Travel+Leisure Co. (NYSE:TNL), one of the world's leading vacation companies serving a network of approximately 230 vacation ownership resorts serving more than 2 million members, announced in its recent SEC filings: reported an insider sale. George Herrera, a Director of the company, sold 2,969 shares of the company's stock on March 15, 2024. The transactions were executed at an average price of $45.33 per share, for total sales of $134,564.77.

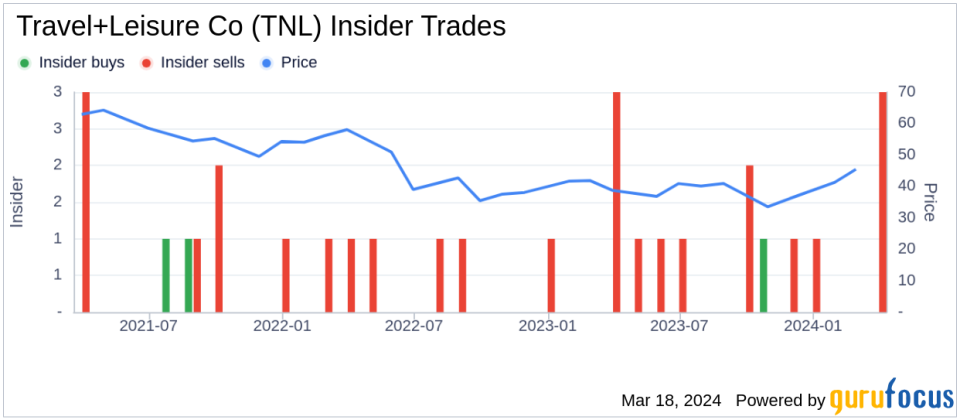

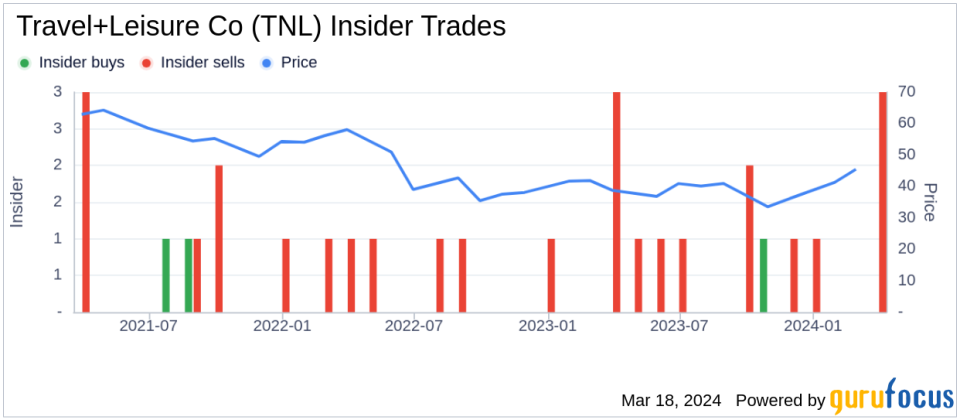

Insider trading history over the past year shows that George Herrera sold a total of 5,686 shares and did not buy any company stock. This latest transaction continues Travel + Leisure Co's trend of insider sales, with a total of 10 insider sales and his only 1 insider purchase over the past year.

On the day of the sale, Travel & Leisure's stock was trading at $45.33, giving the company a market capitalization of $3.275 billion. The price-to-earnings ratio of 8.67 is lower than the industry median of 21.09, but is higher than the company's historical median price-to-earnings ratio.

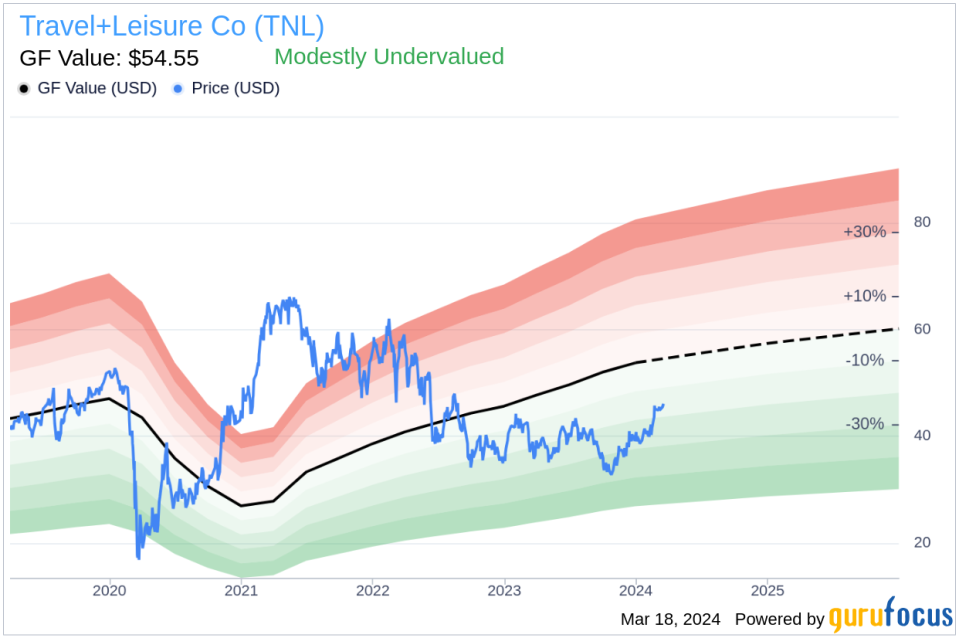

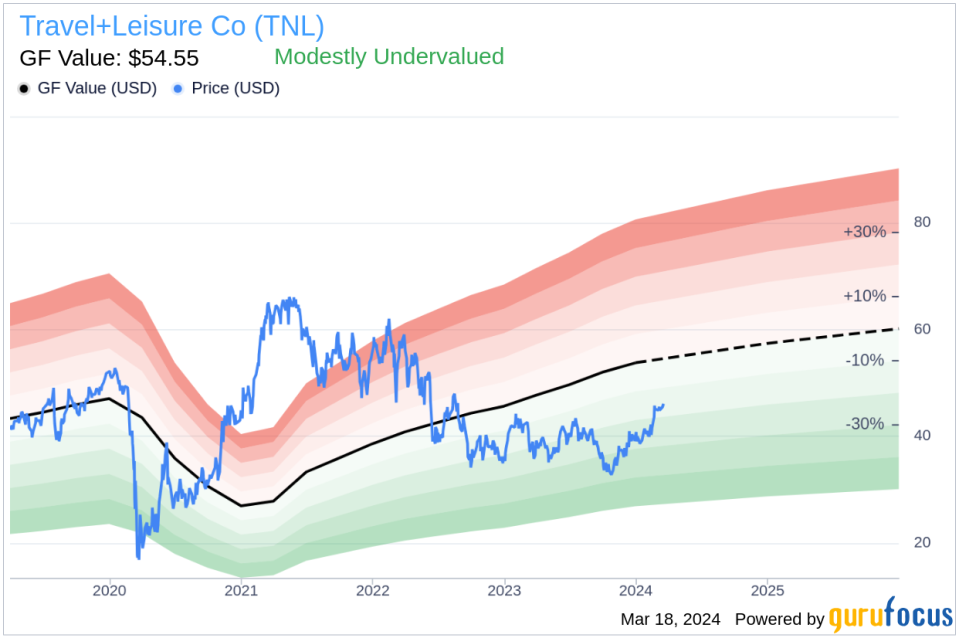

According to GuruFocus Value chart, with a stock price of $45.33 and a GF value of $54.55, Travel+Leisure Co's price to GF value ratio is 0.83, which suggests it is moderately undervalued. GF Value is an estimate of intrinsic value that takes into account historical trading multiples, GuruFocus adjustment factors based on past earnings and growth, and Morningstar analyst forecasts of future performance.

The insider trends image above reflects recent insider trading activity at Travel+Leisure Co.

The GF Value image above is a visual representation of a stock's valuation relative to its intrinsic value.

For more information on Travel+Leisure Co's insider transactions, interested parties should refer to its SEC filings.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.