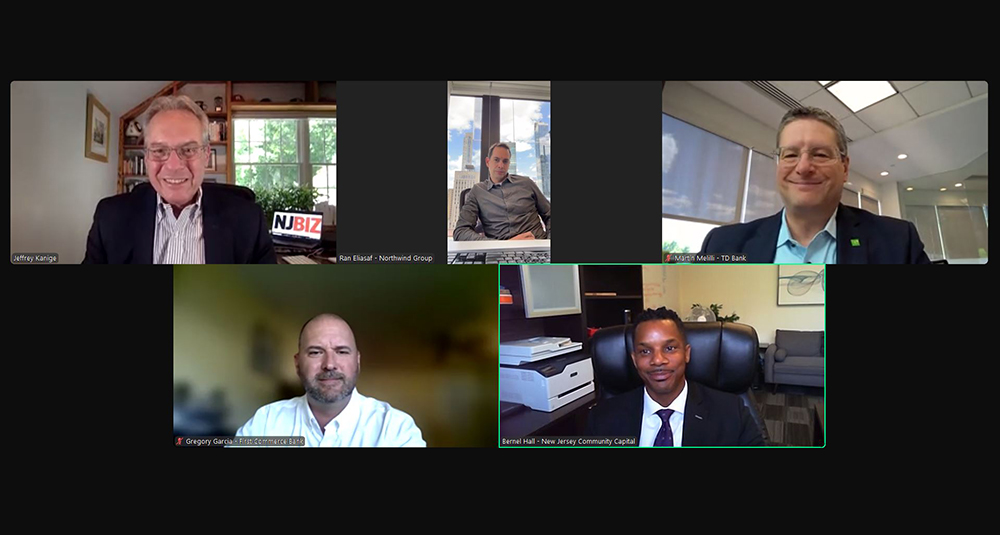

In a panel convened by NJBIZ, four industry leaders, each with their own unique perspective, explained how companies can navigate the complex economic landscape in banking and finance.

Panelists included Gregory Garcia, executive vice president and chief operating officer at First Commerce Bank; Martin Merilli, president of commercial markets at TD Bank; Vernell Hall, president and CEO of New Jersey Community Capital; and Ran Eliasaph, founder and managing partner at Northwind Group. The May 28 discussion was moderated by NJBIZ Editor Jeffrey Kanige.

Throughout the 90-minute discussion, Mr. Kanye and the panelists discussed a wide range of key issues and trends in the banking and finance sector. Mr. Kanye delved into questions surrounding the impact of interest rates and monetary policy.

“Interest rates are higher than they were four years ago, but they're not exorbitantly high by historical standards,” Kanige said. “People are getting used to a different world, or at least that's what I'm hearing. Are you hearing the same thing from the people you work with – your clients, your customers – about interest rates, and how is it impacting your business?”

“The market is coming out of a long period of low interest rates and needs to adjust to a new reality,” Eliasakh explained. “Initially, the expectation was that interest rates would accelerate in the lowering of rates. But that's not going to happen. You can see that now when you look at the curve. It means cap rates and valuations will have to adjust. And it will happen. It's already starting to happen in commercial real estate. It's definitely happening in office, which is valuing significantly lower now than it was three or four years ago. It's going to happen in multifamily. It has to happen. There needs to be a correction.”

He said many of the loans made over the past five to seven years that are now due for refinancing are experiencing some problems.

“There are a lot of deals that need more time to stabilize and capital needs to write checks to right-size the loans, and that's what's happening,” Eliasafu said. “We're still seeing a lot of loans being extended as current lenders, whether it's banks, non-banks or mortgage rates, are giving them more time. Some call this a 'fake extension,' but it's real. I think a lot of loans are being extended now out of hope of better rates and a better environment in the future.”

Hall agreed. “My colleagues have said, 'Extend it and pretend,' and I've heard, 'Survive to '25,'” Hall said. “A lot of people don't want to take interest rates, or banks offer floating rates, but then you get locked in when you withdraw capital. Nobody wants to lock in a high interest rate, so they extend the low interest rates that are already there and try to ride out inflation.”

Is change on the horizon?

The NJCC president and CEO noted that there haven't been many construction starts due to the pandemic, and as a result, there's a lot of work to be done to make up for the new supply that's not yet in circulation.

“People are remaining pretty stubborn when it comes to inflation because there's not a lot of new product out there,” Hall explained. “That said, I think we'll see change over the next 18 months, but it's a slow change because of the natural slowdown during the pandemic. And because interest rates are so high, people doing the supplying are thinking, 'I don't want to be locked into high interest rates for the long term, so let's just hang in there and see how it goes, and then when interest rates come down over the next few years it's hard to get out easily.'”

Garcia joked that he doesn't have the same views on trends as Eliasaph and Hall, but he noted that the number of expected rate cuts by the Fed has dropped dramatically as the year has progressed.

“At the beginning of the year, everybody was saying six rate cuts, and now we're hearing two, and today even Goldman Sachs pushed back their first rate cut from July to September,” Garcia said. “As we get closer to July, they have to push it back. I think everybody in this webinar should be aware that we're going to be in a high interest rate environment for a long time. And understand that, and don't just hope that interest rates will go down to where they were two years ago. And plan accordingly. At the end of the day, it's all about strategic planning for your business, and hope is not a strategy.”

Replay: Banking and Finance Trends Panel Discussion

To watch the full panel discussion, please click to register.

Kanige turned to Melili and asked him what the corresponding plan would be and what can be done to weather such a situation.

“Jeff, when you start asking about where interest rates are right now and where they've been historically, I've been making that point for quite some time now,” Melilli said. “People are freaking out right now. Yes, interest rates have gone up 500% or so in the last two years, but historically they're still pretty low. When the first rate hike happened, I found a lot of people were shocked by the price. People panicked and they stopped.”

But since then, many of the projects have moved forward, while many of the ones that didn't were ultimately moot, Melilli explained.

Digital Transformation

From there, the conversation moved on to topics including economic and geopolitical uncertainty, regulatory change, liquidity, advice for businesses starting and scaling, struggling businesses and underserved communities, and sustainable investing.

Kanige then shifted the discussion to technology and digital transformation, talking about how banks and other lenders are leveraging technology and what we can expect going forward.

“Is it possible that the proliferation of technology, artificial intelligence and other types of technology, will have a significant impact on access to capital or the availability of capital?” Kanige asked.

“Fintech is enabling people who were previously unbanked to get debit cards and build credit histories that can then be used to build traditional banking avenues,” Hall says. “Anyone working in the financial engineering field can now gather more information about a particular customer faster and process that information more quickly and efficiently to offer them a credit product that's tailored to that customer.”

Hall said there are many predictions that AI will replace banking jobs, but he cited Garcia's comments in a discussion about character lending.

“Personality assessment still requires a human element,” Hall says. “Even with faster data transfer, collection and processing, you're still going to need someone who can read between the lines and decide whether this is a good personality bet for a small business loan or real estate development loan.”

Merilli said the bank is studying the topic intensely, noting that the pandemic has accelerated the process for many banks that had no choice. “A lot of businesses have come to banks, particularly our bank, for things like ACH functionality and bill payment fraud detection, and we see that continuing,” Merilli said. “TD Bank is taking a slightly different approach than other banks from an AI perspective. We're not trying to be first to market. We're leaving that up to JPMorgan Chase, Bank of America, and others, and they'll determine what works and what doesn't work from a digital standpoint. But then we'll follow that and implement what works for our customers.”

In case you missed it:

“Martin's right on the money. I think the banking industry in general has always been slow to adopt technology and new service channels, to some extent,” Garcia said. “I think the pandemic has changed that perspective a little bit because they had to make a ton of PPPs. [Paycheck Protection Program] Loans were being made available within days. So we started to get a little bit smarter about technology, and I think this is a key initiative for most, if not all, financial institutions today.”

Garcia said the bank is looking to leverage technology to make banking easier for customers while they go about their busy business. “It's about the relationships and connecting with customers that I mentioned earlier, but it's also about giving them the tools to make their day-to-day banking and financial transactions a little bit easier,” he said. “That's what we're really focused on on the technology side. And on the other hand, we're actually using AI right now. We're testing it in some of our back-office operations. The tasks that, frankly, our employees don't enjoy doing – the data mining and the tedious tasks for some of our employees. Taking that out of their hands and letting them engage in the creative side, the analytical side, makes their careers and their work a little bit more rewarding.”

Advice for businesses: “Stay on the path”

Following the discussion on capital markets and promising investment areas, Kanige answered a few questions from the audience and then gave the panellists another opportunity to offer their final comments.

“I think it's going to be a very exciting time for the commercial real estate and lending markets,” Eliasakh said. “It's going to be volatile, and I think we're already seeing winners and losers right now. A lot of companies are focusing on legacy portfolio issues, which is creating space for new players to emerge. Over the next two years, we'll see new private equity firms and investors emerge as new leaders in the industry. We're already seeing some big transactions happening, and we're seeing some large builds trading at record low prices right now.”

I think it will be a very exciting time for the commercial real estate and lending markets.

– Ran Eliasaph, Northwind Group

“I think it was a really good discussion. I learned a little bit myself. I thank you all,” Garcia said. “We as a bank, as a financial institution, we will continue to do our job. Times change, for better or for worse, and we will adapt. I think everybody should look at their business the same way. Don't panic, stay calm, keep on the path, and you'll be OK.”

“I want to thank NJBIZ for hosting, and I also want to thank the panelists for their many insights and thoughtful comments,” Hall said. “In a similar vein, I don't think there's a one size fits all view of the economic situation. Different sectors are going to do well. Other sectors may struggle for a while. But we have to remember, everything is cyclical. Everything will recover. So, small business owners, real estate developers, stay the course. We need you.”

“One last thing: we only make money by lending money,” Melilli said. “So entrepreneurs, follow your dreams and let's make them come true together.”