(Bloomberg) — Asian stock markets fell after disappointing forecasts from Meta Platforms, raising concerns that the industry that has driven the bull market in stocks has gone too far.

Most Read Articles on Bloomberg

Stock indexes in Japan and South Korea fell, and futures in Hong Kong also fell. Australian financial markets are closed for the public holiday. The yen is trading in a narrow range after falling above 155 yen to the dollar for the first time in more than 30 years on Wednesday, raising the possibility of intervention.

A $250 billion exchange-traded fund (ETF) tracking the Nasdaq 100 took a hit after the close of regular U.S. trading as Facebook's parent company fell more than 15%. Meta expects second-quarter sales to be lower than analysts expected and raised its full-year spending forecast.

“Meta's resources are vast, but they are not infinite,” said Hargreaves Lansdown analyst Sophie Land-Yates. She said: “The language around spending plans is getting bolder again and this could be spooking the market.”

Heading into earnings, the S&P 500 index struggles to gain momentum as traders position themselves for economic indicators that will help them form a view on the Federal Reserve's next steps. It remained around 5,070. US Treasuries opened little changed in Asia after yields rose on Wednesday.

In Japan, the yen fell to 155.37 yen to the dollar on Wednesday, breaking above the 155 yen level for the first time since June 1990. Traders will be wary of comments from Tokyo officials on Thursday suggesting growing readiness for intervention.

Japan Airlines CEO Mitsuko Tottori said in a group interview that Japan's weak currency is a “big problem,” adding that a higher exchange rate would be better than the current rate of around 155 yen to the dollar. Ta.

South Korea's SK Hynix said it expected the memory market to fully recover after AI demand helped semiconductor makers' profits expand at the fastest pace since at least 2010.

In other regions, there was a risk-off trend across the market in response to the decline in US inventories, and crude oil prices declined only slightly. Gold remained largely unchanged.

Revenue development

Facebook's parent company reported first-quarter revenue of $36.5 billion, an increase of more than 27% compared to the same period last year. That was a slight beat from analysts, who had expected an average of $36.1 billion in sales, according to estimates compiled by Bloomberg. Profits more than doubled to $12.4 billion.

“We advise investors to focus on the positives,” said Tejas Desai of GlobalX ETF. “The company's fundamentals continue to show strength, and that's the key story.”

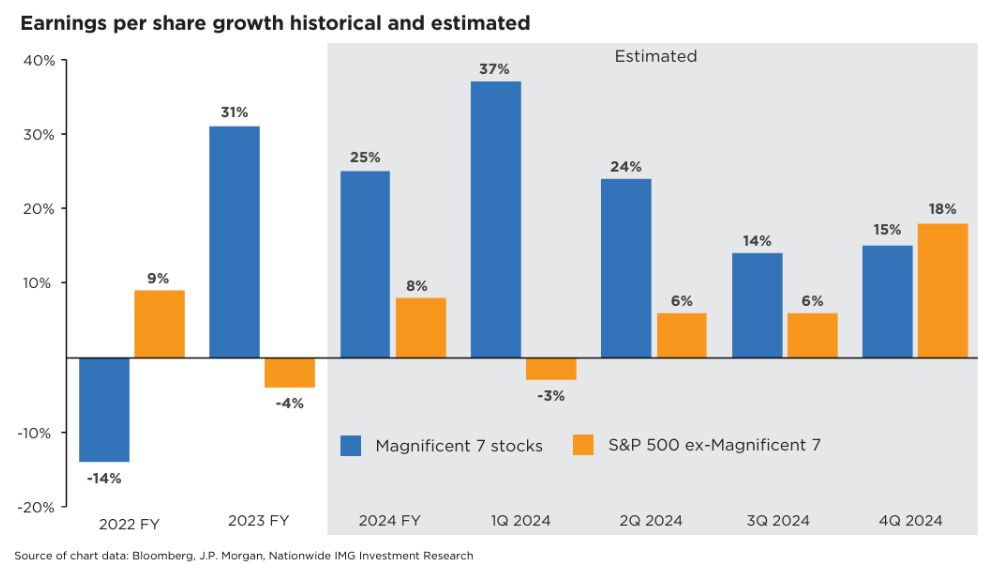

Nationwide's Mark Hackett explains that the seven tech megacaps have performed well over the past two years due to superior profit growth relative to the broader market, but this advantage will diminish in 2024. By 2025, it is likely to decline even further.

“The Magnificent Seven are not as powerful as they once were,” Hackett said. “We see this as a positive development for investors looking to diversify from recent market leaders.”

Traders have been scaling back the number of rate cuts they expect from the Fed in recent weeks following a series of solid economic data. Economists surveyed by Bloomberg said gross domestic product (GDP) is likely to fall to around 2.5% in the first quarter, a figure that still potentially signals continued inflationary pressures. I predict that.

“Tomorrow's all-important GDP report comes as market participants look forward to soft numbers that will lead to a rate cut sooner rather than later,” said Jose Torres of Interactive Brokers. “We expect higher-than-expected numbers, which is great for the outlook for revenue growth but negative for the timing and extent of rate cuts.”

This week's main events:

-

US GDP, wholesale inventories, new unemployment claims, Thursday

-

Microsoft, Alphabet, Airbus earnings Thursday

-

Japanese interest rate decision, Tokyo CPI, inflation and GDP forecast, Friday

-

US Personal Income and Expenditures, PCE Deflator, University of Michigan Consumer Sentiment, Friday

-

ExxonMobil, Chevron earnings, Friday

The main movements in the market are:

stock

-

S&P 500 futures were down 0.6% as of 9:09 a.m. Tokyo time.

-

Hang Seng futures fell 0.4%.

-

S&P/ASX 200 futures down 0.8%

-

Japan's TOPIX fell 0.8%

-

Euro Stoxx50 futures fall 0.5%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0704.

-

The Japanese yen remained almost unchanged at 155.26 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2711 yuan to the dollar.

cryptocurrency

-

Bitcoin rose 0.4% to $64,329.07

-

Ether rose 0.5% to $3,144.18

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP