(Bloomberg) — Shares of beleaguered Chinese solar power producers have rebounded in recent days amid growing speculation that the government will take steps to sustain the industry’s rapid capacity expansion. .

Most Read Articles on Bloomberg

According to local media reports, the Chinese government may end its policy of restricting installations if power cuts exceed 5% of a particular power source's installed capacity. The source of the information was not disclosed. The National Development and Reform Commission, which imposed the rule in 2018 to improve the efficiency of electricity supply, did not respond to a faxed request for comment.

To meet its climate goals, China has led the world in building renewable energy. But the power grid is sometimes overwhelmed by the additional power, forcing power plants to stop generating electricity or even provide power at negative rates. This expansion has also left the solar industry with excess manufacturing capacity, which has weighed heavily on valuations in recent years.

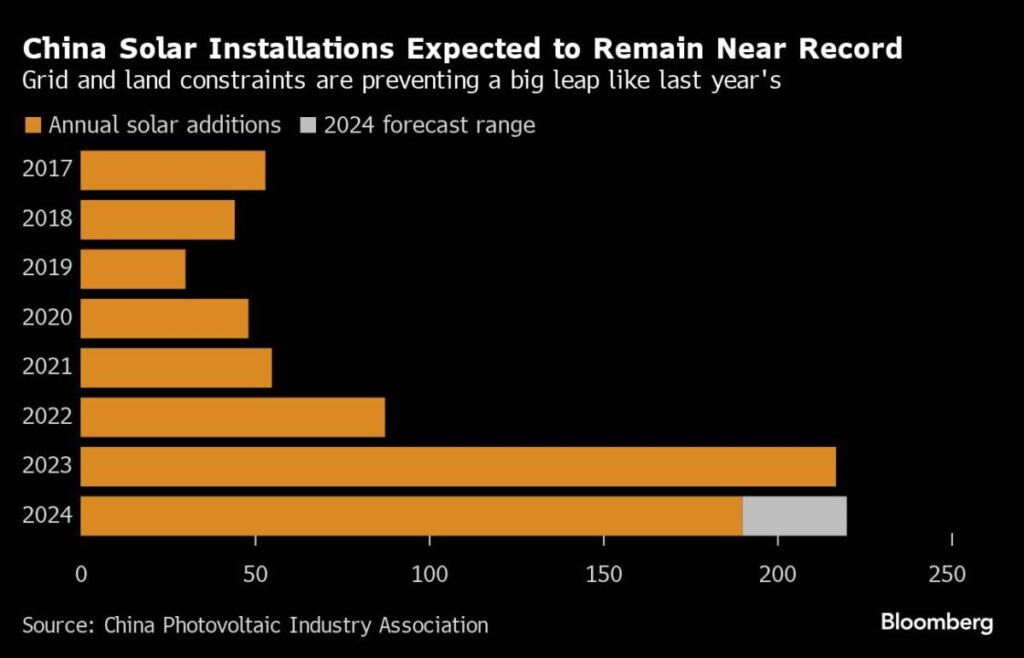

Analysts including JPMorgan Chase & Co.'s Alan Hong wrote in a research note on Sunday that lifting the cap would reduce solar power in some regions where grid constraints would force developers to gradually back away. He said it may be possible to continue installing the panels. The bank forecast a 21% increase in installations this year to 225 GW, further surpassing last year's record.

Shares in leading solar glass maker Xinyi Solar Holdings rose 10% in Hong Kong this week by Tuesday's close, while equipment maker SunGrow Power Supply rose 9.4% in Shenzhen. Shares of top panel makers such as Longhi Green Energy Technology and Trina Solar also rose.

Renewable power is difficult and expensive to store, making power curtailment a persistent headache for the industry. In 2017, wind and solar power boomed thanks to generous government subsidies, but billions of dollars worth of electricity was wasted because the grid couldn't absorb it. After that, the installation slowed down over the years.

This time it might be different. Hong said government officials are softening their stance on wasting electricity as clean energy becomes a major source of economic growth.

But even if the policy ends, the more fundamental problem of power grid congestion will need to be addressed, said Dennis Ipe, an analyst at Daiwa Capital Markets. This will require major investments in energy storage and transmission.

on the wire

The National People's Congress' focus on further reducing China's carbon emissions could brighten the outlook for the solar power sector.

Australian winemakers and MPs say China is proposing to lift punitive tariffs on Australian wine, suggesting an end to a three-year trade dispute is near as the two countries seek to strengthen ties. said.

China's urgent exploration for iron ore is likely to further intensify competition.

This week's diary

(All Beijing unless otherwise noted)

Wednesday, March 13th:

-

China to release total lending and money supply figures for February by March 15th

-

CCTD weekly online briefing on Chinese coal, 15:00

-

China Nonferrous Metals Industry Association holds copper smelting enterprise symposium in Beijing

-

Mysteel hosts International Iron Ore Conference in Qingdao, Day 1

Thursday, March 14th:

Friday, March 15th:

-

China sets monthly medium-term lending rates, 09:20

-

New home prices in China in February, 09:30

-

China's weekly iron ore port stockpiles

-

Shanghai exchange weekly product inventory, ~15:30

-

Mysteel hosts International Iron Ore Conference in Qingdao, 3rd day

-

Revenue: CATL

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP