(Bloomberg) – Investors are in a risk-on mood, buying up stocks in Europe and emerging markets at the expense of the U.S. and tech sectors, according to a new Bank of America survey of fund managers.

Most Read Articles on Bloomberg

The strategists, led by Michael Hartnett, said in a note that participants' allocations to European stocks rose by the most since June 2020, while allocations to emerging market stocks saw the biggest increase since April 2017. Ta. The March survey also supported the financial sector, with new risk-on appetite emerging at the expense of US stocks, technology and consumer discretionary sectors.

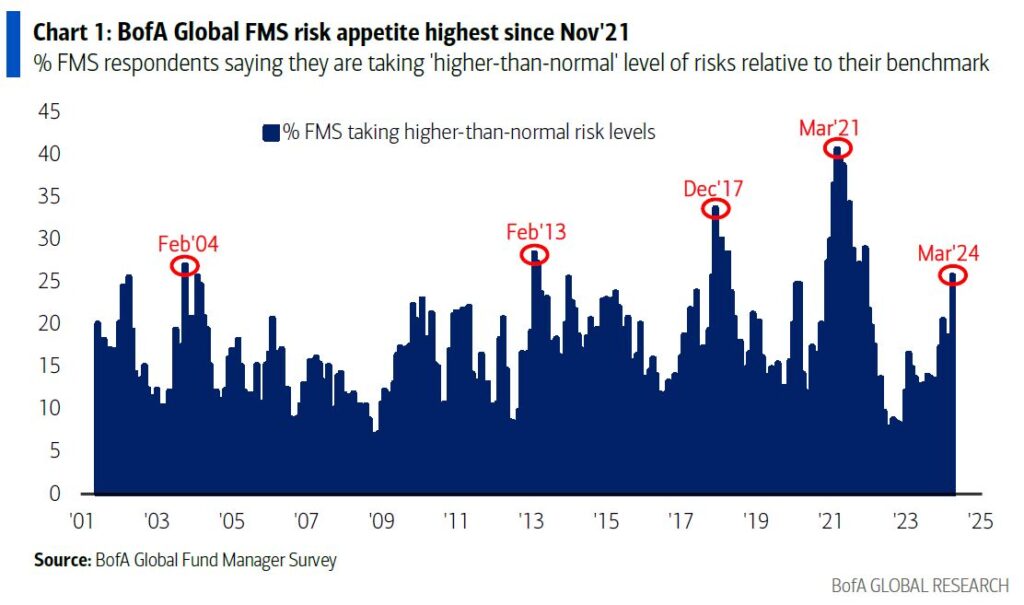

Fund managers are seeking more global exposure as opinion polls show risk appetite has reached its highest level since November 2021 and the consensus remains that the economy will have a soft landing. Allocations to equities are at their highest level in two years, but bullish positions in the U.S. are growing, with research showing longs in the Magnificent Seven Group of U.S. technology stocks are the most crowded trades. ing.

Investors polled were divided on whether artificial intelligence stocks are in a bubble, with 40% saying yes and 45% saying no.

The survey results also highlight optimism about global growth expectations, which are at their highest in more than two years. Investors' bets on global markets have paid off recently. European stocks have risen over the past eight weeks, outperforming the S&P 500. The MSCI Emerging Markets Index also outpaced the rise in the US benchmark over the same period.

The poll was conducted from March 8th to March 14th among 198 participants with total assets under management of $527 billion.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP