Nvidia (NASDAQ:NVDA) has been one of the world's best performing stocks over the past 18 months. The chipmaker's stock price has risen nearly sevenfold over the period. This abnormal growth can certainly turn off some investors and lead them to believe that it is overvalued. However, it's worth remembering that momentum can actually be one of the best indicators of future stock performance, especially if a company has a track record of outperforming expectations.

Personally, I remain bullish on NVDA stock. That's not just because of its momentum, but because the company is at the heart of his AI revolution, which is still in its infancy.

AI Kingpin

As a company, Nvidia is at the center of the AI revolution, with graphics processing units (GPUs) that have the capabilities needed for big AI and large language models. Although these units were originally built for the gaming sector, GPUs are also ideal for AI's large-scale data processing needs.

Unlike central processing units (CPUs), which process tasks one at a time, GPUs excel at parallel processing and can perform multiple tasks at the same time. Without this technology, the advances we have seen in AI, such as the development of facial recognition technology and self-driving cars, would not be possible.

Nvidia's advantage comes from its GPU architecture. Unlike CPUs with a small number of cores, Nvidia packs a huge number of cores into a single chip. This allows for higher processing power within a smaller space, which is critical for efficient AI processing. Additionally, Nvidia is focusing on high-bandwidth memory, which allows these cores to access data quickly, making AI calculations even faster. So Nvidia has gained a huge advantage in his AI hardware race.

However, in the world of AI, it's not just about the hardware. Nvidia's CUDA software provides direct access to the GPU's virtual instructions. This software ecosystem allows developers to build and improve their AI projects, making Nvidia a one-stop shop for all things AI.

Isn't Nvidia really expensive?

Nvidia stock is expensive in that it's out of reach for many investors. Trading at around $900 per share, some investors may have a hard time buying his share of Nvidia stock as part of a diversified portfolio of holdings. However, from a valuation perspective, I don't think Nvidia stock is overvalued or overvalued. In fact, it could still represent good value.

Nvidia currently trades at 35.4 times forward earnings, making it more expensive than the S&P 500 (SPX), but not too expensive for the tech industry. Moreover, the company is expected to continue its impressive growth over the medium term. In fact, Nvidia's revenue is expected to grow 34.78% annually over the medium term.

This means that Nvidia's all-important PEG ratio is 1.02. While 1.0 may be considered a fair value benchmark, I believe it represents good value given the long-term trends in the AI industry and the market's bullishness towards US technology.

This means Nvidia's 2026 revenue is 29.77x, 2027 revenue is 25.26x, and 2028 revenue is 21.49x. Additionally, it's worth noting that Nvidia continues to outperform analysts' most bullish forecasts. That's always a good sign and will likely continue to exceed expectations.

Is NVDA stock a buy, according to analysts?

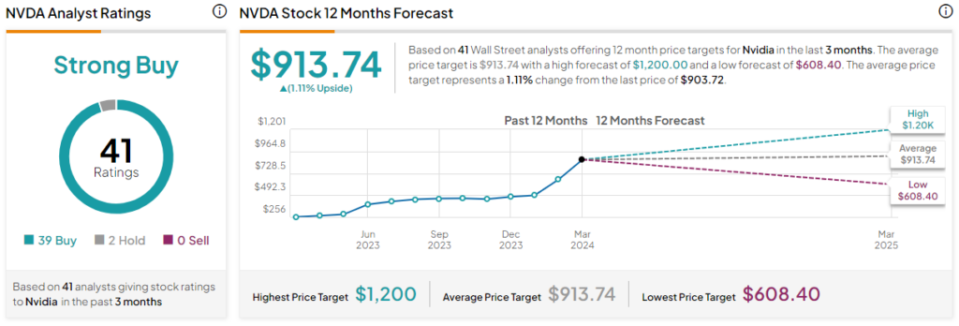

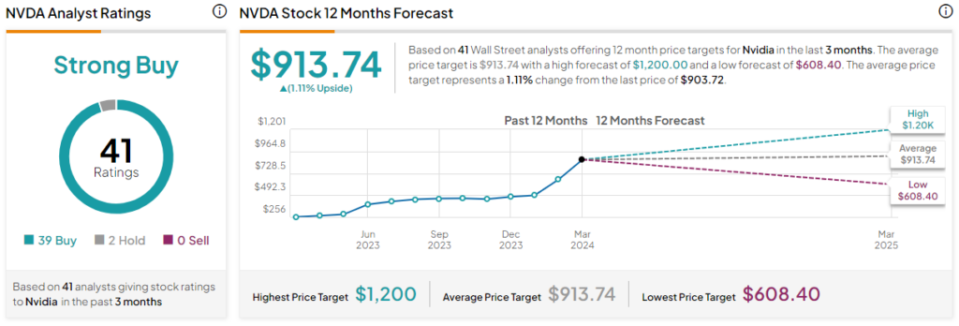

NVIDIA stock is highly valued by analysts due to its potential position in the AI revolution and attractive valuation metrics. Nvidia currently has 39 buy ratings, 2 hold ratings, and 0 sell ratings. The average price target for Nvidia stock is $913.74, implying an upside potential of 1.1%. The highest price target is $1,200, and the lowest price target is $608.40.

conclusion

Nvidia has been at the center of the AI revolution, but there are two important things to consider going forward. It's his Nvidia's competitive advantage in the most important generative AI market and the fact that the AI revolution is only just beginning.

Over the past 18 months, Nvidia has built a formidable moat and thrived on it. Other companies, including Intel (NASDAQ:INTC), is eyeing Nvidia's crown, but it's unclear how it will catch up. The Santa Clara-based company's new H200 chipset is essential for generative AI and large-scale language models. When it comes to inferring large language models, H200 is believed to be 1.4 to 1.9 times faster than his H100. This is an amazing leap in just one year.

Moreover, the market is growing and is likely to grow even faster. Softbank (OTC:SFTBY) Masayoshi Son is considering a $100 billion venture in the AI chip space, and OpenAI's Sam Altman is investing $7 trillion in a series of AI chip factories to meet surging demand and reshape the global semiconductor sector. They are reportedly seeking dollars.

I remain bullish on Nvidia given the near-term momentum in the space, the fact that GPU demand still outstrips supply, and the fact that we're at the very beginning of the AI revolution.

disclosure