We've received mixed messages from the market recently. The S&P 500 ended April down 4%, its first monthly decline after five consecutive months of gains. However, May started with an uptick in trading, leading to a better-than-expected Q1 2024 earnings season.

Additionally, the Federal Reserve signaled that it intends to keep interest rates steady for “a longer period of time” while inflation remains stubborn. A rate cut by the end of this year is still considered possible, but it is likely to occur in the fourth quarter of this year.

As the situation unfolds, Savita Subramanian, head of U.S. equities and quantitative strategy at Bank of America, thinks there is reason for optimism. “I think reasonable market conditions, probably better growth going forward, higher interest rates, a little bit more inflation, we're headed for a soft landing,” he said.

Subramanian's outlook gives us a profit template. She is sticking to her S&P target of 5,400, or 5.5% up from current levels, by the end of the year.

Supporting her bullish view, Bank of America analysts are urging investors to seize opportunities by pointing to two specific stocks. After running both tickers through TipRanks' database, it's clear that the rest of the Street agrees, with each earning a “Strong Buy” consensus rating. Let's take a closer look.

KKR&Co. (KKR)

We enter the world of global finance and wealth management with KKR & Company. KKR is an investment and asset management firm that works with clients around the world to move third-party capital into capital markets. The firm makes capital resources available to corporate clients and assists them with debt and equity investments, public underwriting of new market transactions, and other financial transactions. KKR leverages long-term capital to build a healthy revenue base for its investors and shareholders.

There are also numbers that show the scale of KKR's business. As of March 31, the company had total assets under management of $578 billion, including approximately $183 billion in private equity investments, $260 billion in credit, $61 billion in infrastructure, and $71 billion in real estate. . Total assets under management increased 13% year-over-year, including $31 billion in new capital raised in the first quarter of his '24.

In the first quarter, KKR also reported strong earnings. The company's adjusted net income came in at $864 million, or $0.97 per share, and the EPS figure was 2 cents better than expected and up 20% year-over-year. In fee-related revenue, another important metric, KKR generated $669 million ($0.75 per share), an increase of 22% year over year.

The stock has been covered by Bank of America's Craig Siegenthaler, with the five-star analyst impressed with the company's overall position and future prospects. he writes, “We reiterate our buy rating as we are bullish on KKR's funding cycle, asymmetric income statement upside to recovery, and the potential for the S&P 500 index. Additionally, KKR's business is highly diversified with strong expansion opportunities in verticals (infrastructure, real estate, credit), a broadly positive investment track record, core competencies in product innovation, and a best-in-class private franchise in Asia. The model is the most aggressive in the group, which caused it to underperform the 2022 bear market EPS revision, but we believe this will lead to significant earnings growth acceleration as the market continues to recover. I believe.”

This Buy rating comes with a $134 price target and a one-year upside potential of 41%. (To see Siegenthaler's track record, click here)

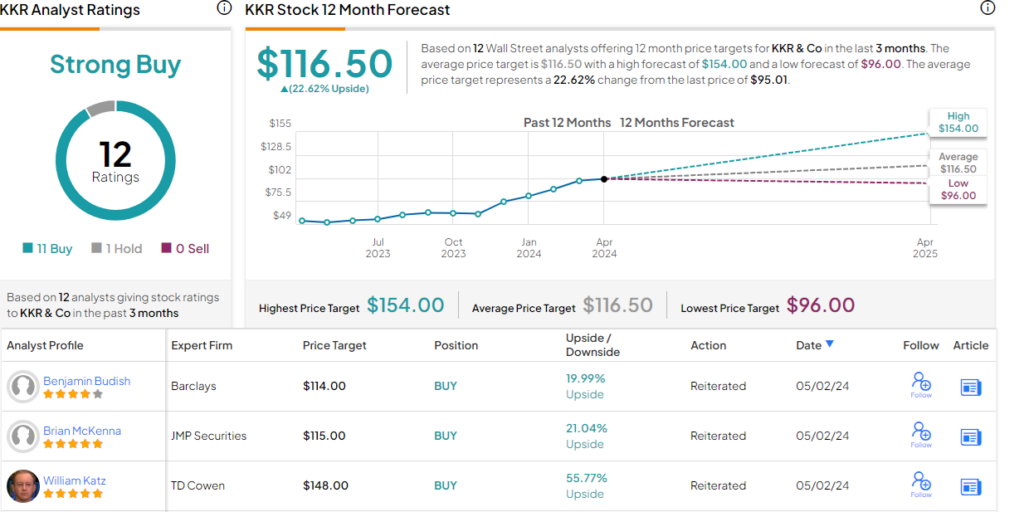

Bulls are strong on this stock, as evidenced by 12 analyst reviews, including 11 buys to 1 hold, supporting the bullish consensus rating. The stock is trading at $95.01, and the average price target of $116.50 suggests an upside of 22.5% over the next year. (look KKR stock price prediction)

avis budget group (car)

Moving from global finance to the car rental business, take a look at Avis Budget Group. This company is one of the world's largest car rental companies and operates throughout the world through multiple brands. Avis Budget's brands include its eponymous rental car subsidiary, as well as Payless Car Rental and Zipcar. Together, these activities form a network that operates in 180 countries. Avis Budget has more than 24,000 employees working at more than 10,000 locations. The company rents around 655,000 vehicles and during the 2023 calendar year he realized revenue of $12 billion.

Although the company has a strong position in the car rental industry, it has also faced some challenges this year. The used car market faces headwinds from oversupply and high interest rates. This hit Avis' budget recently when the company sold a record number of used cars.

The company's most recent quarterly results (Q1 2024) showed a 5% increase in rental days compared to the same period last year. This gave him $2.6 billion in quarterly sales, which he exceeded expectations by $80 million. In the end, Avis Budget's net EPS loss was $3.21, 33 cents per share lower than expected.

Despite the revenue loss, Bank of America's John Babcock remains optimistic about rental car companies, explaining why: The company has historically been one of the strongest and best-performing public rental car companies in the United States. We believe the stock trades at an attractive valuation and is at risk from rising fleet costs. Additionally, CAR expects its earnings to recover in 2025, supported by strong volume growth, relatively stable pricing, and productivity and efficiency initiatives. Additionally, it may gain share from HTZ, but HTZ may have challenges with its liquidity position. ”

Babcock's Buy rating on the stock is complemented by a $140 price target, suggesting 21% upside potential for the stock over the course of the year. (Click here to see Babcock's track record)

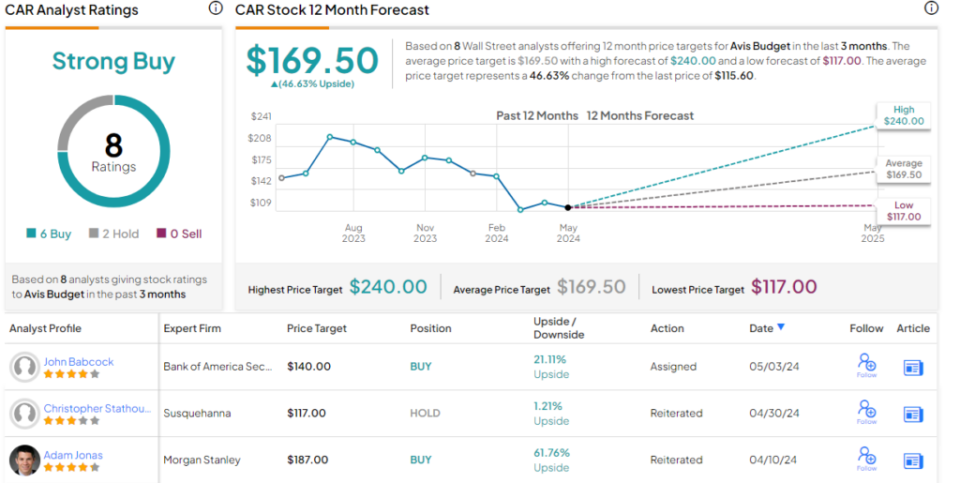

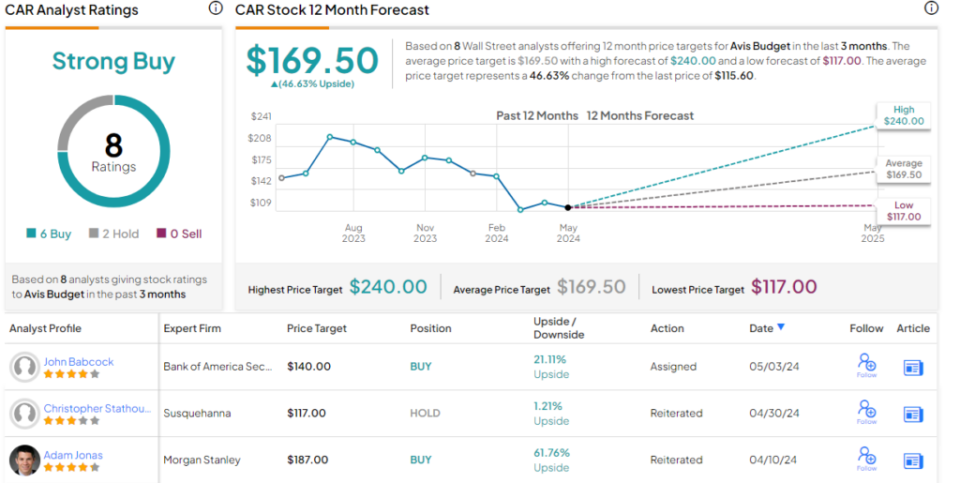

CAR stock has received 8 recent analyst reviews, with 6 rated it as a “buy” and 2 rated it as a “hold,” giving it a consensus rating of a “strong buy.” The average price target for the stock is $169.5, implying a 46.5% upside from the current price of $115.6. (look Automobile inventory forecast)

Visit TipRanks to find good ideas for trading stocks at attractive valuations. Best Stocks to Buy is a tool that unites all of TipRanks' stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.