(Bloomberg) — South African assets are recovering, buoyed by investor hopes that the country will form a market-friendly government during the next 13 days of coalition talks.

Most read articles on Bloomberg

The rand surged 1.6 percent on Monday, its biggest one-day gain since Dec. 14, when the ruling African National Congress failed to secure a parliamentary majority for the first time in three decades.South African dollar-denominated government bonds were the top performers in Bloomberg’s Emerging and Frontier Country Eurobond Index, while the FTSE/JSE All Share Index ended the day as the second-best dollar-denominated gauge of stocks among the 92 indexes monitored by Bloomberg.

The new government has until June 17 to be sworn in, and any expected coalition government could look quite different to the one previously expected.

Sign up here for our twice-weekly Next Africa newsletter

Before the election, much of Wall Street had expected the ANC to win about 45% of the vote and form a coalition with smaller parties. But the party only got 40.2% of the vote, raising several scenarios that investors had previously viewed as unlikely, including a coalition with the left-leaning Economic Freedom Fighters and former President Jacob Zuma's newly formed Umkhonto we'Sizwe party.

“Our understanding is that the market views the possibility of a coalition government with the main opposition Democratic Alliance as fragile but generally benign,” said Yvette Babb, portfolio manager at William Blair Investment Management.South African assets were very volatile in the first hours of trading on Monday before closing out more stably.

“A formal partnership with the DA would be most favourable and may lead to higher asset prices. However, given the increased implementation risks, we believe there may be a permanent increase in South Africa's risk premium,” Babu added.

Despite the electoral defeat, the ANC remains the country's largest party. Finance Minister Enock Godongwana said on Monday that the party would not make rash decisions in choosing a coalition partner in order to maintain investor confidence and continuity of economic policy.

Ongoing coalition talks include a potential alliance with the EFF, MKP and DA. The ANC has rejected MKP demands for President Cyril Ramaphosa to step down and is considering either a minority government or a “confidence and supply” agreement to maintain stability.

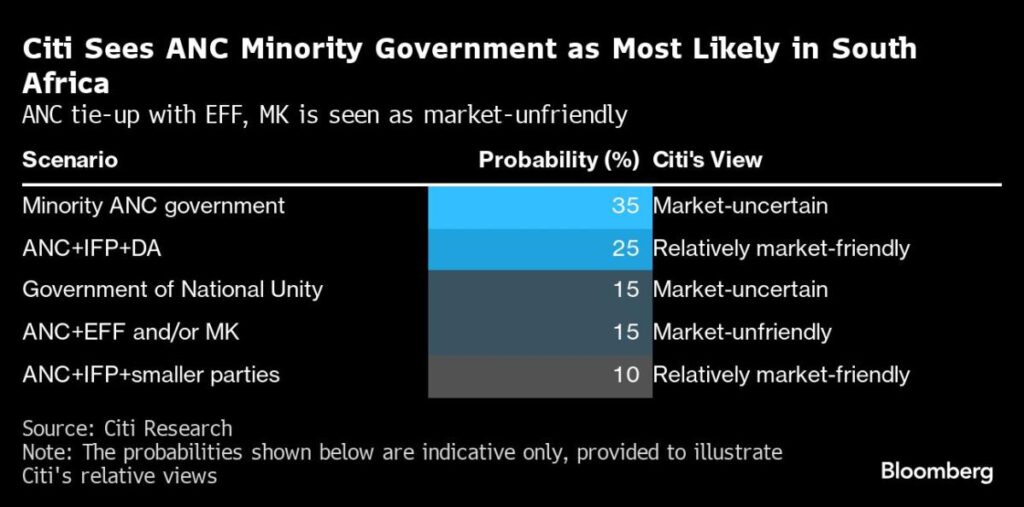

Citigroup expects the ANC to form a minority government, creating “uncertainty and instability in parliament,” economist Gina Schuman said in a client note. A deal with the DA would be welcomed by financial markets as it could speed up economic reform and privatization efforts and is seen as the more likely scenario, Schuman said.

Risks remain

South Africa's sovereign risk premium fell on Monday after recording its biggest increase since January by the close of trading on Friday. The extra yield investors are demanding to hold the country's dollar-denominated debt rather than U.S. Treasuries stands at 319 basis points, according to data from JPMorgan Chase.

“The increased risk premium that would result from an ANC-EFF-MK coalition government is precisely the reason not to be part of such a coalition,” Schuman said, putting the probability of this outcome at 15%.

Sebastien Barbé, head of emerging markets research at Credit Agricole, said MKP's strong performance increases uncertainty for the rand. A coalition with the DA would be better for the rand than one with MKP or the EFF, he said.

“The rand is not particularly strong at the moment and has decent carry, which may limit the downward pressure from political uncertainty,” Barbe said. “But in the short term, the risk of a stronger rand is a negative.”

You can follow Bloomberg's Africa coverage on WhatsApp: Sign up here .

–With assistance from Ana Monteiro.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP