Australian Embedded Finance Business and Investment Opportunity Market

DUBLIN, May 22, 2024 (Globe Newswire) — “Australian Embedded Finance Business and Investment Opportunities Data Book – 75+ KPIs for the Embedded Lending, Insurance, Payments and Wealth Sector – Updated Q1 2024” Report added. ResearchAndMarkets.com Recruitment.

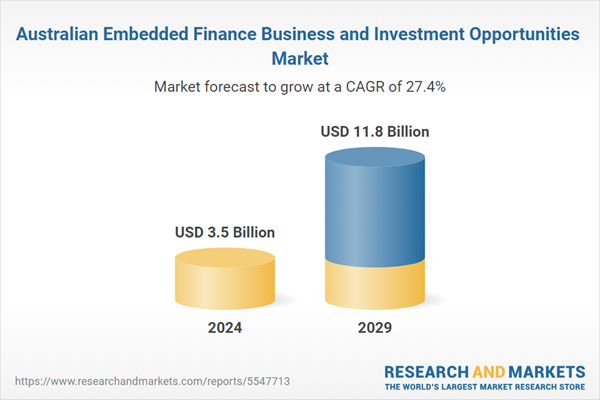

Australia's embedded finance industry is expected to grow by 37.7% on an annual basis to reach US$3.5 billion by 2024. The embedded finance industry is expected to grow steadily during the forecast period and register a CAGR of 27.4% from 2024 to 2029. The country's embedded finance revenue is expected to reach US$11.77 billion by 2029, up from US$3.5 billion in 2024.

The report offers a detailed data-centric analysis of the Embedded Finance industry covering market opportunities across lending, insurance, payments and asset-based finance sectors as well as risks across various sectors. The report includes 75+ KPIs at country level to provide a comprehensive understanding of Embedded Finance market dynamics, market size, and forecast.

Segments the market opportunity by type of business model, consumer segment, and distribution model. Additionally, it also provides detailed information across different segments of each sector of embedded finance. KPI Revenue provides a deep understanding of end market trends.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast Period |

2024-2029 |

|

Estimated market value in 2024 (USD) |

$3.5 billion |

|

Projected market value to 2029 (USD) |

$11.8 billion |

|

compound annual growth rate |

27.4% |

|

Target area |

Australia |

range

Embedded finance by major sector

-

retail

-

logistics

-

Telecommunications

-

manufacturing industry

-

Consumer Health

-

others

Embedded finance by business model

-

platform

-

patron

-

Regulatory body

Embedded finance with a decentralized model

-

unique platform

-

Third party platform

Australian Embedded Insurance Market Size and Forecast

Embedded Insurance by Industry

-

Insurance built into consumer products

-

Embedded Insurance in Travel and Hospitality

-

Insurance built into the car

-

Insurance integrated into medical care

-

Insurance built into real estate

-

Built-in insurance in transportation and logistics

-

Insurance embedded in others

Built-in insurance by consumer segment

Embedded Insurance by Offering Type

Built-in insurance by business model

-

platform

-

patron

-

Regulatory body

Built-in insurance by distribution model

-

unique platform

-

Third party platform

Embedded Insurance by Distribution Channel

-

embedded sales

-

bancassurance

-

Broker/IFA

-

tied agent

Built-in insurance by insurance type

Embedded insurance in the non-life insurance field

Australian Embedded Loan Market Size and Forecast

Embedded Financing by Consumer Segment

-

business loan

-

Personal Lending

Embedded financing by the B2B sector

-

Embedded Financing in Retail and Consumer Goods

-

Embedded financing in IT and software services

-

Embedded financing in media, entertainment and leisure

-

Embedded financing in manufacturing and distribution

-

Loans embedded in real estate

-

Other incorporated financing

Embedded financing with the B2C sector

-

Embedded financing in retail shopping

-

Built-in financing for home renovations

-

Embedded financing in the leisure and entertainment sector

-

Embedded financing in healthcare and wellness

-

Other built-in financing

Embedded Loans by Type

-

BNPL financing

-

POS financing

-

personal loan

Embedded financing by business model

-

platform

-

patron

-

Regulatory body

Embedded financing with distribution model

-

unique platform

-

Third party platform

Australian embedded payments market size and forecast

Embedded payments by consumer segment

Built-in payment by end-use department

-

Embedded payments in retail and consumer goods

-

Payments embedded in digital products and services

-

Payments embedded in utility bill payments

-

Embedded payments in travel and hospitality

-

Embedded payments in leisure and entertainment

-

Embedded payments in health and wellness

-

Payments built into office supplies and equipment

-

Other embedded payments

Built-in payments by business model

-

platform

-

patron

-

Regulatory body

Incorporating a decentralized payment model

-

Unique Platform

-

Third party platform

Australian Embedded Wealth Management Market Size and Forecast

Australian asset-based financial management industry market size and forecast

Asset-based finance by asset type

Asset-based finance by end users

For more information on this report, please visit https://www.researchandmarkets.com/r/fb1526.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900