Goodboy Picture Company/E+ (via Getty Images)

So far in 2024, investors have re-adopted long-term thinking and invested heavily in tech stocks with a wide future. AI, especially Nvidia (NVDA), is one of the companies most affected by this. Long-term thinking, these are not the only areas where there is room for expansion.

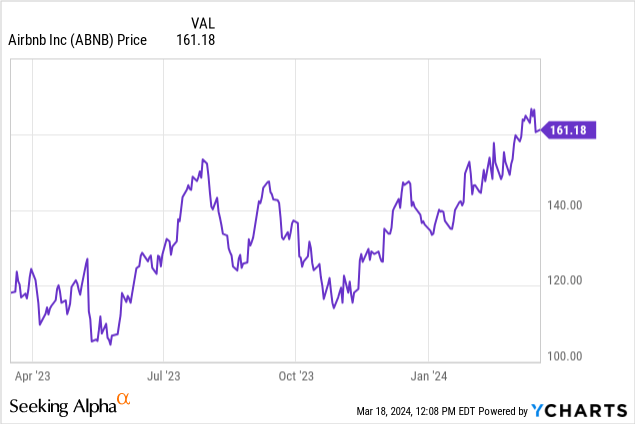

Look no further than Airbnb (NASDAQ:ABNB) for another long term purchase with great potential. The travel platform's stock is already up as much as 20% year-to-date, with gains accelerating after its mid-February earnings release. Nevertheless, I continue to think Airbnb will enjoy further upside towards the end of the year.

Continuous platform improvements help drive long-term growth

The last time I wrote a bullish opinion on Airbnb was in December, when the stock was trading near $140 per share.Received meaningful benefits Since then I have remained bullish I'm happy with this stock and very happy to hold it in hopes of further upside.

In the few years since its introduction, Airbnb has gone from being a disruptor to a true mainstream in the travel industry. The world seems to have adapted to Airbnb peacefully coexisting with hotels. The latter focuses on luxury, service, and amenities, while Airbnb caters more to authentic, neighborhood-oriented, and budget-conscious travelers.

At the same time, Airbnb continues to fine-tune its platform in response to user feedback. For example, many in the traveler community were fed up with the exorbitant cleaning fees on the Airbnb platform. The Airbnb platform was used by many hosts as an invisible pricing vehicle. Airbnb has since introduced a “total price” option that shows prices after taxes, which many users appreciate.

The company has also made it easier for hosts to do business. The company has introduced a “similar properties” tool that allows hosts to compare their home to other properties in the area and set the right price. This has improved pricing efficiency on the Airbnb platform, benefiting both hosts and customers.

And while it's not a lever currently under consideration, I would argue that Airbnb still has room to experiment with its own pricing. The company currently earns 17% of its total bookings (3% from hosts and 14% from guests). Although relatively high, given that there are no true competitors with the scale and brand recognition that Airbnb has, perhaps the company is looking to increase its take rate without significantly alienating much of its customer base. You could push it by a few percentage points.

Here are some long-term reasons to be bullish on Airbnb.

- Airbnb's ever-expanding portfolio of services is much more than just a lodging platform. Airbnb continues to drive innovation and further monetization opportunities. Examples of these include “Experiences” (offering local activities with local guides) and “Airbnb Rooms”, which offer rooms in low-cost housing in line with the company's original Couchsurfing ethos.

-

Longer stays increase the share of both travel and rental expenditures. With so many companies announcing permanent remote or hybrid working arrangements, many workers are becoming digital nomads and jumping at the chance to work from anywhere. Airbnb is seeing an increase in bookings for long-term stays of 28 days or more. This trend could lead to Airbnb essentially capturing “rental” budgets from digital nomads as well as travel demand. As a result of this trend, average travel distance has increased significantly.

-

Travel demand remains strong post-COVID-19. Travelers are still making up for vacations lost after the pandemic, and while consumers appear to be spending less in many categories, their appetite for spending on experiences remains undiminished.

-

Opportunities to compete with large OTAs in providing new listing platforms for hotels. Hotels have always been under pressure from Expedia (EXPE) and Booking (BKNG), which charge high prices despite being a necessary marketing tool. Airbnb already allows boutique hotels to list on its platform for a fee. Over time, Airbnb could compete in this more minor part of the business and take more share from OTAs.

-

We keep profitability in mind. Immediately after the pandemic, Airbnb laid off about 20% of its staff. While it continues to hire, this profit-driven mindset and the fact that Airbnb is structurally leaner than it was before the pandemic has helped the company achieve significant revenue growth.

Stay here longer: Airbnb's fourth-quarter results demonstrate the resilience of the company's growth trajectory, and it remains a strong buy through the remainder of 2024.

Q4 downloads

Let's take a closer look at Airbnb's latest quarterly results. A summary of earnings for the fourth quarter is as follows.

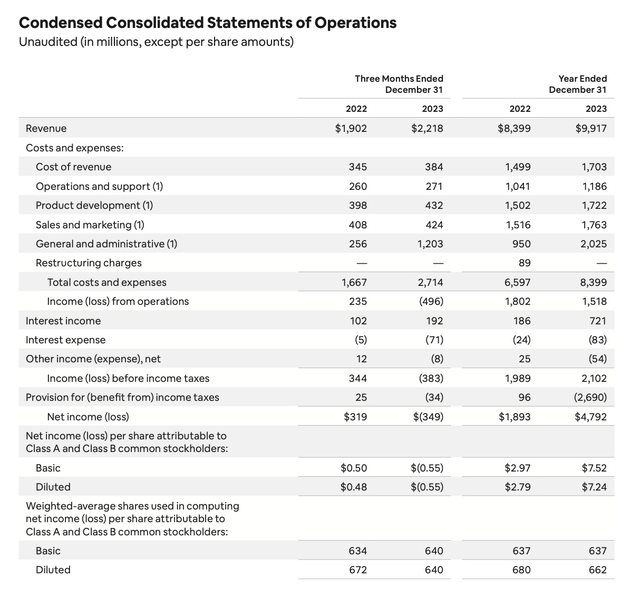

Airbnb Q4 Results (Airbnb Q4 Shareholder Letter)

Airbnb's revenue rose 17% year over year to $2.22 billion, well above Wall Street's forecast of $2.16 billion (up 13% year over year). Note that Airbnb is benefiting from a stronger dollar, so on a constant currency basis, Airbnb's revenue is down 14% year over year.

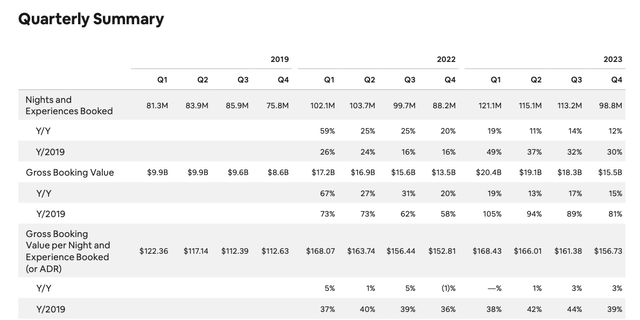

Room reservations increased 12% year-over-year and continue to grow 30% compared to the pre-pandemic quarter. At the same time, his ADR, or average daily rate, continued to rise, hitting a fourth-quarter record of $156.73 for the company.

Airbnb Trend Indicators (Airbnb Q4 Shareholder Letter)

Regarding regional trends, Airbnb made an important note that travel to and from Asia continues to recover. Stays and experiences booked in Asia increased 22% year-over-year in the fourth quarter. At the same time, China's economic recovery has seen an increase in Airbnb bookings from the world's most populous country. 90% compared to the previous year.

Latin America also continues to be a growth star, with bookings up 22% year-on-year. The company is also seeing an increase in travelers from the region, with bookings from Chile, Peru and Ecuador more than doubling compared to before the pandemic.

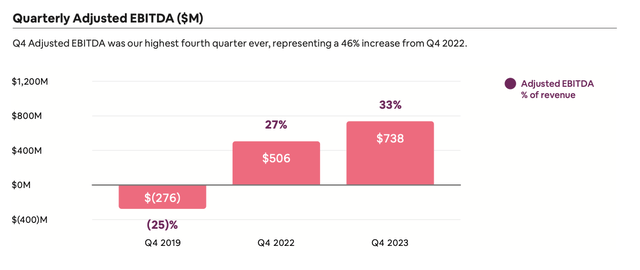

We also like the fact that Airbnb continues to drive significant revenue growth.Adjusted EBITDA soared $738 million, an increase of 46% from the previous year; That's an impressive margin of 33%.

Airbnb Adjusted EBITDA (Airbnb Q4 Shareholder Letter)

Risks and key points

Of course, Airbnb is not without risks. The main risk is dancing with ever-evolving local regulations. However, we are reassured by the fact that Airbnb states that no city accounts for more than 2% of total bookings.

Overall, I continue to see strong tailwinds for the company. We are counting on the 2024 Paris Olympics as another major growth driver (the Olympics always puts pressure on hotel availability, and Airbnb's influx of supply is the perfect sponge for this demand) ) and we look forward to continued profit growth. Please linger here.