- A Midwestern couple has an income of $200,000 but is in debt due to “abnormal lifestyle habits.''

- The couple lives paycheck to paycheck with a mortgage and personal debt.

- This situation is common among high-income earners who spend a lot of money.

A Midwestern couple has nearly $800,000 in debt, even though both of them work, own rental properties to earn extra income, and live in a relatively inexpensive Midwestern city.

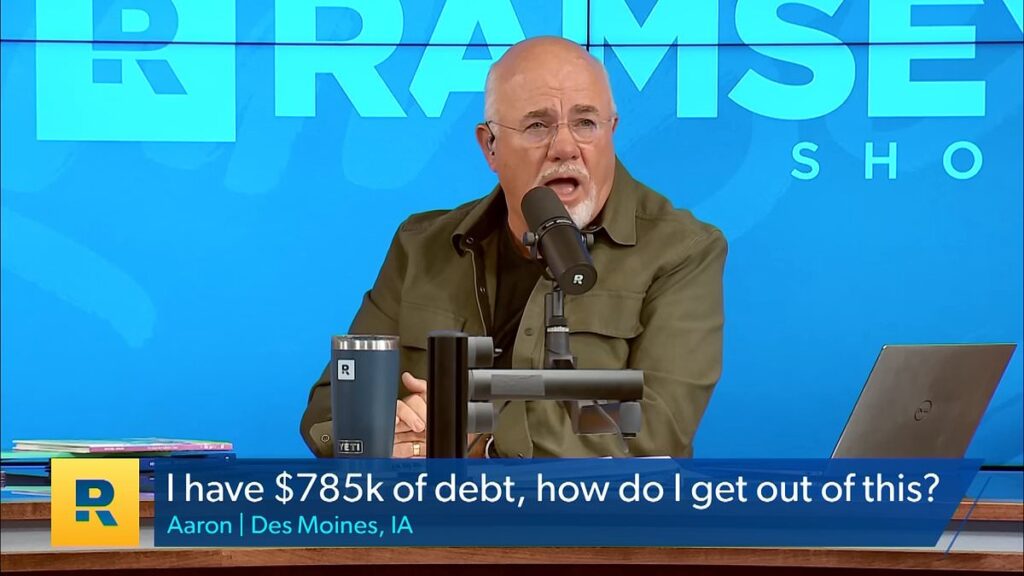

The couple, who live in Des Moines, Iowa, are experiencing what financial advisor Dave Ramsey calls “lifestyle creep,” a phenomenon in which consumers increase their expenses as quickly as or faster than their income. ing.

Despite earning a base salary of $175,000 and earning an additional $20,000 from rental properties, the couple found themselves living just beyond their paychecks, racking up massive debts worth $785,000. .

Husband Aaron plans to sell the couple's $325,000 worth of rental property to alleviate debt, but wife doesn't believe in emotional connection and living debt-free. I am hesitant to sell it for this reason.

Such scenarios are common among high-income earners, with nearly half of all six-figure earners living paycheck to paycheck.

The median household income in the U.S. in 2022 was $74,580, according to the latest census data.

Aaron's salary of $175,000, combined with his passive income from rental properties, would put him in the top 20 percent of earners in the United States.

But Ramsey diagnosed Aaron's “lifestyle abnormalities” as the main reason for his increased spending. Here, an increase in income also leads to a corresponding increase in expenditure.

“In less than a year, my salary doubled and it got a little crazy,” Aaron told Ramsey on the podcast.

The couple is deeply in debt, with a $450,000 mortgage balance on their home and an additional $192,000 on their investment home.

On top of that, the couple has personal loans, car loans, student loans, and credit card debt.

Rising interest rates are making debt more difficult to deal with.

“You guys are truly bankrupt!” Ramsay declared after analyzing the couple's situation. “It would be horrible to earn $200,000 and spend it like you were in Congress and starve to death.

“There's a pretty serious level of denial going on at home,” Ramsay said frankly. “I think I’m more upset about this than you are.

“I think we both need to understand that we can't live like this. It's ridiculous. We're pulling back as hard as we can,” Ramsey said.

Ramsey says couples urgently need to get their spending under control, sell rental properties and overcome psychological barriers to financial freedom.

The $325,000 sale proceeds are enough to cover your outstanding debt and allow you to focus on your mortgage.

Ramsey and co-host Jade Warshaw note that while many Americans overspend to keep up appearances, stopping trying to impress others can improve your financial well-being. emphasized that it will improve.

“Not caring what people think is a superpower,” Ramsey said, believing that ignoring other people's opinions is a “superpower” that can significantly improve fiscal health. ing.