Re:cap, a German startup specializing in revenue-based fundraising, has raised $14.6 million in Series A funding.

Founded in 2022, the Berlin-based company offers a proprietary software platform that helps connect companies with investors. The platform uses data to assist with credit decisions and financing availability. Borrowers can access re:cap loans for up to five years and up to 5 million euros (about $5.5 million). The company has partnered with HSBC Innovation Banking, which acquired SVB's European assets after the bank's collapse, to offer longer-term products.

In recent years, fears of a recession, rising inflation that is hurting consumer spending and rising interest rates have put pressure on companies' profit margins, making revenue-based financing a tough model for debt-based lending.

“Overall, the private debt market is booming faster than most alternative asset classes and the opportunity is generally large,” Re:cap CEO and co-founder Paul Becker told Business Insider. “If you look at the startup boom that began about three years ago, things have changed a bit. Today, you see some players just jumping on the bandwagon, whereas we've been very serious about this since day one.”

Re:cap told BI that its focus on data allows it to avoid similar problems to its competitors.

Re:cap raised funding from Entree Capital, in addition to existing investors Felix Capital and Project A. Becker told Business Insider that he wanted existing investors to lead the funding round because it's a broad market where fundraising for fintech can be difficult and take too long.

Funding into European startups is expected to fall 45% year-on-year to $45 billion in 2023, according to Atomico, but investment in European fintech fell much less than the overall decline. Funding into fintech startups fell 70% to $5 billion in the first half of 2023, from $17.1 billion compared to the same period in 2022, according to Finch Capital.

“Of course there are benefits to going out to raise capital, but in this case there were greater benefits to keeping the investor group intact, expediting the process and focusing on building the business,” Becker added.

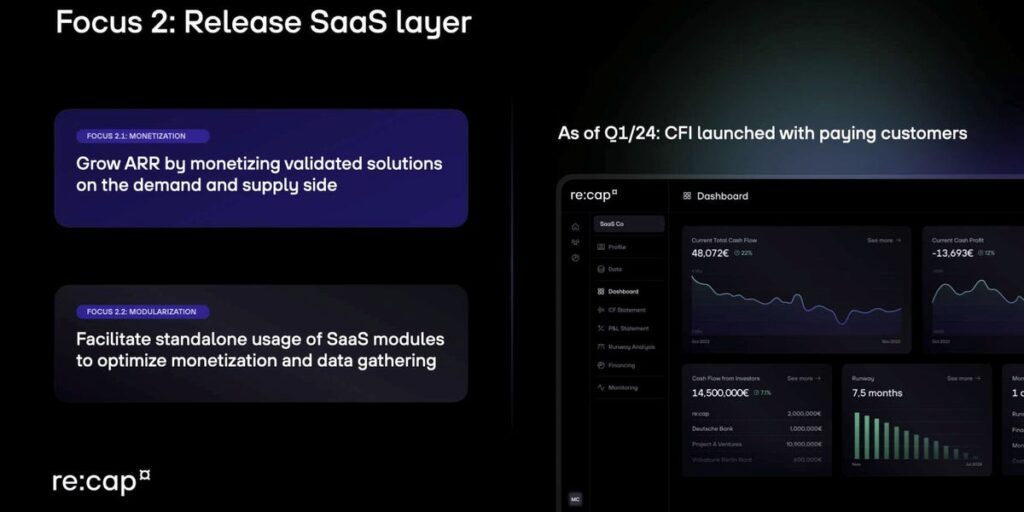

The funding will help the company double its employee base to about 80 people by the end of 2025. The company also plans to expand its SaaS product, which provides cashflow management tools to funds such as Channel Capital and Avelina Capital.

Check out Re:cap's presentation below: