n.bataev

Introduction and investment thesis

CrowdStrike (NASDAQ:CRWD) has been enjoying a dominant position in the IT security space for many years and seems to cement this position recently. The company’s one-stop-shop Falcon platform resonates well with customers, which combined with its emerging product line forms a unique sales proposition.

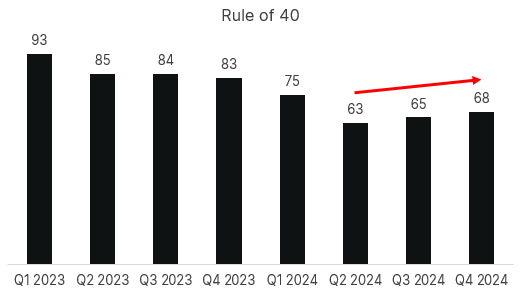

Last time I’ve covered the company after its FY24 Q3 earnings release back in December (CrowdStrike: Rule of 65 and counting), where I pointed out that an important fundamental turnaround has been realized. The company managed to grow its Rule of 40 metric (ARR growth + FCF margin) for the first time in the past two years driven by a significant increase in its Free Cash Flow margin. I’ve argued that this could be just the beginning and the improvement in this metric should continue. I based my thesis on the assumption that the company’s FCF margin could expand further, which could be coupled by topline growth reacceleration driven by strong performance of emerging products and the increasing number of consolidation deals.

Based on the most recent FY24 Q4 earnings print and the accompanying earnings call these forces seem to be still motion, which resulted in the Rule of 40 metric climbing further to 68:

Created by author based on company fundamentals

In the light of this trend and the surprisingly strong deal pipeline the company reported, I believe that the immediate post-earnings optimism has been warranted. I think that the consolidation that followed provides a good entry opportunity at current valuation levels.

Fears of IT security spending fatigue misinterpreted

After the surprisingly conservative financial outlook from CRWD competitor Palo Alto Networks (PANW) in February, IT security stocks began to fall in sympathy. PANW management talked about spending fatigue among its customers, which was in stark contrast to the general belief that IT security spending will continue to increase over 2024 amid a worsening threat landscape. The FY24 Q4 earnings release of CrowdStrike defied the last doubts that PANW’s problems are not company specific.

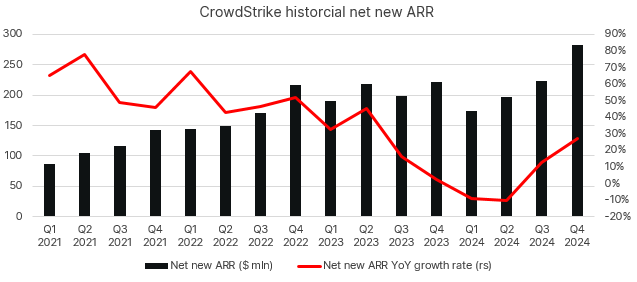

Net new ARR reached a record of $282 million equaling 27% growth yoy. This has been the second consecutive quarter of net new ARR growth reacceleration, meaning new business at CrowdStrike has picked up substantially:

Created by author based on company fundamentals

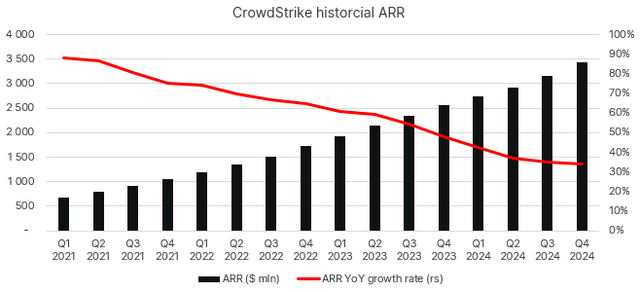

This resulted in total ARR of $3.435 billion in FY24 Q4, a yoy growth of 34.2%. This has been only slightly shy from 34.9% in the previous quarter, showing that investors can possibly witness a topline growth turnaround soon:

Created by author based on company fundamentals

After several quarters of gradually slowing topline growth a possible reacceleration could prove significant fundamental strength, especially at such a scale and such a high nominal sales growth rate. The main reasons I believe this could be possible are the following:

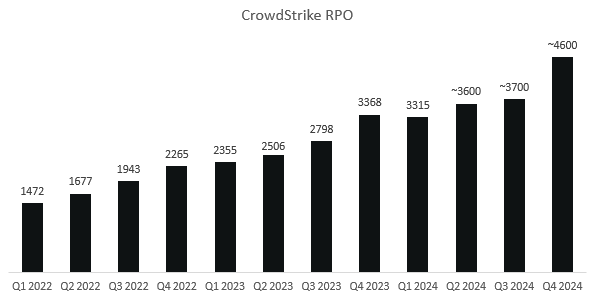

Although management didn’t expect the usual year end budget flush at the end of FY24 it happened anyway. Remaining performance obligations (RPO) jumped to $4.6 billion making up ~150% of total FY24 revenue. According to CRWD’s 10-K filing 60% of these obligations are expected to be realized in the upcoming 12 months, so approximately $2.8 billion of sales are already secured for FY25, leaving ample room for continued growth. Looking at the RPO chart shows that CrowdStrike finished FY24 on an exceptionally strong note, even if numbers for the past three quarters are only provided as rounded numbers:

Created by author based on company fundamentals

The qoq increase in RPO in Q4 could have been somewhere around 24%, significantly stronger than over the previous years. I believe this confirms management’s narrative on platform consolidation, which topic has been highlighted repeatedly on recent earnings calls. George Kurtz, President and CEO listed several examples of competitive takeouts, with Microsoft (MSFT), Palo Alto Networks and Splunk (SPLK) being the main share donors. Meanwhile win rates experienced an uptick over the quarter, showing that CrowdStrike also successfully competes against non-legacy players.

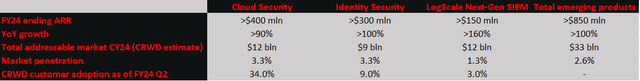

Looking at the product front CrowdStrike’s emerging product line continues to excel. The three key solutions in this segment are Cloud Security, Identity Security, and the company’s LogScale Next-Gen SIEM solution. The FY24 ending ARR of these products reached more than $850 million, growing north of 100% yoy making up ~25% of total ARR. Looking at the market penetration of these products based on CRWD estimates there is ample room for them to continue their impressive growth:

Created by author based on Q4 earnings presentation and FY24 Investor Day presentation

The total market penetration of these solutions is only in the low single digits, while the penetration among existing customers is also very low, especially in the case of Identity Security and LogScale Next-Gen SIEM. The TAM of these emerging products makes up ~$33 billion for CY24 and has the potential to double for CY28. Based on this these products should be an important driver of topline growth over the upcoming years.

It has been welcoming news that together with the Q4 earnings release CRWD announced the acquisition of Flow Security, a start-up founded in 2021 exceling in data loss prevention. This could be an important step in adding a fourth strong pillar to the emerging product line, which CrowdStrike estimates to reach a TAM of $4 billion in CY24 only to double for CY28.

Beside emerging products, the core security offering (endpoint security, security & IT ops, managed services) of the company had also a great quarter, which can be evidenced by the record number of deals with 8 or more modules more than doubling yoy. This underlines the consolidation narrative on CrowdStrike’s Falcon platform, which seems to be a general trend in IT security. Based on the trends I’ve described above CRWD is clearly a major beneficiary of this trend.

Finally, two important developments on the product front have been the general availability of Falcon for IT and Charlotte AI. Falcon for IT represents CrowdStrike’s recent push into IT infrastructure management leveraging its existing technologies. This is an important step for the company to go beyond cybersecurity and diversifying its revenue streams. Based on management comments from the Q4 earnings call customer excitement is great around the product, so it’s another important data point to look out for over 2024.

Regarding Charlotte AI management shared that 80% of the beta users believe that the solution could increase their efficiency with the platform to a great extent. Coming now into general availability I believe this should be another important new revenue stream over the upcoming years.

Based on the above I believe CrowdStrike has a compelling fundamental setup for the upcoming years, and topline growth reacceleration could be already on the corner. I think fears of pricing pressures for CRWD are overblown as the company competes with quality and not with cheap bundles. This means that CRWD tries to educate its potential and existing customers that the price they pay for their cybersecurity contract isn’t what matters at the end, it’s the total cost of operating it. A frictionless, automated, single cybersecurity platform of top-quality needs significantly less IT staff to operate it, not to mention potential breaches, which usually cost millions of dollars for a larger company. This is where CrowdStrike excels.

Taking a quick look at margins the company’s gross margin continued to expand further from already impressive levels. Total gross margin reached 78% almost a 3%-point increase from a year ago driven by stable pricing and increasing cost efficiencies in data centers. This helped pushing non-GAAP operating margin to a record level of 25%. FCF generation also hit a record with $282 million in the Q4 quarter representing an FCF margin of 33% when measured against revenues. The impressive numbers prompted management to raise its FCF margin target by 1%-point for FY25 to 31%-33%, which is quite close to the company’s longer term 34%-38% target model.

Based on these trends I believe the company’s Rule of 40 metric has more room to expand and could surpass the 70-mark again in a few quarters. With this, I believe CrowdStrike remains the SaaS company with one of the best (if not the best) fundamentals making its stock a mandatory element in a high growth tech portfolio.

Valuation and risk factors

Of course, the stock shouldn’t be bought at all costs, but after assessing the company’s forward Price/Sales multiple against its current growth prospects I see no compelling reason why investors shouldn’t buy the stock now. Currently, shares trade at a forward P/S ratio of 20, which could look rich for the first sight. However, if we consider that CRWD maintains its current topline growth rate of ~35% for the upcoming 3 years the ratio would drop to ~8 within 3 years assuming constant share price and no dilution, which is of course only theoretical. This shows that until growth prospects continue to look strong a premium valuation is warranted.

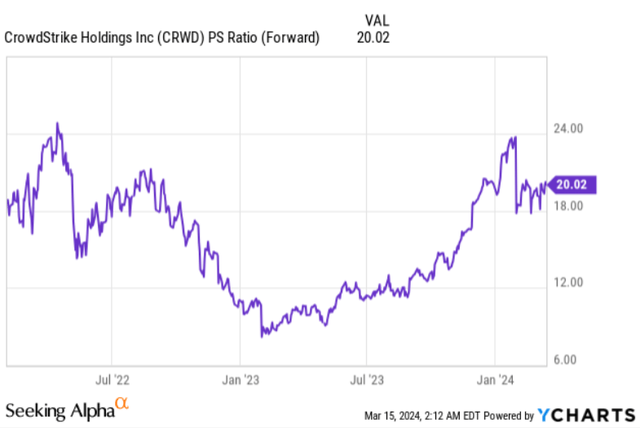

Looking at the past two years the valuation of shares fluctuated in a wide range:

YCharts

The forward P/S multiple has reached its 2-year bottom at ~8-9 at the beginning of 2023 coming off from a ~25 peak just a year before. Before forward sales estimates rolled to the upcoming calendar year the multiple reached 24 at the beginning of 2024, while shares trade currently around 20. This shows that based on general risk sentiment, the outlook for long-term interest rates, the general economic cycle and many other factors the market can value the shares of the company within a very wide range despite a relatively stable fundamental outlook. I believe the realistic chances of a soft landing coupled with gradually decreasing interest rates could support a rather positive risk sentiment in 2024, which makes me say, that the current forward P/S ratio of 20 in the light of CRWD’s strong fundamentals is realistic in the current environment.

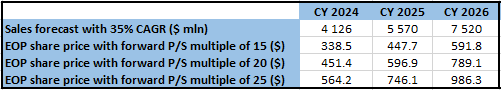

Below, I’ve created 3 simple valuation scenarios based on the assumption that sales grow at a CAGR of 35% over the upcoming years combined with 2% annual dilution:

Based on author’s assumptions

This shows that if shares close 2024 at a forward P/S multiple of 20 where they trade today, the share price should increase to $451.4 for the end of the year, meaning an upside potential of ~37%. This is my base case scenario, where the share price has the potential to more than double within 3 years.

If rates would stay higher for longer, which would compress tech valuation multiples to some extent a more conservative P/S ratio of 15 would result in a constant share price over 2024. However, also in this case there is considerable upside for shares over a 3-year horizon with a potential 80% gain.

Finally, in a more optimistic scenario where valuation levels increase further to a forward P/S multiple of 25 the share price could reach close to $1,000 in 3 years’ time, tripling from current levels. I believe this scenario would require continued risk-on sentiment resulting from decreasing interest rates, a stable macroeconomic and geopolitical environment, and of course continued strong execution from CrowdStrike. I believe this scenario is not unimaginable as well, but it assumes an ideal set of conditions.

It’s important to note that these are just a few theoretical scenarios, much more could happen in reality. This could depend on some important risk factors CRWD faces. Competition in the cybersecurity space seems to be increasing, which began to manifest itself in increasing pricing pressures as witnessed by Palo Alto Networks or Microsoft. Although CrowdStrike seems to fend off these pressures for now, it’s important to keep a close eye on this matter.

Cybersecurity threats are also an important risk factor in this space, where one or two larger incidents could materially impact the share price of a company (e.g.: see Okta (OKTA)). Although CrowdStrike’s best-in-class Falcon platform repeatedly excels in IT security tests, this is still an important risk factor when investing in this space.

Conclusion

FY24 Q4 earnings of CrowdStrike defied concerns of a potential slowdown in cybersecurity spending and showed that the company finished FY24 on an exceptionally strong note. Rapid growth and the expansion of emerging products combined with a substantial backlog provide a strong setup for FY25, which has been confirmed by an initial ~30% yoy revenue growth guidance from management. This, combined with a gradually improving margin profile over the upcoming years should continue to aid the appreciation of shares.