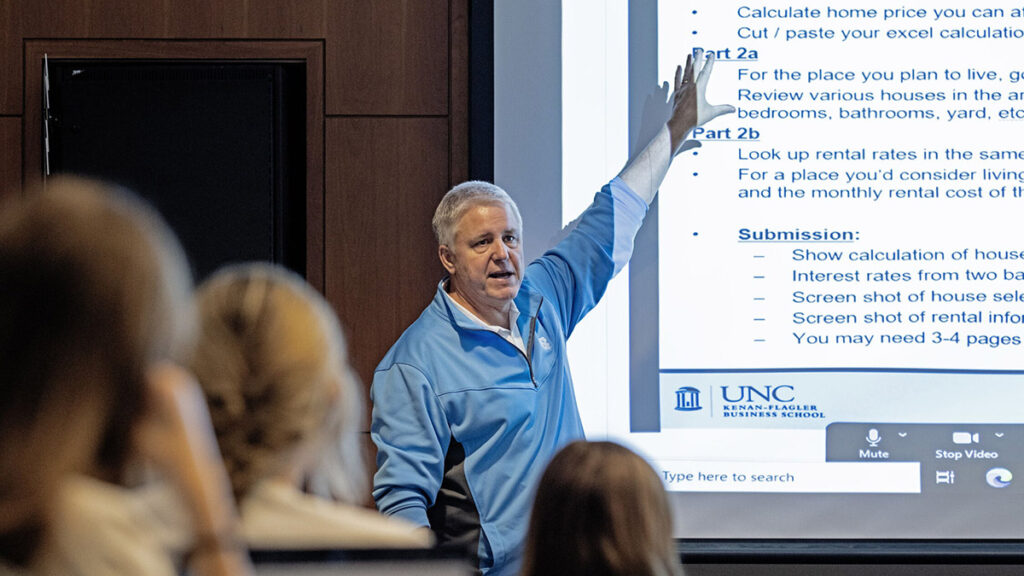

Chip Snively has taught finance courses to undergraduate business majors and MBA students since joining the UNC Kenan-Flagler Business School in 2011.

Snively says the transition from business to academia was the best decision he could have made, and he sees his job as helping students realize their highest potential.

Now, UNC Kenan-Flagler is sharing her expertise and passion for education with even more students. Mr. Snively is teaching a new personal finance class aimed at non-business majors.

“Business is like English, and all students need to learn about it,” says Dean Mary Margaret Frank. She changed her major from art history to business at Carolina because she thought she needed a foundation in business to realize her dream of starting an art gallery. She says, “No matter what field you're going into, business impacts your life, your work, and your community.”

The personal finance class was born out of parents' desire for Carolina to foster financial literacy in its students and the university's search for ways to increase the social mobility of first-generation college students, faculty said. said Abigail Panter, senior associate dean for education.

“There's nothing better than a solid course with a syllabus and formal education that makes sure all the pieces are in place,” Panter says. “I can't compete with a course like this.”

Dr. Perrin Jones, an anesthesiologist and University Board member, also strongly supported the development of the personal finance course.

“My idea was that it would be good for students to know how to manage their money as early as possible to minimize the debt they have when they graduate. “It could affect whether students take out loans or get a job while in school,” he says.

create a personal financial plan

Snively already taught a personal finance class for business students, so he was a natural choice for the new class. He spent his six months designing the course, thinking about how he could offer one of the most practical courses students would ever take.

Students learn about saving, investing, and budgeting. The final project involves creating her five-year financial plan, which requires each student to think about life after undergrad. They decide where to work and live, what income and other sources of income they have, and what kind of lifestyle they expect. To complete the final project, the student will set her five financial goals and consider budgets and projections, risks and concerns.

Snively takes a pragmatic approach to personal finance.

“I'm not going to walk out of here and be Warren Buffett,” he tells his students. “But I want you to be intellectually curious about these things. Whether you major in Russian history, economics, journalism, or chemistry, all of this is here. It's important for you when you leave. In fact, it's relevant now.”

For the first time, he taught three sections of 45 students each in the fall and spring semesters. By the end of the year, he had taught about 270 students. The course offering will expand to include around 650 students this year and 1,200 next year, with the possibility of including options for university staff.

Ideally, Panter said, the plan is for all Carolina students to take electives and tie them into general education courses. Emails from students say they are grateful for what they are learning and expect to use the lessons forever. Parents are also very happy.

“It's a gift to the university to have an outstanding professor like Chip with decades of experience teaching our students,” Panter said. “This course is a special pearl.”

Learn more about our personal finance classes.