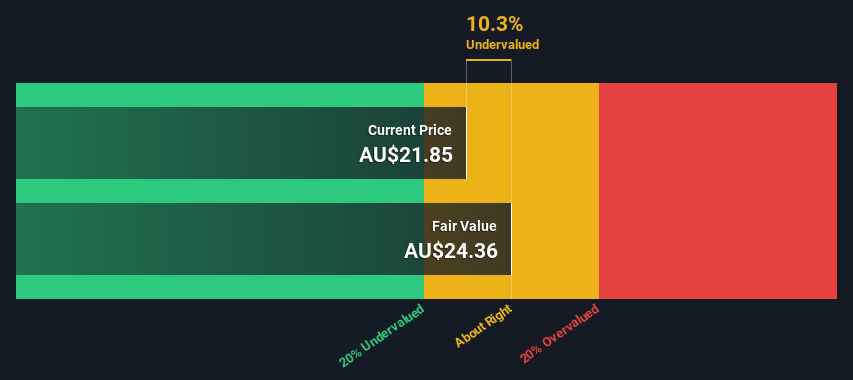

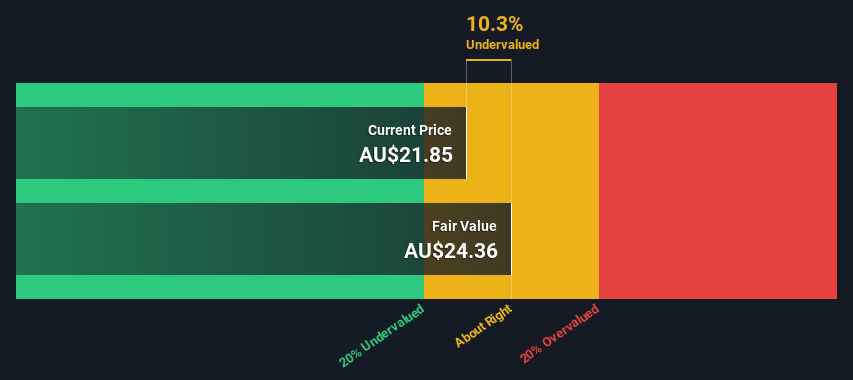

Flight Center Travel Group's expected fair value is AU$24.36 based on two levels of free cash flow into the stock.

-

The current share price of AU$21.85 suggests that Flight Center Travel Group may be trading close to its fair value.

-

Our fair value estimate is 6.7% above Flight Center Travel Group's analyst price target of AU$22.84.

How far is Flight Center Travel Group Limited (ASX:FLT) from its intrinsic value? Using the latest financial data, discounting expected future cash flows to its current value, you can determine if the stock price is fair. Please check if. One way to accomplish this is to employ a discounted cash flow (DCF) model. It may sound complicated, but it's actually very easy!

However, keep in mind that there are many ways to estimate a company's value, and a DCF is just one method. For those who are keen to learn stock analysis, the Simply Wall St analysis model here may be of interest.

Check out our latest analysis for Flight Center Travel Group.

model

We use a two-stage growth model. This means considering his two stages of company growth. In the initial stage, a company may have a higher growth rate, and in the second stage, it is usually considered to have a stable growth rate. The first step is to estimate the cash flow to the business over the next 10 years. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume that companies with shrinking free cash flow will see their rate of contraction slow, and companies with growing free cash flow will see their growth rate slow over this period. This is to reflect that growth tends to be slower in the early years than in later years.

It is generally assumed that a dollar today is worth more than a dollar in the future, so the sum of these future cash flows is discounted to today's value.

Estimated 10-year free cash flow (FCF)

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

|

|

Leveraged FCF (AUD, million) |

AUD 223.6 million |

AUD 421.4 million |

AUD 460.1 million |

AUD 432.5 million |

AUD 351.9 million |

AUD 340.2 million |

AUD 334.4 million |

AUD 332.7 million |

AUD 333.6 million |

AUD 336.4 million |

|

Growth rate estimation source |

Analyst x5 |

Analyst x5 |

Analyst x5 |

Analyst x2 |

Analyst x2 |

Forecast @ -3.32% |

Estimated @ -1.68% |

Estimated @ -0.53% |

Estimated @ 0.28% |

Estimated @ 0.84% |

|

Present value (A$, million) Discounted at 7.7% |

AUD$208 |

Australian dollar 363 dollars |

Australian dollar 368 dollars |

AUD 321 |

AUD$242 |

AUD$218 |

AU$199 |

Australian dollar 183 dollars |

Australian dollar 171 dollars |

Australian dollar 160 dollars |

(“Est” = FCF growth rate estimated by Simply Wall St)

Present value of cash flows over 10 years (PVCF) = AUD 2.4 billion

Next, you need to calculate the terminal value, which takes into account all future cash flows over this 10-year period. For various reasons, a very conservative growth rate is used that cannot exceed the country's GDP growth rate. In this case, we used the five-year average of the 10-year Treasury yield (2.2%) to estimate future growth. Similar to the 10-year “growth” period, we use a cost of capital of 7.7% to discount future cash flows to their present value.

Terminal value (TV)=FCF2033 × (1 + g) ÷ (r – g) = AUD 336 million × (1 + 2.2%) ÷ (7.7% – 2.2%) = AUD 62 billion

Present Value of Terminal Value (PVTV)= TV / (1 + r)Ten= AUD 6.2 billion ÷ ( 1 + 7.7%)Ten= AUD 2.9 billion

The total value is the sum of the cash flows over the next 10 years plus the discounted terminal value, resulting in a total capital value, which in this case is AUD 5.4 billion. The final step is to divide the stock value by the number of shares outstanding. Compared to the current share price of AU$21.99, the company appears to be at about fair value, at a 10% discount to the current share price. However, keep in mind that this is just a rough estimate and like any complex formula, garbage goes in and garbage goes out.

Prerequisites

The above calculation relies heavily on two assumptions. One is the discount rate and the other is the cash flow. You are not required to agree to these inputs. I encourage you to redo the calculations yourself and give it a try. Additionally, DCF does not give a complete picture of a company's potential performance because it does not take into account the cyclicality of the industry or the company's future capital requirements. Given that we are considering Flight Center Travel Group as a potential shareholder, the cost of capital is used as the discount rate, rather than the cost of capital taking into account debt (or weighted average cost of capital, WACC). For this calculation, we used 7.7% based on a leverage beta of 1.212. Beta is a measure of a stock's volatility in comparison to the market as a whole. Beta values are derived from industry average beta values for globally comparable companies and are constrained to a range of 0.8 to 2.0, which is a reasonable range for stable businesses.

SWOT analysis of Flight Center Travel Group

strength

Weakness

opportunity

threat

to the next:

Although important, the DCF calculation should not be the only focus when researching a company. The DCF model is not a perfect stock valuation tool. If possible, it's a good idea to apply different cases and assumptions and see how they affect the company's valuation. For example, a small adjustment to the terminal value growth rate can dramatically change the overall result. We've put together three basic items to consider for Flight Center Travel Group.

-

financial health: Is FLT's balance sheet healthy? Check out our free balance sheet analysis, including 6 quick checks on key factors like leverage and risk.

-

future earnings: How does FLT's growth rate compare to its peers and the broader market? Dive deeper into analyst consensus numbers for the coming years by interacting with the free Analyst Growth Expectations chart.

-

Other high quality alternatives: Do you like good all-rounders? Explore our interactive list of quality stocks to figure out what else you're missing.

PS. The Simply Wall St app performs daily discounted cash flow valuations for all ASX stocks. If you want to know the calculations for other stocks, please search here.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.