Even strong financial results cannot sway investors.

The past week has been a roller coaster for markets, with investors weighing in on the latest update, with mixed results from a weaker-than-expected first-quarter U.S. gross domestic product and earnings from big tech companies from continued inflationary pressures. I digested everything from Consumer Expenditure Price Index (PCEPI). And the University of Michigan's consumer sentiment measure declined.

On the revenue front, the first quarter of the season continues to perform better than expected. His first four reports from The Magnificent Seven were released last week. Tesla (NASDAQ:TSLA) has been relatively underperforming this year, reporting on Tuesday that production of new affordable electric vehicles fell short of expectations for first-quarter earnings per share and sales. Investors will likely see the stock rise nearly 20% since the news broke that it would launch in 2025.[1]

The next company to rise was Meta Platforms (NASDAQ:META), which released its results after Wednesday's close and easily beat expectations on revenue and bottom line, but with a weak earnings outlook and AI CEO Mark Zuckerberg's comments on the issue were also mixed. The actual spending that caused the stock price to plummet after the news.[2]

On Thursday, Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) both reported better-than-expected earnings, leading to more positive results and market reactions. Alphabet's 15% year-over-year EPS growth was his highest in two years, driven by strong YouTube ad revenue and the strength of Google Cloud. Following strong results, the company paid its first-ever dividend and announced a $70 billion share buyback.[3] Microsoft's stock rose 2.5% the day after the report, despite strong growth in its cloud division in the first quarter on the back of AI demand and slightly softening its fiscal fourth-quarter earnings outlook. Did.[4]

So far, 46% of S&P 500 stocks have reported year-over-year earnings growth of 3.5%, according to FactSet data.[5] This means that 77% of companies beat analyst expectations, which is above the 10-year average, on par with the 5-year average, and slightly less than the 1-year average of 78%. . But the concern this season is in earnings, with just over half of reports slightly above Wall Street expectations on the top line, which is below the one-year, five-year and 10-year averages. . Not only are fewer companies outperforming in sales, but the difference is much smaller at 1.3%, well below the five-year average of 2.0%. This may explain why investors seem less excited about this season's results, rewarding positive surprises lower than average and being harsher on negative surprises than in previous years. I will punish you. Earnings growth is driven by cost reductions, not the earning power that investors are hoping for. Cost cutting has limited impact on the business, and profitability is a good driver for his EPS growth.

This week's deck – Amazon, Apple, etc.

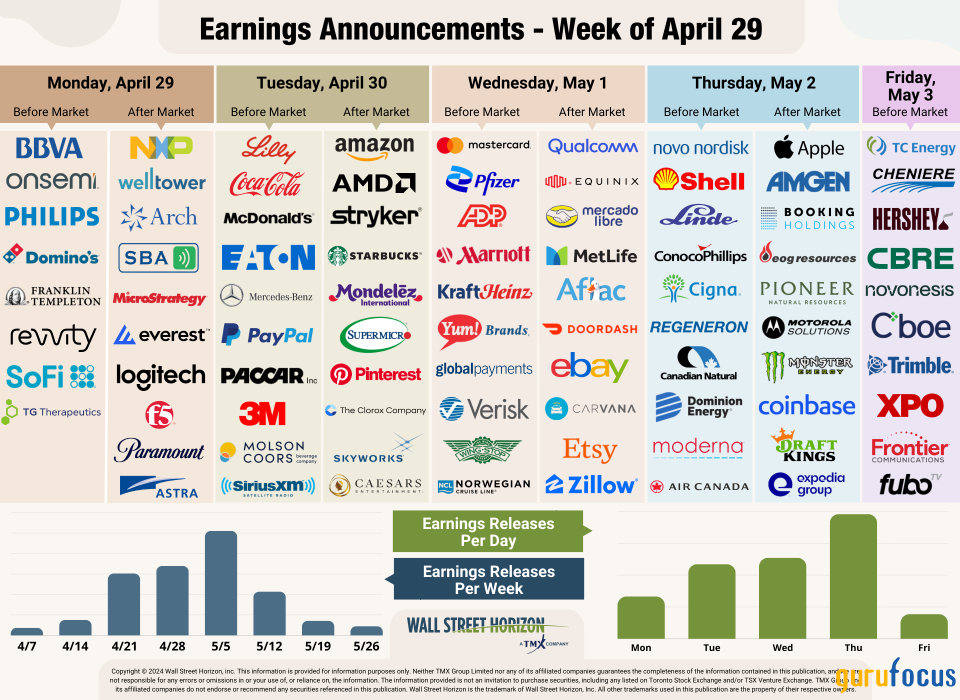

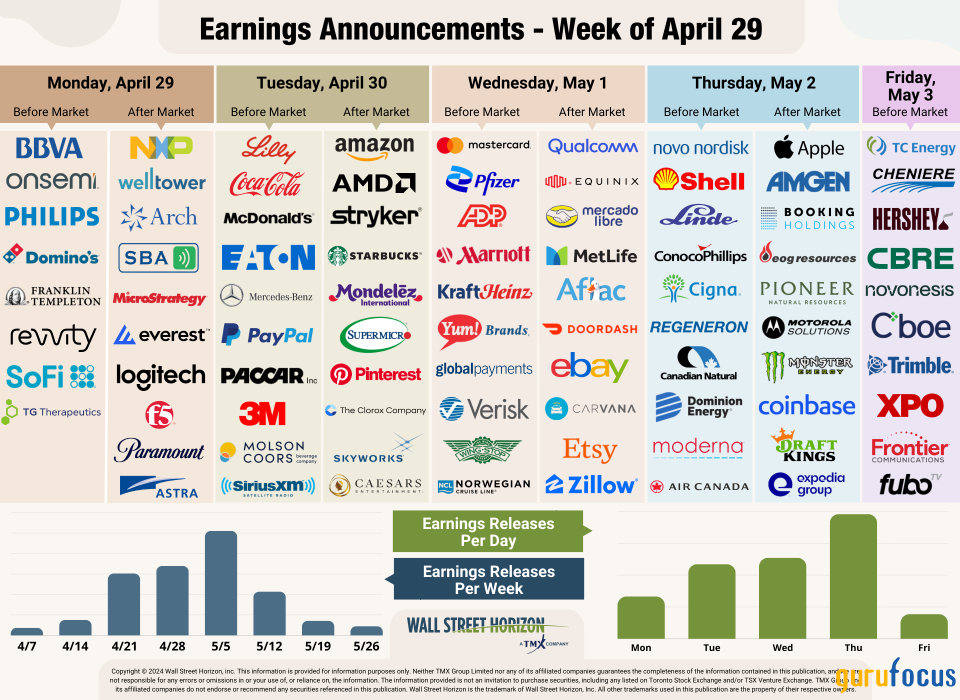

The Magnificent Seven remains the biggest driver of growth this season. Investors had been hoping for broader growth across sectors starting this year, but that remains to be seen. Two more names will be announced this week when Amazon (NASDAQ:AMZN) reports its earnings on Tuesday, April 30th, followed by Apple (NASDAQ:AAPL) when it reports after the bell on Wednesday, May 1st. It will be announced.

Source: Wall Street Horizon

This week's outlier closing date

Academic research shows that when a company announces a quarterly earnings date that is later than previous announcement dates, it is usually a sign that the company will share bad news on an upcoming conference call, while an earlier announcement date is It has been shown that the opposite is true.[6]

This week saw the release of results for a number of large companies on key metrics with Q4 2023 earnings dates deviating from historical norms. Three S&P 500 companies have confirmed outlier earnings dates this week, all of which are later than normal, resulting in negative DateBreaks Factors*. Those names are The Coca-Cola Company (NYSE:KO), 3M Company (NYSE:MMM), and The Hershey Company (NYSE:HSY).

* Wall Street Horizon DateBreaks Factor: A statistical measure that compares a financial year end date (fixed or restated) to a reporting company's five-year trend for the same quarter. A negative value means the return date is confirmed to be later than the historical average, while a positive value means it is earlier.

The Hershey Company (NYSE:HSY)

Company Confirmation Report Date: Friday, May 3, BMO Forecast Report Date (Based on Historical Data): Thursday, May 2, BMODateBreaks Factor: -3*

The Hershey Company is scheduled to report its first quarter 2024 results on Friday, May 3. Although this is just one day later than expected, this marks a break from the company's strong Thursday reporting trend and marks the first time it has reported results on a Friday. . This is the first time the company has reported a first quarter in May, according to our data dating back to 2006.

Hershey missed earnings estimates last quarter, and by the next day the staple name was down more than 3%.[7] Defensive sectors such as consumer discretionary were the laggards for much of the decline in the second quarter (with the exception of the week of April 15-19, when Staples led). This is because cyclical stocks continue to outperform in this high interest rate environment. Hershey's first-quarter earnings per share are expected to decline 7% from a year ago, according to analyst estimates collected by FactSet.

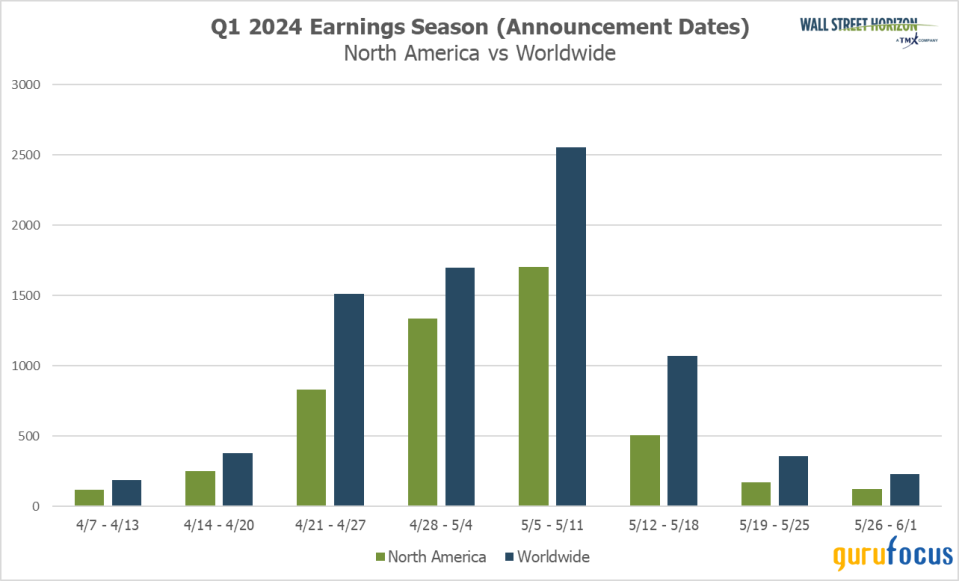

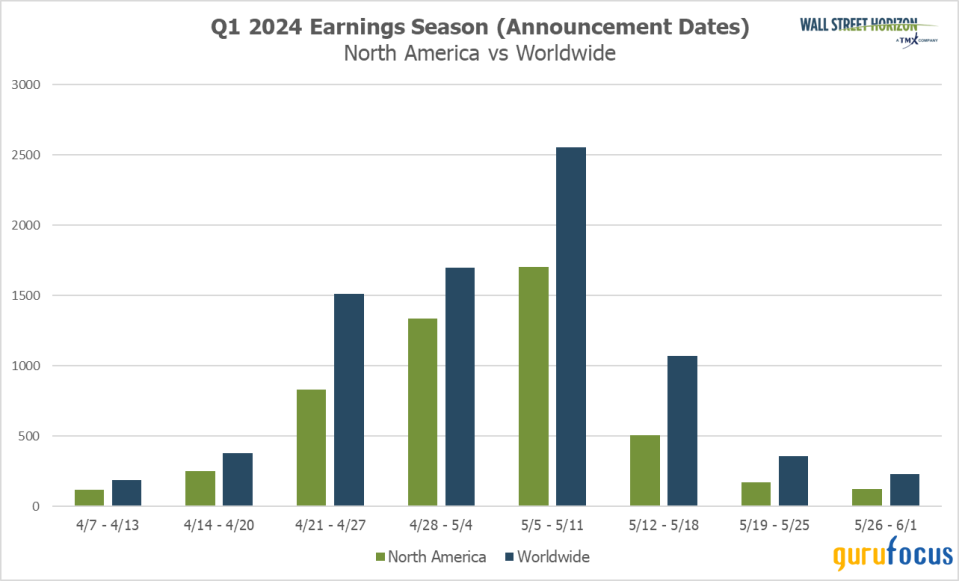

Q1 earnings wave

The peak week of this season is between April 22nd and May 10th, with more than 1,500 reports expected each week. May 9th is currently predicted to be the most active day, with 1,236 companies expected to report. So far, 70% of companies have confirmed their financial year end date (out of over 10,000 global companies), so this may change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

[1] Tesla Announces First Quarter 2024 Financial Results, Tesla, April 23, 2024, https://ir.tesla.com [2] Meta Reports 2024 First Quarter Results, Meta Platforms, Inc., April 24, 2024, https://investor.fb.com [3] Alphabet Announces First Quarter 2024 Results, April 25, 2024, https://abc.xyz/assets/91/b3/3f9213d14ce3ae27e1038e01a0e0/2024q1-alphabet-earnings-release-pdf.pdf [4] Earnings Release Q3 2024 – Microsoft Cloud Strength Drives Q3 Results, April 25, 2024, https://www.microsoft.com [5] EARNINGS INSIGHT, FactSet, John Butters, April 26, 2024, https://advantage.factset.com [6] Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. Thaw, Travis L. Johnson, December 2018, https://papers.ssrn.com [7] Hershey Reports Fourth Quarter and Full Year 2023 Financial Results. Providing 2024 Outlook, The Hershey Company, February 8, 2024, https://hershey.gcs-web.com

Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell, or modify this document without the prior written consent of Wall Street Horizon. This information is provided for informational purposes only. Neither TMX Group Limited nor its affiliates guarantee the completeness of the information contained herein and assume no liability for any errors or omissions in the information or for your use of or reliance on the information. This publication is not intended to provide legal, accounting, tax, investment, financial, or other advice and should not be relied upon for such advice. The information provided is not a solicitation to purchase any securities, including those listed on the Toronto Stock Exchange or the TSX Venture Exchange. TMX Group and its affiliates do not endorse or recommend any securities mentioned herein. TMX, TMX Design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are trademarks of TSX Inc. and are used under license. Wall Street Horizon is a trademark of Wall Street Horizon, Inc. All other trademarks used herein are the property of their respective owners.

This article first appeared on GuruFocus.